Summary:

Coca-Cola is the world’s largest beverage manufacturer. Its leader position makes it one of the most beautiful money making machines on the market.

KO’s distribution network is one of its most powerful competitive advantages. It can introduce any type of beverage across the world in a heartbeat.

However, currency headwinds coupled with an increasing taste for healthy products has slowed down Coca-Cola’s revenue growth potential.

DSR Quick Stats

Sector: Consumer defensive

5 Year Revenue Growth: 8.22%

5 Year EPS Growth: 4.44%

5 Year Dividend Growth: 8.27%

Current Dividend Yield: 3.08%

What Makes Coca-Cola (KO) a Good Business?

There is little to say that hasn’t been said already about Coca-Cola so I’ll make this section brief.

First things first, Coca-Cola is probably the best known brand across the globe. Such brand power cannot be replicated. Besides the classic Coke, the company owns several popular brands such as Vitamin Water, Powerade, Minute Maid, Dasani, Simply Orange and most recently Keurig. It claims to own twenty brands worth over $1 billion each in its portfolio.

KO’s second notable competitive advantage is its distribution power. The company has the ability to offer its products in over 200 countries. Here’s an idea of how wide this company is spread:

Source: Coca-Cola infographic

Therefore, each time the company has a new product; it can promote and distribute it across the world the next morning.

Ratios

Price to Earnings: 24.49

Price to Free Cash Flow: 20.75

Price to Book: 6.424

Return on Equity: 24.34%

Revenue

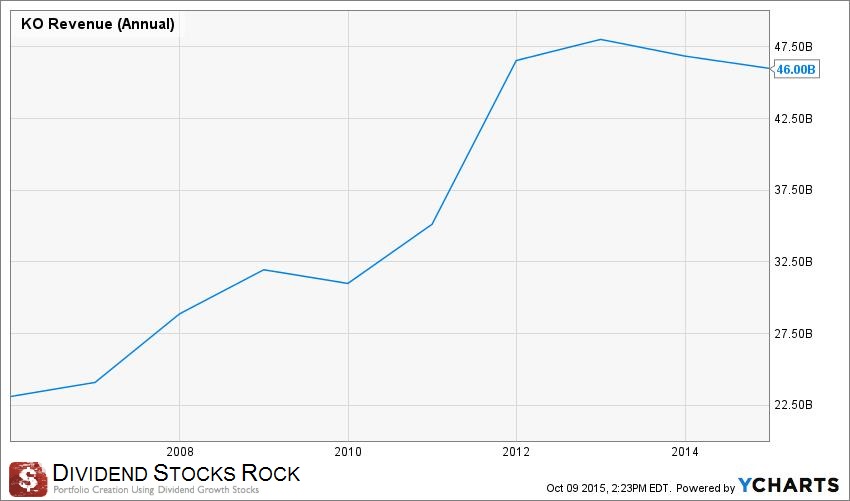

Coca-Cola is experiencing a small decline in North America for its popular carbohydrate drinks. A strong currency doesn’t help to support revenue growth either. We can say that revenue is relatively flat since 2012. Looking forward, I don’t expect an important increase in 2016, but the US dollar should not be a major factor since most of its strength has already been taken into account.

How KO fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. The first four principles are directly linked to company metrics. Let’s take a closer look at them.

Principle #1: High dividend yield doesn’t equal high returns

I always remain cautious about companies paying over 5% dividend yield. They always show greater risks than lower yielding stocks.

