Summary

Coca Cola, one of the most well-known companies, sells beverages in over 200 countries and territories around the world.

-Revenue Growth: 8.5%

-Cash flow Growth: 8%

-Dividend Yield: 2.90%

-Dividend Growth: 9%

I think Coca Coca stock would make a fair long-term investment at the current price, but I’d look to buy on dips. The valuation currently gives little margin of safety.

Overview

The Coca Cola Company (KO), with one of the strongest brands in the world, is the largest non-alcoholic beverage company around. Established in 1886, Coca Cola has been growing sales for over a century now and has a presence in over 200 countries. The company is a dividend aristocrat, as it has increased dividends for 49 consecutive years. Ironically, while the company has grown considerably in the past 15 years, it has been a fairly bad investment because it was valued so highly back in the 90s.

The Coca Cola Company:

-Has been in business for 125 years

-Offers 3,500 beverages, and targets certain brands for certain markets (with only the flagship Coca Cola being sold in every single one of their markets)

-Works with over 300 bottlers around the world, and owns substantial stakes in some of the larger ones

-Includes 14 brands that have $1 billion or more in annual sales

-Sells its products in 200 countries

-Offers 1.7 billion servings per day

-Has nearly 140,000 employees

Geographic Volume and Revenue:

Coca Cola sold 25.5 billion unit cases and had revenue of $35.119 billion worldwide in 2010.

| Segment | Volume | Revenue |

|---|---|---|

| Latin America | 28% | 11% |

| North America | 22% | 32% |

| Pacific | 18% | 14% |

| Europe | 16% | 13% |

| Eurasia and Africa | 16% | 7% |

| Bottling Investments | – | 23% |

| Corporate | – | 0% |

The above table shows rounded percentages for the Coca Cola Company’s volume and revenue for each segment out of the whole.

Revenue, Income, Cash Flow, and Metrics

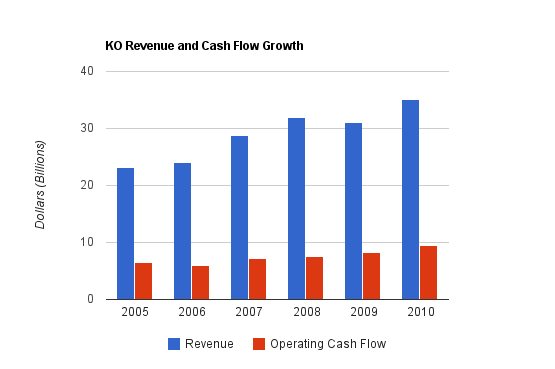

The company has grown considerably over the last few decades, and highlighted here is their most recent five-year performance.

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $35.119 billion |

| 2009 | $30.990 billion |

| 2008 | $31.944 billion |

| 2007 | $28.857 billion |

| 2006 | $24.088 billion |

| 2005 | $23.104 billion |

Over the past 5 years, Coca Cola has had more than 8.5% in annual compounded revenue growth.

Unit case volume has been increasing as well. The company sold 23.7 billion, 24.4 billion, and 25.5 billion cases of product in 2008, 2009, and 2010 respectively.

Income Growth

| Year | Income |

|---|---|

| 2010 | $11.809 billion |

| 2009 | $6.906 billion |

| 2008 | $5.807 billion |

| 2007 | $5.981 billion |

| 2006 | $5.080 billion |

| 2005 | $4.872 billion |

Coca Cola’s net income grew by nearly 20% compounded annually over this period, but most of this was due to a large spike in 2010. This spike was a one-time event related to other income rather than a sustainable growth increase for the company.

Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $9.532 billion |

| 2009 | $8.186 billion |

| 2008 | $7.571 billion |

| 2007 | $7.150 billion |

| 2006 | $5.957 billion |

| 2005 | $6.423 billion |

The company has grown cash flow by an average of 8% annually over this period.

