-Seven Year Average Revenue Growth Rate: 2.8%

-Seven Year Average EPS Growth Rate: 5.7%

-Seven Year Average Dividend Growth Rate: 12.2%

-Current Dividend Yield: 3.43%

-Balance Sheet Strength: Leveraged, Stable

The company appears to be a reasonable buy in the low $80’s for an estimated 9-10% rate of return going forward.

Overview

Clorox (NYSE: CLX) is a leading consumer products company and a solid dividend payer. It was founded almost 100 years ago in 1913, and currently has a market capitalization of over $9 billion. At one point during the 20th century, Clorox was purchased by Procter and Gamble, but due to concerns over a lack of competition, Procter and Gamble sold Clorox and it is again a stand-alone company.

The company is divided into four business segments: Cleaning, Household, Lifestyle, and International.

Cleaning

The cleaning segment provides 32% of company revenue, and includes brands such as Clorox, Liquid Plumber, 409, Tilex, and Pine-Sol.

Household

The household segment provides 30% of revenue and includes brands such as Glad, Kingsford, Match Light, Fresh Step, and Scoop Away.

Lifestyle

The lifestyle segment provides only 16% of revenue and includes Burt’s Bees, Hidden Valley, Brita, and Masterpiece.

International

The international segment provides the remaining 22% of revenue, and includes some international brands as well as some of the domestic brands like Clorox.

Valuation Metrics

Price to Earnings: 19

Price to Free Cash Flow: 19

Price to Book: 74

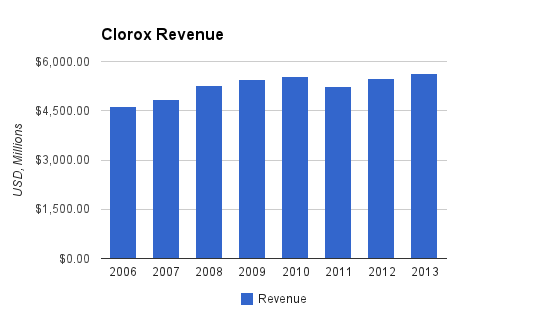

Revenue

(Chart Source: DividendMonk.com)

Revenue grew at a low average rate of only 2.8% per year over this period. The company did, however, sell its auto care business for three quarters of a billion dollars, which impacted revenue.

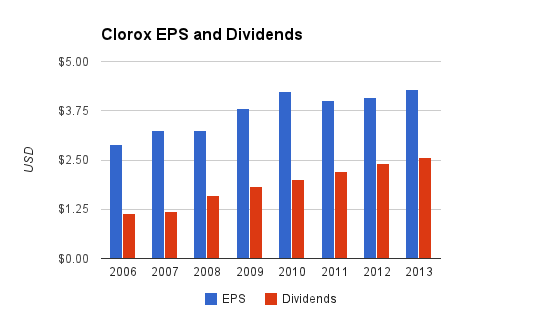

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS growth was modest at 5.7% per year on average. The dividend growth rate was high at over 12.2%. To maintain a steady payout ratio, Clorox will have to have some combination of EPS growth rate acceleration and dividend growth rate reduction. The current dividend yield is 3.43% and Clorox has increased its dividend every year since the 1970’s.

Approximate Historical Dividend Yield at Beginning of Each Year:

| Year | Yield |

|---|---|

| Current | 3.43% |

| 2013 | 3.45% |

| 2012 | 3.60% |

| 2011 | 3.47% |

| 2010 | 3.26% |

| 2009 | 3.26% |

| 2008 | 2.52% |

| 2007 | 1.81% |

| 2006 | 1.90% |

Clorox has expanded its payout ratio from 40% to 60% over this period, which along with changes in valuation has resulted in a higher dividend yield over time.

How Does Clorox Spend Its Cash?

