Summary

Compass Minerals is a large producer of salt and specialty fertilizer.

-Five year annualized revenue growth: 7.6%

-Five year annualized EPS growth: 36%

-Five year annualized dividend growth: 8%

-Current dividend yield: 2.47%

-Balance Sheet: Moderately Weak

Although I’m not of the opinion that CMP is a particularly strong buy at the current price, I think it’s a reasonable defensive selection.

Overview

Compass Minerals (NYSE: CMP) produces and sells salt and specialty fertilizers to countries around the world, although a large chunk of the sales occur in the US, Canada, and the UK. Deicing salt is mostly sold in the Great Lakes and Mid West regions of the US, and in the UK. Consumer and industrial salt is sold throughout the US and Canada. Specialty fertilizers are sold in western and southern US, and in Latin America, Japan, Australia, and New Zealand. Uses for salt include highway deicing, residential deicing, water conditioning, nutrition, dust control, and food preparation. The company has nearly 1,800 employees and a market capitalization of approximately $2.5 billion.

Sales breakdown

Highway Deicing: 48%

Consumer and Industrial: 33%

Specialty Potash Fertilizer: 18%

Records Management: 1%

Businesses

Compass Minerals is the parent company of seven businesses:

North American Salt Company

Provides diversified salt products to customers throughout the United States.

Sifto

Provides diversified salt products to customers throughout Canada.

Salt Union Ltd.

Provider of rock salt to customers throughout Britain to keep roads safe.

Great Salt Lake Minerals Corporation

Largest producer of sulfate of potash in North America.

Big Quill Resources

Canada’s largest producer of potassium sulphate.

Pristiva

Pristiva focuses on selling products to the salt water pool industry.

Deepstore Records Management

Deepstore is an interesting innovation of the company. Deepstore offers long-term document storage services in its old Winsford, England salt mine. In empty portions of their mine, the temperature and humidity is constant and free of pests, and so the company offers low-cost storage services.

Revenue, Earnings, Cash Flow, and Metrics

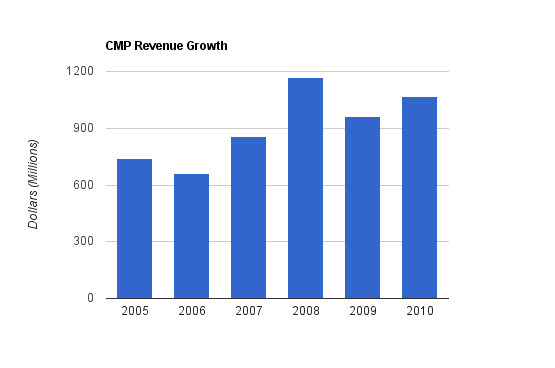

Revenue Growth

| Year | Sales |

|---|---|

| 2010 | $1,069 million |

| 2009 | $963 million |

| 2008 | $1,168 million |

| 2007 | $857 million |

| 2006 | $661 million |

| 2005 | $742 million |

Over this five-year time period, Compass Minerals has grown revenue by approximately 7.6% per year, on average.

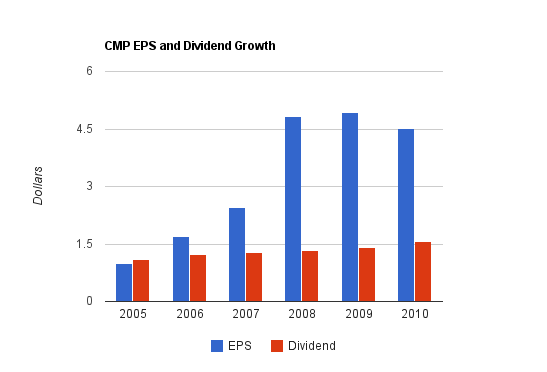

Earnings Growth

| Year | EPS |

|---|---|

| 2010 | $4.52 |

| 2009 | $4.93 |

| 2008 | $4.82 |

| 2007 | $2.44 |

| 2006 | $1.70 |

| 2005 | $0.98 |

CMP has grown EPS by an average of 36% annually. Growth is going to be slower growing forward.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $241 million |

| 2009 | $119 million |

| 2008 | $254 million |

| 2007 | $119 million |

| 2006 | $96 million |

| 2005 | $88 million |

Cash flow growth averaged 22% annualized over this five year period.

