Summary:

Clorox has focused on innovation to generate future growth;

The company shows a portfolio of premium brands providing stable cash flow;

While the PE ratio is high (23+), the company is still trading at a 10% discount.

DSR Quick Stats

Sector: Consumer Defensive

5 Year Revenue Growth: 0.51%

5 Year EPS Growth: 2.07%

5 Year Dividend Growth: 9.07%

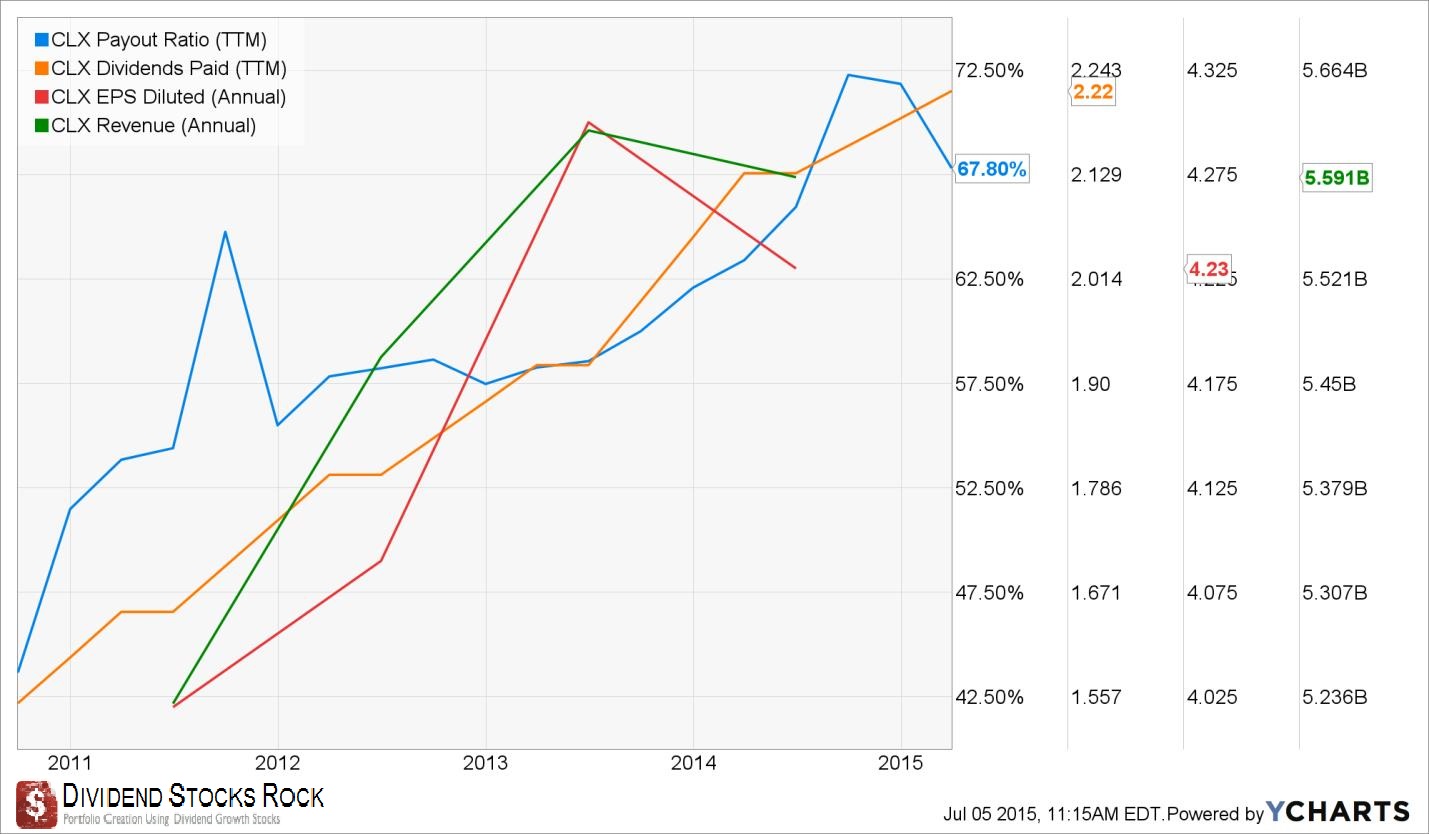

Current Dividend Yield: 2.79%

What Makes Clorox (CLX) a Good Business?

