The Coca Cola Company is the largest beverage business in the world, serving 200 countries with thousands of different products.

-Seven Year Revenue Growth Rate: 11%

-Seven Year EPS Growth Rate: 9.8%

-Seven Year Dividend Growth Rate: 8.9%

-Current Dividend Yield: 2.70%

-Balance Sheet: Leveraged but Strong

Overall, I view Coca Cola as a reasonable dividend growth stock to buy in the low $40’s. While Coke stock is never cheap, the risk-adjusted growth from worldwide operations, five decades of annual dividend increases, and product diversification should make for a rather defensive investment for the next decade.

Overview

The Coca Cola Company (NYSE: KO), with one of the strongest brands in the world, is the largest non-alcoholic beverage company around. Established in 1886, Coca Cola has been growing sales for over a century now and has a presence in over 200 countries with more than 500 total brands, ranging from carbonated beverages to juices to teas to water. The company is a dividend aristocrat, and it has increased dividends every year for over five consecutive decades. Ironically, while the company has grown considerably in the past 15 years, it has been a fairly bad investment because it was valued so highly back in the 90s. Over the last several years, with a more reasonable valuation, shareholders have enjoyed solid capital and dividend growth.

Geographic Diversification:

-Latin America accounts for 29% of Coca Cola Company’s product volume.

-North America accounts for 21%.

-The Pacific region accounts for 18%.

-Eurasia and Africa together account for another 18%.

-Europe is last at 14%.

Ratios

Price to Earnings: 21.7

Price to Free Cash Flow: 24.1

Price to Book: 5.7

Return on Equity: 27%

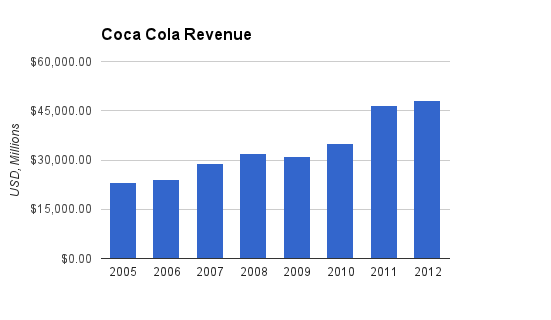

Revenue

(Chart Source: DividendMonk.com)

Revenue grew at a brisk 11% per year pace over this period, but a significant chunk of the total growth was due to the acquisition of their North American bottling operations.

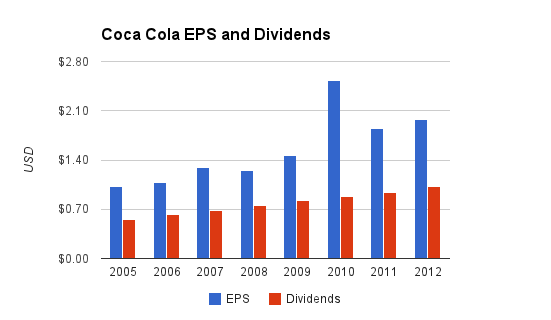

EPS and Dividends

(Chart Source: DividendMonk.com)

EPS grew at 9.8% per year on average over this period while the dividend grew at 8.9% over the same period. The dividend payout ratio from earnings is currently approximately 55% while the dividend yield is a moderate 2.70%.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.70% |

| 2013 | 2.7% |

| 2012 | 2.7% |

| 2011 | 2.8% |

| 2010 | 3.0% |

| 2009 | 3.3% |

| 2008 | 2.2% |

| 2007 | 2.6% |

| 2006 | 2.7% |

Coca Cola’s dividend yield is in line with its recent historical average. A larger yield could have been obtained during the 2008-2009 period, which is true for most stocks.

How Does Coca Cola Spend its Cash?

Over the 2010-2012 period, Coca Cola brought in $21.7 billion in free cash flow. During the same period, $13 billion was spent on dividends and $12 billion was spent on share buybacks (along with $4.7 billion in stock issued, for a net buyback amount of about $7.3 billion). The company also had a $1 billion positive net on acquisitions; sales were larger than purchases for these cumulative three years.