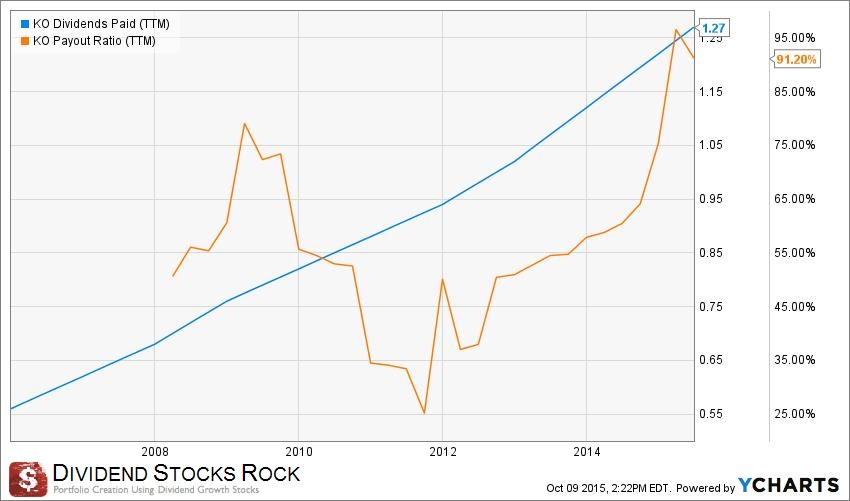

Coca-Cola’s dividend yield is becoming quite interesting lately going over the 3% bar. As you can see, the dividend paid keeps increasing year after year and the yield is staying within relatively the same range. This means the stock gains in value at the same pace.

Principle#2: If there is one metric, it’s called dividend growth

As a member of the selective dividend aristocrats group, KO’s dividend growth reputation is well defined. Over the past 5 years, its dividend growth rate is around 8%, doubling its dividend payment every 9 years or so.

The fact the company is selling consumable products across the world makes KO one of the most efficient cash flow machines in the stock market. A part of this cash flow is always redistributed to its shareholders.

Principle #3: A dividend payment today is good, a dividend guaranteed for the next ten years is better

We know that KO is a shareholder friendly stock, but is it able to keep increasing its dividend payment as it has in the past? I like to cross the dividends paid along with the payout ratio to find my answer:

While sales in units is increasing, currency headwinds has greatly affected the company’s earnings. This is why the payout ratio keeps increasing as you can see on the chart. While a 90% payout ratio is not amazing, the currency effect should be less important in 2016 and help to stabilize this ratio.

Principle #4: The Foundation of a dividend growth stock lies in its business model

Even though the company is going through a tougher period in terms of growth, it doesn’t take anything away its beautiful business model. KO shows a strong cash flow generation ability and benefits from important economies of scale across its network.

Its economic moat is well protected and we shouldn’t expect KO to be threatened any time soon.

What Coca-Cola Does With its Cash?

KO has been increasing its dividend payment for 53 consecutive years already. This makes it a senior dividend aristocrat. On top of paying its shareholders, the company has an important share buyback program.

In order to support growth and to diversify its product offering, the company doesn’t hesitate to make acquisitions. Its important cash flow is quite useful when it’s the time to buy other brands.

Investment Thesis

As a dividend growth investor, KO should be part of your portfolio. Its cash flow generation ability is quite impressive and it is safe to claim that your dividend payments will double every 7-9 years.

Coca-Cola has the ability to buy other popular brands and introduce them through their network. This will be a great growth opportunity for the years to come. Another growth factor will come from emerging markets. While we have heard about emerging markets potential for over a decade now, the product consumed per capita remains relatively low compared to North America. You can guess that Coca-Cola will benefit from any improvement of the middle class situation in those countries.

Risks

Coca-Cola’s main challenge in my opinion is to generate higher sales from its healthier products. While the company owns several great brands, the carbohydrate drinks sales are still the spine of the company. Long term growth may slow in the future and hurt the dividend growth perspective at the same time.

However, this won’t prevent the company from increasing its dividend. It will just slow down this amazing cash flow machine.

Should You Buy KO at this Value?

If you believe that KO shows a weaker financial forecast than usual, this may be the time to buy it. However, when I look at the past 10 years PE ratio, it seems the market is ready to be patient by valuing the stock relatively high:

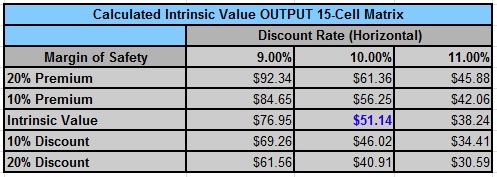

A more precise approach is by using the dividend discount model. I will use an 8% dividend growth rate for the first 10 years and reduce it to 7% afterwards. Since we are talking about a strong company, I will use a 10% discount rate:

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

It looks like the company trades at almost a 20% discount. This partially explains why the market is ready to pay 24 times the earnings.

Final Thoughts on KO – Buy, Hold or Sell?

I think that if you don’t own KO in your dividend growth portfolio, the current valuation should be enough for you to make a purchase. While we are not in a perfect environment, this company will continue to increase its cash flow and distribute higher payouts to its shareholders.

Disclaimer: I hold KO in my DividendStocksRock portfolios.

Leave a Reply