The Clorox Company (Clorox) is a manufacturer and marketer of consumer and professional products. Basically, anything you find when you open a closet at home has a 50% chance to belong to CLX portfolio brand. The Company operates four divisions: Cleaning (Pinsol, Clorox), Household (such as bags & wraps… Glad anyone?), Lifestyle (Brita, Burts Bees) and International (to cover sales for the above three divisions outside the US of A). As you can see, their revenues are pretty well spread among the four divisions:

What is even more interesting about Clorox is that 80% of their brands are #1 or #2 in their market. The size and variety of its brand portfolio enables CLX to scale their production and generate important synergy among its different brands. This is how CLX also shows a lower sales & administration cost as a percentage of sales vs their main competitors (14% compared to 21% in the industry according to a Clorox investor presentation: source)

Ratios

Price to Earnings: 25.10

Price to Free Cash Flow: 19.94

Price to Book: 46.09

Return on Equity: 291.40%

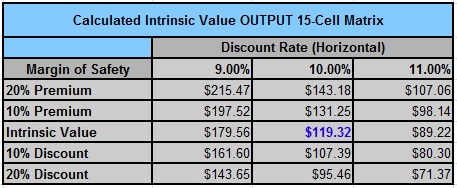

Revenue

Since 2013, CLX revenues have barely increased, this is why the 5 year growth is far from being spectacular (CAGR of 0.51%). This is mainly due to the difficult international context coupled with currency headwinds. In order to support revenue growth, CLX has put in place a massive innovation program to improve its existing products and create new ones.

The innovation program now has a 3% sales growth target for 2015 and the years to follow. This seems like solid growth for such a large and mature company.

How CLX fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve gone through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. The first four principles are directly linked to company metrics. Let’s take a closer look at them.

Principle #1: High dividend yield doesn’t equal high returns

High dividend stocks systematically underperformed the market mostly because there is always a good reason why the dividend yield is so high. In general, the market requires a higher yield from company showing higher risk. Also, most companies with high dividend yield show very limited dividend growth capacity.

The CLX yield has been relatively low over the past 5 years and it’s even more true ever since the stock price increased in valuation over the past 12 months. The yield is now around 2.75%. This is not a huge dividend yield, but I would rather buy shares of a company that shows strong dividend growth than a high dividend yield.

Principle#2: If there is one metric, it’s called dividend growth

As I just wrote, dividend growth is the mother of all solid companies held in my portfolio. The reason is simple; if a company shows strong dividend growth, it is driven by increasing sales and profits. Two very powerful factors to look at for any type of business.

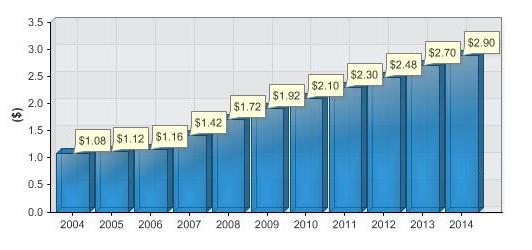

The dividend payment has more than doubled in the past 10 years. Enough said.

Principle #3: A dividend payment today is good, a dividend guaranteed for the next ten years is better