Balance Sheet

Coca Cola has a total debt/equity ratio of about 110%, and nearly 40% of the existing shareholder equity consists of goodwill. The total debt/income ratio is about 4x.

The high interest coverage ratio of over 25x paints a very sturdy picture of Coca Cola’s debt management. Overall, Coca Cola does make substantial use of leverage, but their overall financial shape remains very strong.

Investment Thesis

Coca Cola potentially has a place in a portfolio as a defensive core dividend-growth holding.

2020 Vision

Coca Cola currently has what they call the “2020 Vision”. It’s a specific long-term plan for growth over the 2010-2020 decade. This is substantial because it shows that the company is looking ahead and setting tangible long-term expectations and benchmarks for their company, and also assists investors in estimating a stock valuation for the company. Most shareholder-friendly companies of course have objectives like “create shareholder value over the long run”, but this is a rather specific set of goals for a ten-year period.

The most concrete and useful goal is the volume growth. The 2020 Vision states that Coca Cola will increase it’s global servings per day to 3 billion (compared to 1.8 billion currently). That would represent rather aggressive volume growth.

Volume Growth

Over the past three years, Coca Cola has done a solid job at increasing volume of their products. They sold 25.5 billion cases (representing 192 ounces of finished beverage each) in 2010, 26.7 billion in 2011, and 27.7 billion in 2012. This represents 4.2% volume growth, which if extrapolated would lead to about about 38 billion cases per year or 2.5 billion servings per day in 2020. The company will therefore have to accelerate volume growth a bit to meet their 3 billion servings per day goal, but even a 3-4% volume growth rate is nonetheless very solid business growth.

Approximately half of their volume of products solid consists of the Coca Cola trademark brands, while the other half consists of the rest of their brands combined. Their total sparkling brand lineup grew in volume by 3% in 2012 while their total still brand lineup grew by 10%. So the company is slowly aligning itself a bit away from carbonated beverages, although carbonated beverages are still the bulk of the business.

Per Capita Consumption

Currently the annual per-capita worldwide consumption of all Coca Cola products (which includes all of their various brands), is 94 eight-ounce servings. This is up from 92 last year, 69 in 2001, and 44 in 1991.

-The United States, with 316 million people, consumes 401 per capita servings each year, which is down from 403 last year and 407 in 2001. This is more than one eight-ounce serving per day, per person, on average, and could come from a Coke product, another Coca-Cola owned soda brand, one of their juices or teas, or bottled water, etc.

-Several Latin American countries lead in per capita consumption. The highest is Mexico at 745 per capita servings, followed by Chile at 486 per capita servings.

-Europe is much more heavily populated than North America but on average has less Coca Cola product consumption. Belgium is highest at 333, Spain is next at 283. For the three strongest economies, Great Britain consumes 200, Germany consumes 191, and France is lower at 141.

-In Eurasia and Africa, the annual per capita consumption is much lower in the mid 30’s, although up from 17 in 2001. This includes India (population: 1.2+ billion) with only 14 per capita annual servings, Pakistan (population 187 million) with only 21 servings, Nigeria (population 158 million) with only 26 servings, Russia (population 143 million) with 79 servings, and others.

-In the Pacific group, 50+ servings are consumed annually, per capita. This is up from 33 in 2001. This includes only 39 servings in China (population over 1.3 billion), and only 15 servings in Indonesia (population 240 million). Some of the more economically developed east Asian countries consume more.

In other words, while Coca Cola is extremely global, they are not nearly as penetrated into several high population markets as they are in North America, Latin America, and Europe. Several of the most populous countries in the world, including China, India, Indonesia, Pakistan, and Nigeria, consume less than a tenth or twentieth of what Americans consume. Coca Cola only needs to achieve moderate per-capita volume growth in these population-dense countries in order to increase global volume by a fairly robust amount.

In terms of Coca Cola attempting to achieve 3 billion servings per day in 2020, and the previously mentioned need for mild volume acceleration compared to what they’re currently doing, it looks like this is where it’ll have to come from. The company seems to be predicting that it’ll hit certain critical points that allow some pretty solid overall volume growth from these populated regions. Still, coming short of the 3 billion goal with 3-4% annual volume growth and 1-2% annual inflation pricing growth, that translates into 4-6% revenue growth per year.