Metrics

Price to Earnings: 12.7 (but it’s closer to 20 excluding one-time events)

Price to Book: 4.9

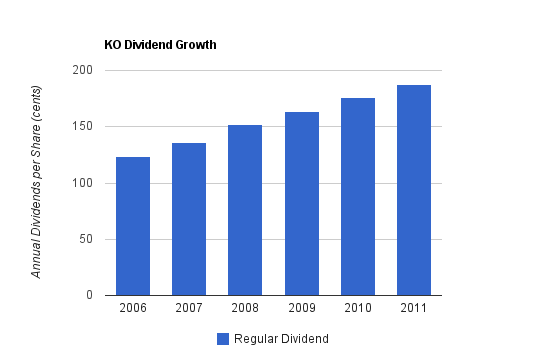

Dividend Growth

The Coca Cola Company has increased their dividend for 49 consecutive years. This puts them near the top of the historical dividend growth list. The stock currently yields approximately 2.90%, and they’ve raised their dividend by 6.8% this year. The payout ratio is between 50% and 60%, which is an optimal payout ratio for a company like this, in my opinion.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2011 | $1.88* | 2.90% |

| 2010 | $1.76 | 3.00% |

| 2009 | $1.64 | $3.28% |

| 2008 | $1.52 | 3.04% |

| 2007 | $1.36 | 2.50% |

| 2006 | $1.24 | 2.80% |

Coke has grown stock dividends by nearly 9% compounded annually over the past five years. The most recent increase, from 2010 to 2011 was a bit under 7% (*and numbers in the above table for 2011 are extrapolated to assume this quarterly dividend will be paid all year, as per usual).

The company has also been repurchasing shares annually. The company had net share repurchases of over $1 billion this past year. Because their stock is never at a low valuation, I’d prefer the company to keep share repurchases at a fairly low/moderate level.

Balance Sheet

Coke has a fairly strong balance sheet. LT Debt/Equity is only 0.39, the interest coverage ratio is over 10, and only one third of total shareholder equity consists of goodwill. Despite being a very solid balance sheet, it’s not as pristine as it was before the acquisition of their North American bottler. They took on debt, increased interest payments, and acquired substantial goodwill, but kept these numbers fairly moderate/conservative.

Investment Thesis

Coca Cola and its bottling partners already have a huge worldwide presence, but there is a lot of room for growth. Moderate company growth combined with dividends and share repurchases should result in reasonable long-term risk-adjusted returns for shareholders at the current stock valuation.

2020 Vision

Coca Cola currently has what they call the “2020 Vision”. It’s a specific long-term plan for growth. This is substantial because it shows that the company is really looking ahead and setting ten-year tangible expectations and benchmarks for their company. Most shareholder-friendly companies of course have objectives like “create shareholder value over the long run”, but this is a rather specific set of goals for a ten-year period from a large company.

In summary, the 2020 Vision states that Coca Cola will double it’s global servings per day to 3 billion from 1.6 billion and will double system revenue and improve margins. If this is pulled-off as planned, along with their dividend payout and stock buybacks, it will create solid shareholder returns over a 10 year period.

The company has committed to investing $25 billion in their overall system over the next five years. Coca Cola’s immense worldwide distribution system is a critical aspect of its sturdy economic moat, and investments at this scale further distance itself from its competitors.

Health

A downside to the company is that many of their flagship products, including and emphasizing Coca Cola itself, are not healthy. They’re fine in moderation, but if consumed daily, the calorie and sugar content is quite unhealthy. Fortunately over the last 10 years or so, the company has been growing and acquiring healthier brands to offset their unhealthier brands.

The company first acquired Minute Maid back in 1960, and lately has been following Pepsico’s lead in building a healthier set of brands. They’ve expanded their sports drink, juice, and tea lineup. Odwalla, for instance, was acquired by Coca Cola in 2001 and folded into the Minute Maid division. Now, Coca Cola offers over 1000 juice beverages (although some of these are less-than-spectacularly-healthy juice drinks). They also offer over 800 low or no calorie drinks.

Market Growth

Although the Coca Cola Company already has worldwide distribution, their potential in emerging markets is substantial. The average per-capita annual consumption of Coca Cola products is 89 servings according to their own information. The nation with the highest annual consumption is Mexico, with 675 annual 8 ounce servings per capita. The United States is fourth on the list, with 394. The consumption in China and India is only 34 and 11 respectfully, and these are the two most populous countries in the world. Other high population areas such as Nigeria, Pakistan, and Indonesia only consume 28, 15, and 13 servings per year.