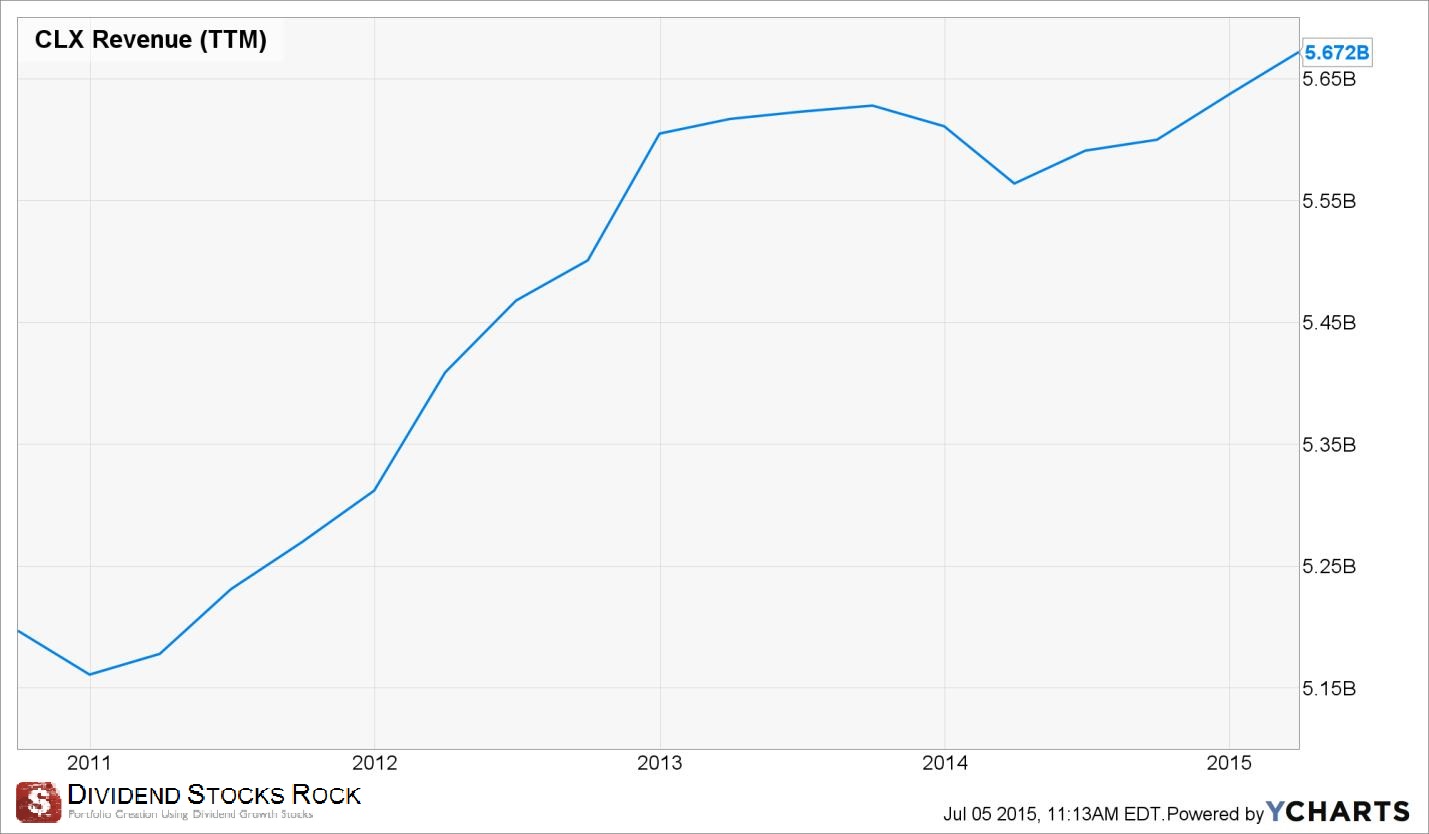

I think CLX’s dividend payment reputation is not to be discussed here. After 38 consecutive years of dividend increases, we can expect the company to continue. However, a quick look at the dividend payout ratio is always a good idea.

The company used to stick between 50% and 60% which leaves a very comfortable margin to increase it. Lately, the ratio has drifted higher than 70% and the aggressive dividend growth policy (9% over 5 years) might has to be reviewed in the long term.

Principle #4: The Foundation of dividend growth stocks lies in its business model

The Clorox business model is based on a very solid brand portfolio where most of their brands hold the #1 and #2 position in terms of market share. This makes it very hard for other competitors to enter the CLX playground.

Plus, since the company is selling consumer products, it generates constant cash flow helping the company pay ever increasing dividends while continuing to invest in the future.

What Clorox Does With its Cash?