Risks

Coca Cola strong competition from Pepsico, and there isn’t really a move that one company can make that the other can’t copy. Both of them acquired their North American bottlers in the last few years, for example. Coca Cola will have to continually invest in its global bottling and distribution system if it hopes to continue to hold and take market share from their principle competitor.

Unhealthy beverages face headwinds in developed markets, as evidenced by stagnant per capita consumption. A majority of the company’s products primarily consist of sugar water, which adds calories of a rather unhealthy variety to a typical daily diet, and likely contributes to “diseases of affluence”. Even some of the juices and other drinks are certainly not what one would call healthy, though the company does have some healthier options in their overall product lineup. Political forces or consumer trends could adversely affect the volume growth of the business, but the company does have significant geographic diversification to buffer their bottom line from any specific market problems. In addition, the company can make key acquisitions or offer new options within its existing brands to continually match consumer preference.

Conclusion and Valuation

All of the ingredients of a successful company continue to exist in Coca Cola. Their wide moat is based on their strong brand and unmatched distribution footprint, and then further widened by their bottling partnership network. Their dividend has grown every year for more than 50 years. Lastly, their long-term vision includes continuing volume growth mixed with maintenance of the profit margin, share buybacks, and dividend growth.

If Coca Cola can grow volume by 4% per year on average over the next decade (which is lower than what they’re currently growing by on an annual basis) and can achieve 2% pricing growth per year, then that’s 6% annual revenue growth. Assuming margins are stable and net stock buybacks are 2% of the market cap each year, that translates into 8% annual EPS growth. A stable dividend payout ratio then leads to the assumption of 8% long-term dividend growth per year.

Using a two-stage Dividend Discount Model, if Coca Cola grows the dividend by 8% per year over the next decade followed by 7% thereafter, and a 10% discount rate is used, the calculated fair stock price is between $40 and $41.

Buying at the current price or waiting for a small dip therefore appears to be a reasonable move to achieve at least a high single digit rate of return of 9-10% per year.

Full Disclosure: As of this writing, I am long KO.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

KO is a great company. It was actually one of my first dividend growth stocks. Right now with a 2.7% starting yield, it’s a little too overpriced for my tastes. But if it pulls back enough to get up to 3%, I’d consider adding to my position.

I bought KO a little more than a year ago based on the dividend growth potential. I try not to purchase stocks with dividend yield under 3% but KO was one of my exception. With such dividend growth rate, it is already paying a 3.31% yield based on my cost of purchase. This is definitely a stock to hold forever, regardless at which price you buy it.

Great write up on one of the true great companies – one that you keep forever. I brought KO back in September and have been saving and waiting to add to my position.

Such a great company, I’d love to add KO to my portfolio some time in the future. It’s one of the few stocks that I would consider that’s under a 3% yield. Look at that revenue growth!

I really enjoy the drink but really didn’t know anything about the stock and the company financials. seems like this is worth looking into for our portfolio. One of those buy hold and buy some more would seem like.

If you’re going to own dividend paying stocks, this one is a must IMO.

KO is a great company.

I’ve owned KO for a few years now. DRIPping in my tax-deferred account.

Killer review Matt, although that’s nothing new here. :)

Mark

Really nice, thorough analysis Matt. Gotta love those Dividend Increases!

I hold this one too – 30% capital gain, plus regular dividends since I first got in a few years back.

Michael

I have this stock in my watch list and ready to buy as soon as my strategy permits me to do so. I am excited about this stock and as Mike said above, KO is one of the stocks which is worth to invest in even the current yield is below 3% threshold (mine too).

Thank you for an excellent write up! Your generosity is simply impressive!

Thanks for the analysis. Look forward to knowing your thoughts on the executive compensation @ Coke, where the management is proposing to dilute the equity ( up to 14% i.e. issue 500 Million additional shares) for compensating employees and executives.