CSX Corporation operates a large railroad system that serves most of the eastern United States.

-Seven Year Revenue Growth Rate: 4.6%

-Seven Year EPS Growth Rate: 11.4%

-Seven Year Dividend Growth Rate: 33.1%

-Current Dividend Yield: 2.85%

-Balance Sheet Strength: Leveraged, Fair

Overview

CSX Corporation (NYSE: CSX) is a large railroad company with over 21,000 miles of track in 23 states. The company had a period of poor management and performance, but in the last several years has rebounded to become a strong performer as a Class I railroad. According to the company’s Baird’s Industrial conference presentation, the revenue breakdown for CSX so far in 2012 was as follows:

General Merchandise

General merchandise is the largest segment, accounting for 41% of total revenue. This is further divided into Automotive, Metals, Chemicals, Phosphates, Agriculture, Food and Consumer, Forest, and Exports.

Coal

Coal is a large individual component of revenue, with 14% of total revenue coming from domestic coal transport, and 7% of total revenue coming from export coal transport, for a total of 21%. Domestic coal is facing strong headwinds currently.

Intermodal

For CSX, 38% of revenue came from intermodal shipping.

Ratios

Price to Earnings: 11

Price to Free Cash Flow: 40

Price to Book: 2.3

Return on Equity: 22%

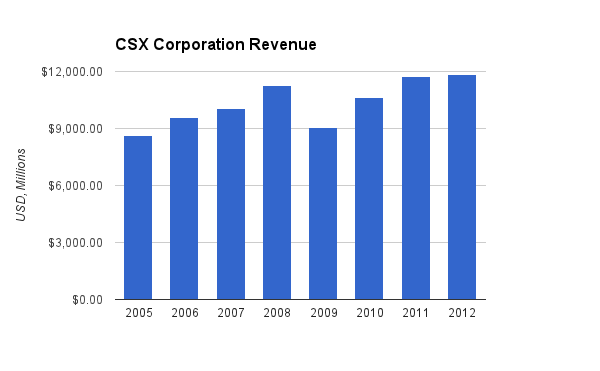

Revenue

(Chart Source: DividendMonk.com)

For both of these charts, the 2012 figures actually refer to the trailing twelve months, which include the last 3 months of 2011 and the first 9 months of 2012.

Revenue over this period grew at an average rate of 4.6% per year, but the growth was erratic due to the large hit the company took during the recession.

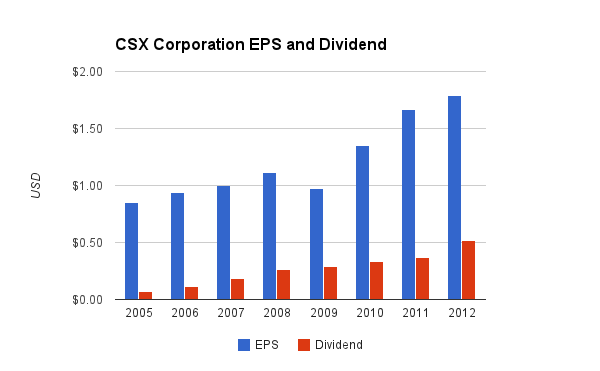

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings growth over this period was substantial, at 11.4% per year. A significant portion of this was due to stock buybacks.

The dividend currently yields 2.85% with a low earnings payout ratio. Free cash flow is very low in the trailing twelve month period and barely covers the dividend, but this is due to a combination of capital expenditures above their long-term baseline, and a recent moderate reduction in operating cash flow due to reductions in coal transport volume. So overall, their dividend appears quite safe going forward.

The dividend has grown at a 30+% annualized rate over the last several years, but this was partially due to an expanding payout ratio. The company targets a 30-35% payout ratio, which is where it’s currently at, so the future dividend growth should be roughly in line with EPS growth.

Approximate historical dividend yield at beginning of each year:

| Year | Yield | Payout Ratio |

|---|---|---|

| Current | 2.85% | 31% |

| 2012 | 2.1% | 29% |

| 2011 | 1.5% | 22% |

| 2010 | 1.7% | 24% |

| 2009 | 2.5% | 31% |

| 2008 | 1.5% | 23% |

| 2007 | 1.5% | 20% |

| 2006 | 2.1% | 12% |

| 2005 | 2.0% | 14% |

How Does CSX Spend Its Cash?

The company lists its three priorities, in order, as:

Capital Investment– CSX expects to invest 16-17% of revenue into core capital investment.

Dividends– CSX expects to pay out 30-35% of TTM earnings as dividends.

Share Repurchases– The company is finishing up a $2 billion share repurchase program with plans for a new one.

During the fiscal years 2009, 2010, and 2011, the company brought in over $3.2 billion in free cash flow. Over this same period, $1.2 billion was paid out as dividends and $3 billion was spent to buy back shares and reduce the share count. The number of shares peaked at nearly 1.4 billion shares in 2006, but has since decreased to around 1.05 billion, because the company spent over $7 billion buying back stock. As a reference, the market cap is currently around $20 billion. No cash was spent on acquisitions.

Balance Sheet

The total debt/equity ratio of CSX is slightly over 100%. Total debt/income is a bit under 5x. The debt has been increasing over the last several years from approximately $5 billion to $9 billion. There is negligible goodwill.

The interest coverage ratio is a bit over 6x, which is on the low side, but stable. Overall, the balance sheet has some leverage, but remains stable, and is in fair condition.

Investment Thesis

This is a sister article to the recent report on Norfolk Southern. Both of these companies operate railroads with nearly identical geographic locations, have nearly identical market capitalizations and stock valuations, have similar balance sheets, have similar priorities of capital investment, dividends, and buybacks, and they both recently took a cash flow and stock price hit from a reduction in coal volume (which is due to their nearly identical geographic footprint).