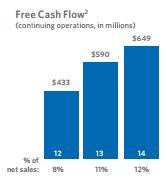

As is the case for most consumer stocks, CLX is a real money making machine. The company focuses on free cash flow generation as demonstrated:

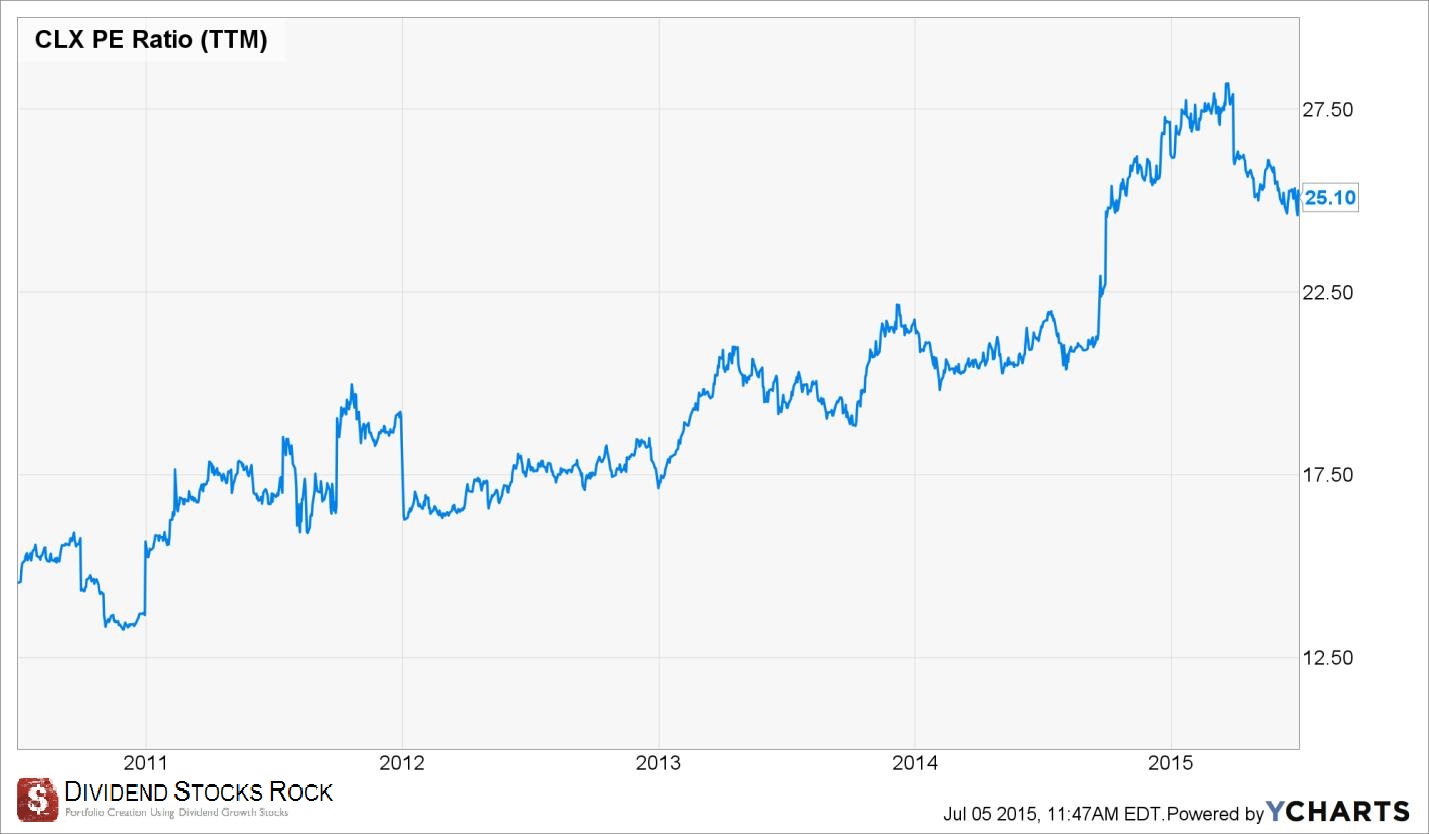

Last year, out of the $649 million in free cash flow, CLX paid $368 million in dividends. The company doesn’t only increase its dividend each year but also actively purchases its shares. The company bought nearly 40% of the outstanding shares over the past 10 years. This probably explains its relatively high PE ratio (over 25) but the company shows a smaller price to free cash flow evaluation (around 19).