Clorox enjoys strong free cash flow generation, and brought in nearly $1,500 million in free cash flow during the combined fiscal years of 2011, 2012, and 2013. During that time period, the company brought in another $650 million in cash from its net acquisition activity (with the cash coming from the divestiture of their auto care segment). Over this same period, the company spent $950 million on dividends and $1,000 million on share buybacks.

Balance Sheet

The debt/equity ratio is very high, because Clorox has practically no equity. Assets minus liabilities leaves essentially zero. The company has about $1.1 billion in goodwill, so the tangible book value is negative.

The debt/income ratio, on the other hand, is fair at 4x. Most importantly, the interest coverage ratio is 8x, so the company’s operating income can pay the debt interest 8 times over.

Overall, it’s a leveraged but stable balance sheet. The company has stated in investor presentations its intention to maintain the current leverage.

Investment Thesis

The company manages a medium-sized portfolio of top brands that for the most part are the #1 or #2 brands in their categories. Some brands such as the Clorox and Kingsford brands dominate their industries with market shares that are multiple times the size of the next largest competitor.

The company aims for 3-5% organic sales growth per year going forward, with the U.S. retail segment having 2-3% growth (representing most of the company), the international segment having 5-7% annual growth (representing less than a quarter of the company), and the U.S. professional segment having 10-15% annual growth (representing only a small portion of the company).

Much of the sales growth, or about 3% per year, comes from product innovation. The product innovation varies, but generally targets one of the 4 “megatrends” that Clorox describes: Health and Wellness, Sustainability, Affordability, and Multicultural (primarily the U.S. Hispanic market). For the professional segment, Clorox is looking to expand into health care applications, to develop and sell new products for that industry.

Risks

Many products such as bleach and charcoal are commodities with no significant differentiation between brands, and yet Clorox enjoys a price premium and leading market share. The lead is maintained by years of marketing and brand recognition rather than clear product superiority. This can have difficult-to-predict consequences on pricing power over the long-term, especially since the company reports a goal of slowly increasing profit margins as part of its overall growth strategy.

A full quarter of revenue is derived from a single retailer: Wal-Mart. This gives Wal-Mart leverage in price negotiations.

Conclusion and Valuation

The company has strong brands, decent diversification, and a long history of consecutive annual dividend growth stretching back to the 1970’s. My 2012 analysis on the company was lukewarm, but after a solid fiscal year and rising stock prices overall, I believe the attractiveness of Clorox as a stock has improved compared to the overall market.

If the company can achieve 3-5% organic sales growth, and continues to buy back 1-3% of its shares each year, then that’s about 4-8% EPS growth assuming constant net margins, which specifically excludes their goal of gradual margin improvement.

Based on the Dividend Discount Model (DDM) with a 10% discount rate (the target rate of return), if the company grows the dividend by an average of 7% per year for the long term, then the fair price is over $90, compared to the current stock price of only about $83. Alternatively, if the dividend growth rate ends up only being 6.5%, that makes the current price in the low $80’s about fair.

In a fairly poor scenario, even if only a 5.7% long-term EPS/dividend growth rate is achieved (chosen to match the previous 7-year average EPS growth), then the current price in the low $80’s can still offer a 9% long-term rate of return, based on the DDM again.

Overall, the company appears to be a fairly stable bet. Most of the returns should come from maintaining pricing against inflation, moderate product innovation, dividends, and buying back shares. The valuation is neither entirely unreasonable nor unusually appealing, but compared to the fairly high valuation of the market currently, it may make a good choice for a stock with a decent dividend yield (3.43%) and consistent dividend growth history.

Full Disclosure: As of this writing, I have no position in CLX, though it is on my watch list for possible purchase.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Haven’t spent much time looking at Clorox, but it is something I would consider once I have other companies funded in the future, and will keep an eye out for a good value to slip some share into my holdings.

In first para,

“…a reasonably buy…”

should be

“…a reasonable buy…”

Thanks, fixed.

I also found myself looking at Clorox a few days ago.. I like the slow and steady approach in increasing EPS, to fuel further DPS increases.. I might consider adding some in October..