From an investor’s perspective, these are very similar equities, so it’s worth highlighting some subtle differences:

Norfolk Southern

-Higher dividend yield of 3.32%

-Slightly stronger balance sheet

-Slightly smaller rail network, with less extension north and south across the eastern coast

-Consistently strong operating performance

-Has slightly more exposure to coal, which is a major headwind currently

CSX Corporation

-Lower dividend yield of 2.85%

-Slightly weaker balance sheet

-Slightly larger rail network, with more extension north and south across the eastern coast

-Had poor financial management years ago, but has rebounded with strong performance

-Has slightly less exposure to coal, which is a major headwind currently

Between the two, I consider Norfolk to be a slightly more resilient dividend stock, while CSX is possibly a bit more of a value play. In general, the market appears to be treating these two businesses very efficiently with the same stock valuation.

Risks

The volume and revenue of a railroad company is highly dependent on the economy. Weak macroeconomic conditions mean less freight is shipped. Since railroads have substantial fixed operating costs, a decrease in volume and revenue results in an amplified decrease in earnings and free cash flow.

CSX and competitor Norfolk Southern have very similar overlapping rail networks over the eastern half of the United States. This will keep pricing rather competitive and efficient.

The company recently took a hit from decreases in coal volume. Coal is being used less in the region for electricity generation, so their domestic coal shipments have a strong headwind that likely isn’t going away soon due to the efficiency of natural gas. The rest of the segments of CSX will have to carry the coal segment and the overall company forward.

Conclusion and Valuation

The company is capable of moving 1 ton of freight 500 miles on one gallon of fuel, which is three times more efficient than trucking. Railroad companies have competitors, but due to the literally entrenched position of their assets, rail companies have some economic advantages as long as the capital is managed well and as long as economic conditions remain viable.

Unless free cash flow picks up substantially, the share buybacks will have to slow down, because the company has been leveraging their balance sheet in a low interest rate environment to reduce the share count and accelerate EPS and dividend growth.

If the operating cash flow rebounds a bit from the recent drop, up to $3.3-$3.4 billion or so, and if the company invests 16-17% of revenue into capital projects as planned, then that leaves around $1.3-$1.4 billion for dividends and buybacks, which is around 7% of the current market cap. As the shareholder yield, that’s roughly the return that an investor would receive with no growth. If 3-4% revenue growth is estimated, based largely on inflation and mild volume increases, then the company is in a position to provide a good rate of return.

Using the Dividend Discount Model with a 10% discount rate as a target rate of return, the company is currently fairly valued at a price of just under $20 based on the estimate of 7% long-term annualized dividend growth (4% from buybacks, 3% from top line growth). If the dividend growth rate is estimated to be 8% instead, then the fair value jumps to nearly $30 for the same discount rate.

I believe that the current stock price of CSX of just under $20 is fairly valued or moderately undervalued, just like Norfolk Southern. In addition, if investors are bullish about the fundamentals of the company over the long-term, but want to enter the stock with a lower cost basis to increase the margin of safety, then selling January 2014 puts at a strike price of $20 can result in a 13-14% annualized rate of return if the option is not exercised, or entering the stock with a cost basis of under $17.50 if the option is exercised.

Full Disclosure: As of this writing, I have no position in CSX or NSC, but NSC is currently on my watch list.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Will you do an analysis of Union Pacific as well?

You got it:

https://dividendmonk.com/union-pacific-corporation-unp-decent-value-at-123-share/

Both NSC and CSX look pretty good to me right now. I’m interested in the method of selling put options to possibly enter a position. I haven’t done this in the past but it seems like an entry strategy worth looking into. What kind of downsides do you think there are to selling put options as an entry strategy?

I have a mini-tutorial on selling put options here:

https://dividendmonk.com/selling-put-options/

The downside is primarily an opportunity cost: you temporarily cap your upside. Selling options lowers your cost basis, slightly reduces potential losses, and in return, it temporarily caps your upside potential.

If you buy CSX stock directly at this price, then who knows, it could go up 20+% within the year. But if you sell that specific option in the article, the best return for the year would be 13-14%. (Other strike prices or expiration dates would have lower or higher potential returns.) Another downside is that tax rates on option premiums can be higher; it depends on whether it’s exercised or not.

So it can be a useful strategy for a long-term investor if you have a reliable estimate of the intrinsic value and a desired entry price. Many investors like to invest on stock price pull-backs, and put options let you get paid to wait for pull-backs.

In my view, good candidates for selling put options to enter positions are companies that are fundamentally reliable but technically volatile, like railroads and engineering companies.

Matt,

Cool to see a face with the name!

Thanks for your analysis on CSX and NSC. Your conclusion, valuation and thesis are all pretty much what I thought they would be. Mild undervaluation, solid fundamentals but lingering headwinds due to coal shipment reductions.

I do hope that other segments can pick up the slack, as coal does appear to be in a secular decline. Obama’s re-election has probably further cemented this.

I like the railroads as a business, but I like hedging my bets and so KMI is one of my plays on that. Don’t want to move coal, and want to start moving natural gas? You’re probably going to use pipelines. I’ll play it either way.

By the way, any particular railroad your personal favorite? UNP appears strong, but the price reflects that.

Best wishes!

CNI is one I really like the fundamentals of. Not a great yield, though.

UNP and Berkshire’s BNSF are also good.

The prices of the above three are higher, of course.

NSC and CSX are the deeper values with problematic headwinds; I like NSC out of the two.

As always great analysis! I haven’t taken a look at CSX before but now I have a starting point for some deep dive research!