As previously mentioned, CLX also spend and important part of its budget toward product innovation. The key to remain a leader in consumer products is to evolve continually and maintain a very strong brand portfolio. CLX has successfully done this over the years.

Investment Thesis

The reason an investor would pick CLX to be part of his portfolio is somewhat obvious: it is an ever increasing dividend stock. Clorox is part of the selective group of dividend aristocrats that has increased its dividend for at least 25 years consecutively. In 2015, they have reached their 38th consecutive year with a dividend raise.

The company is currently driving its 2020 vision focusing on 4 key strategies:

#1 Engage our people as business owners

#2 Increase our brand investment behind superior products and more multi-targeted 3D innovation

#3 Keep the base healthy and grow into profitable new categories, channels and countries

#4 Fund growth by reducing waste in our work, products and supply chain

The company goals are to support a 3-5% organic sales, improve margins by 25 to 50 bps and to generate free cash flow of 10-12% of sales.

In other words; this consumer product giant will aim at reducing their costs, improving their sales and focus on high levels of cash flow in order to increase its dividend payment for the next 100 years.

Clorox’s ability to push new products through its distribution channel should support sales in the upcoming years.

Finally, the world is highly sensitive to potential disease spreading catastrophes. We had another example with Ebola last year. Cleaning and disinfecting products have become very important and CLX is in a leadership position to benefit from this robust trend.

Risks

When you look at the CLX sales growth, you will notice there isn’t any growth among its products. Since international sales represent 20% of total sales, we can’t blame everything on currency headwinds. The problem is that Clorox bleach and charcoal products are used by consumers on a daily basis but there aren’t many ways to make consumers buy more to support higher growth.

CLX spends massively on marketing in order to promote their products and it’s working perfectly as CLX usually enjoys a price premium over its competitors without hurting its sales too much. However, this requires a constant advertising effort and the brand differentiation factor is still very slim for the consumer.

Overall, the main risk around a company like Clorox is to see sales stagnate which would push the dividend payout ratio to higher levels. The dividend payment is far from being at risk, but the payment growth might be very thin in the years to come.

The company is well aware of this situation and this is why it is focusing on improving existing products and has created a strong product pipeline for the upcoming years that should increase sales and resolve the current sales stagnation situation.

Should You Buy CLX at this Value?

CLX has recently benefitted from a strong bullish thesis pushing its valuation through higher levels. You can see in the chart below how the CLX PE ratio has risen over the past 10 years.

Considering the previous market valuation, the PE method shows there is a lot of enthusiasm for Clorox at the moment.