If Coca Cola can maintain market presence as disposable income in these countries and other low consumption areas rises, they should grow substantially. I would hope that their healthier beverages lead the way and that the company continues to expand their healthier brands. Still brands volume grew by 21% in 2010 in Eurasia and Africa as opposed to only 10% for sparkling brands, and still brands grew by 13% in 2010 in the Pacific region as opposed to only 2% for sparkling brands. Globally, still brands accounted for 24%, 23%, and 22% of global volume sold in 2010, 2009, and 2008 respectively.

Risks

Coca Cola offers investors a lot of stability, but does carry certain significant risks. Since most of Coca Cola’s volume and revenue come from international operations, the company faces currency risk. In addition, increasing health-awareness around the world and especially in their saturated developed markets means Coca Cola will need to successfully grow their healthier beverages to remain competitive for the long-term, assuming this trend persists. Water scarcity around the world impacts Coca Cola’s business, especially in certain emerging market areas. Financially and ethically, Coca Cola must balance their operations with sustainability in order to continue achieving long-term success. The company also faces commodity cost risk for certain beverages.

Coca Cola has a rich valuation, both currently and historically. In order to legitimize the premium stock price, Coca Cola’s performance must be better than average. The company offers the potential of solid risk-adjusted returns, but the valuation gives little or no margin of safety in return.

Conclusion and Valuation

In conclusion, I think Coca Cola is a fairly good dividend growth investment at the current price of roughly $65.50. They’ve got strong profit margins, a powerful set of brands, extreme international exposure, diversification, and solid growth. The stock offers a moderate dividend yield, and has been diligently increasing dividends over the past 49 years.

The currently low P/E is misleading. The $11.8 billion in 2010 earnings should be reduced by about $4.7-5.0 billion in one time events for purposes of valuation, which leads to a trailing P/E of over 20. Analysts place the P/E at about 17 based on EPS estimates for full year 2011.

I wouldn’t expect home-run returns, but I believe Coca Cola can provide high-single-digit annual returns over the next ten years, and has mild downside. The company is among the surest of dividend increasers for those seeking passive income.

Full Disclosure: Long KO

You can see my full list of individual holdings here.

Get the Dividend Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Good post. Very strong brands and good exposure to emerging markets. A wider moat is hard to find. It has been Berkshires biggest public holding for years. As you mention the valuation is a bit on the high side.

Great analysis Matt! Thanks for the update on KO.

In terms of blue-chip, U.S. dividend-paying stocks, this guy is the creme de la creme.

Unless the “fundamentals” change significantly, I plan to hold this stock for another 30 years. How about you Matt?

Excellent write-up.

My Own Advisor,

To answer your question, yes, I plan to keep my KO holdings for the foreseeable future. Unless some major fundamental shift occurs, or KO stock becomes outrageously overvalued like it was in the late 90’s and early 00’s, I won’t be selling.

I came to the same conclusion. Great company, and a must have in any dividend portfolio, but the valuation right now is a bit high. Maybe if everyone starts chasing social media companies we will see some price dips.

Great analysis. I agree with you on the valuation…a little on the rich side. Although I consider Coke my “If you could only hold 1 company” stock, it’s actually one of my smaller holdings due to valuation. I picked up some in the mid $50’s and it ran away shortly after that. I haven’t been able to find a nice price since then. When people talk about paying a premium for safety however, you could definitely look at Coke. Great company, great stock and usually worth the premium. As it was said by defensiven, a wider moat is hard to find.

I have a question. You mentioned that there was a large jump in net income in 2010, and if I remember right, it was due to acquisition of some of their bottlers (and Pepsi did the same thing at about the same time). What sort of revenue did this transaction contribution? Or was it just an other income line item on the income statement?

I do agree that they have an incredible strong brand and have been good about growing overall value. However, I’ve chosen not to invest directly in them (nor Pepsi and a few other food companies) due to the health risks of their products.