The reason that EPS and cash flow alternate in recent years has to do with inventory. During some years, the company produces a lot more salt than it sells. This salt gets added to the inventory, and therefore increases earnings, but not cash flow. During the next year, they’ll sell this inventory (and not have to produce as much salt), and their earnings won’t be so great but their cash flow will be strong. This is common among companies, but the commodity nature of the salt business, as well as annual differences in winters, make this particularly significant for Compass.

Metrics

Price to Earnings: 16

Price to Book: 5.8

Return on Equity: 44%

Dividends

Compass Minerals currently has a dividend yield of 2.47% with an earnings payout ratio of approximately 40%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.80 |

| 2010 | $1.56 |

| 2009 | $1.42 |

| 2008 | $1.34 |

| 2007 | $1.28 |

| 2006 | $1.22 |

Compass Minerals has grown its dividend by an average of 8% annually over the past five years. The most recent increase, from 2010 to 2011, was 17%.

Balance Sheet

Compass Minerals has a moderately weak balance sheet. The total debt/equity ratio is 1.17, which is mediocre. The interest coverage ratio is less than five, which is not optimal. The good news is that the company is reducing its debt load over time. Long term debt decreased from a peak of $612 million in 2005 to $483 million at the current time. The annual interest payments decreased from a peak of $73 million in 2009 to $42 million over the trailing twelve month period. Prior to 2008, the company had negative equity. But over the last three years, from 2008 to 2010, total liabilities remained fairly static, changing only from $758 million to $767 million, while total assets increased from $823 million to $1,114 million. Shareholder equity (company book value), therefore increased from $65 million in 2008 to nearly $350 million in 2010. Equity is up to $413 according to the most recent quarterly report.

The short-winded summary of this is that the balance sheet is not particularly attractive, but it’s stable and improving.

Investment Thesis

Goderich Mine in Ontario, Canada is the largest underground rock salt mine in the world. Its current production capacity after a recent expansion is 9 million tons. The company also owns salt mines in Louisiana and the UK. Their mine in Winsford, England is the largest salt mine in that country. These enormous salt mines give Compass Minerals a competitive cost advantage in their markets. It is estimated that they still have several decades worth of salt mining available.

The company also operates mechanical evaporation sites to produce salt for industrial, agricultural, and commercial use. In addition, solar evaporation is used on the Great Salt Lake in Utah to produce sulfate of potash, magnesium chloride, and salt. Their solar evaporation facility is the largest solar salt production site in the US.

Salt producers submit blind bids to governments and other salt end-users, and the lowest bid typically wins. A significant part of the price of salt is the transportation cost, because salt is so cheap per unit of weight. Compass has access to water transportation over the Great Lakes, Mississippi River, and Ohio River, and their other facilities are close to rail networks, and so their transportation costs are low. The combination of having the largest production facilities in their markets, and efficient transportation locations, gives Compass Minerals a significant economic advantage that is impossible to replicate by competitors.

Sulfate of potash is used on high-yield crops, and carries a larger profit margin than commodity potash fertilizers. Compass Minerals is the largest producer of sulfate of potash in the United States. Growing populations and diminishing arable land is a combination that favors the potash industry. The company recently acquired Big Quill Resources, which expands their presence in this industry. In addition, by 2015, the company plans to have completed the second phase of a three phase expansion project of their Sulphate of Potash facilities.

Risks

A principle risk to Compass Minerals is the weather. A huge portion of business is dependent on cold, snowy winters that require a lot of salt on the highways. It’s also dependent on the seasonality and financial strength of its fertilizer buyers. In addition, Compass leases some of its locations, so it’s dependent on the availability of reasonable leasing conditions. The company also faces currency risk and is reliant on reasonable energy prices for its operations.

Conclusion and Valuation

In conclusion, I think Compass Minerals would make for a respectable diversified investment at the current price in the low $70’s, although the price isn’t ideal. A P/E of 16 isn’t bad, but for a company with this much debt and seasonality, I’d prefer a lower valuation for starting an investment. The fundamental economic moat of the company seems to keep the valuation up at this level, since risk-adjusted returns should be pretty solid.

Most portfolios consist of companies that face considerable economic risk, so CMP represents an interesting opportunity to cushion a portfolio from economic risk in return for taking on some weather-related risk. Salt is fairly resistant to economic issues while their smaller sulfate of potash segment is heavily affected by them. The dividend is moderately small but growing, and the payout ratio is low.

Full Disclosure: At the time of this writing, I hold no position in CMP.

You can see my portfolio here.

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

[…] Dividend Monk provided another stellar review of a dividend-paying stock, this time, Compass Materials International. […]