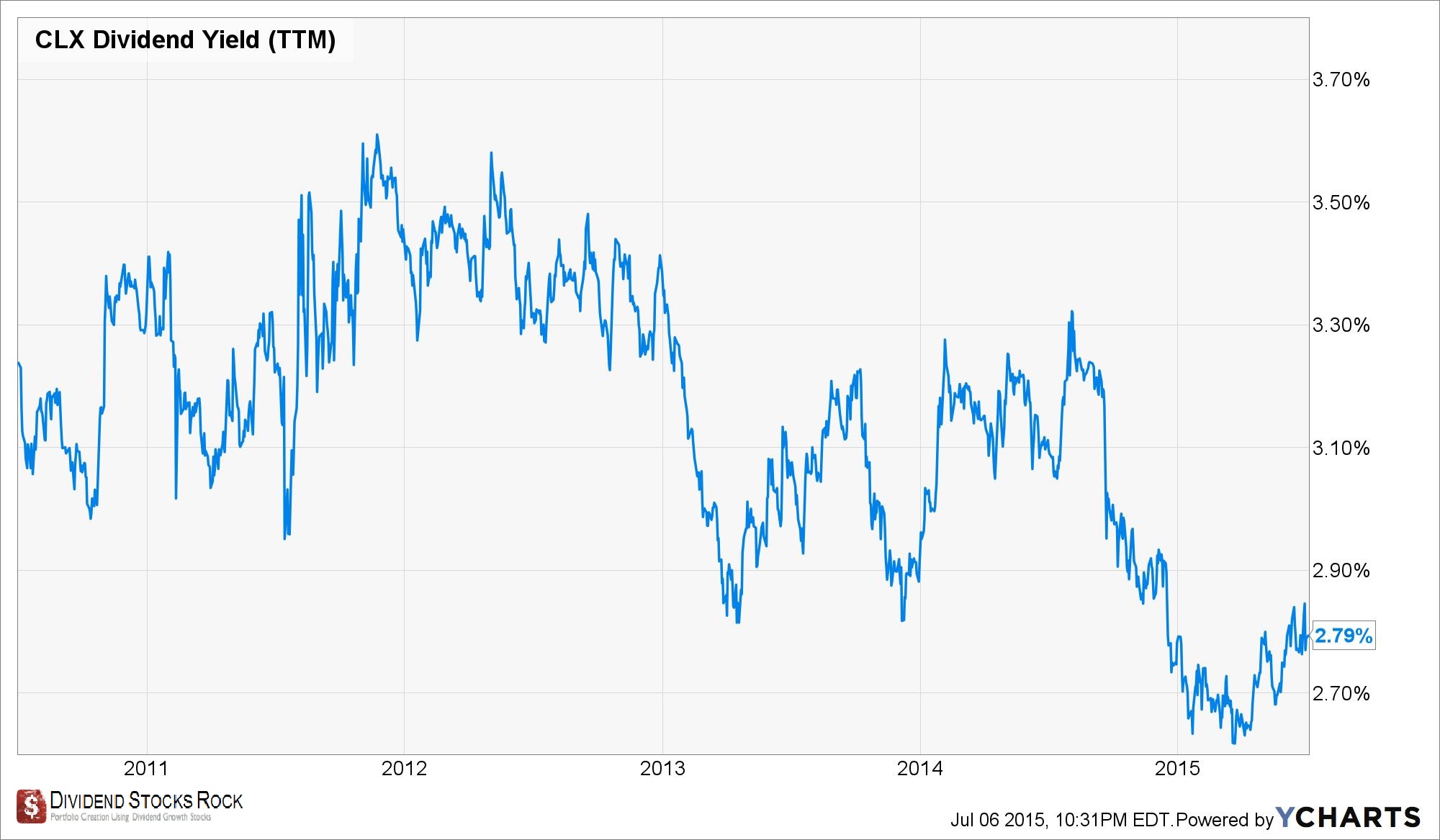

Going further, I’ll use the dividend discount model to determine stock value in terms of dividend distribution. Using a 10% discount rate and a dividend growth rate of 8% for the first 10 years and then 7% after, I get the following chart:

Source: Dividend Toolkit calculation spreadsheet

Source: Dividend Toolkit calculation spreadsheet

As the stock is currently trading around $105, it seems to be trading at a 10% discount.

Final Thoughts on CLX – Buy, Hold or Sell?

Buying shares of CLX will not make you double your investment within the next two years. It is relatively stable company evolving in mature markets. However, this doesn’t mean it’s a bad investment. For its solid dividend growth history, its premium brand portfolio and the fact the company is still trading at a discount considering its dividend payment; I think CLX is a buy.

Disclaimer: I do not hold shares of CLX at the moment.

Great analysis here Mike. I love Clorox and consumer brand stocks. In my opinion, there is always value in a strong brand that can be found in every household. The one thing that scares the you know what out of me is the disparity between dividend growth and EPS growth. How the heck are they going to keep up the strong dividend growth rate if it outpaces their EPS growth by that much. CLX already operates with a high payout ratio, so the current growth rate cannot be sustained over the long run without sacrificing dividend safety. It’ll be very interesting to see how this plays out.

Have a great weekend!

Bert

Interesting take on CLX. I have owned this one for a long, long time and would love to add to my position but have always thought of CLX as overvalued and never added to my existing position. I do have some concern over future growth but there’s little doubt that from a dividend perspective this company is a star. Thanks for sharing.

I strongly believe they are a buy. Good company and wide competitive edge that make the stock very attractive. Thanks for sharing!