The Clorox Company is a leading consumer products company with a variety of strong brands.

Five-Year Annual Revenue Growth Rate: 2.4%

Five-Year Annual EPS Growth Rate: 6.7%

Five-Year Annual Dividend Growth Rate: 14%

Current Dividend Yield: 3.68%

Balance Sheet: Stable, but a lot of debt

Based on the current situation, I view the company as being approximately fairly valued at its current price at around $70. Clorox has strong brands, but the balance sheet has quite a bit of leverage.

Overview

Clorox (NYSE: CLX) is a leading consumer products company and a solid dividend payer. It was founded almost 100 years ago in 1913, and currently has a market capitalization of over $9 billion. At one point during the 20th century, Clorox was purchased by Procter and Gamble, but due to concerns over a lack of competition, Procter and Gamble sold Clorox and it is again a stand-alone company.

2011 Sales Breakdown

| Segment | Net Sales Percentage |

|---|---|

| Cleaning | 31% |

| Household | 31% |

| International | 21% |

| Lifestyle | 17% |

Total 2011 revenue was $5.231 billion. Each of these categories includes a variety of strong brands, and some of them are listed below.

Cleaning:

Clorox, 409, Pine Sol, Greenworks, Tilex

Household:

Fresh Step, Kingsford, Glad, Scoop Away, Match Light

Lifestyle:

Brita, Burt’s Bees, Hidden Valley, Masterpiece

International:

Poett, Mistolen

Ratios

Price to Earnings: 17

Price to Free Cash Flow: 21

Price to Book: N/A*

Return on Equity: N/A*

*due to negative book value

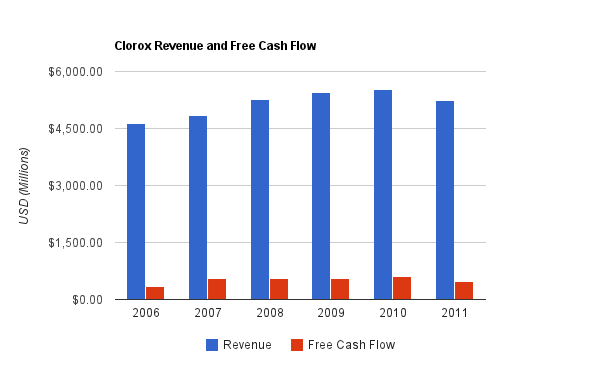

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

Clorox averaged 2.4% annualized revenue growth over this period, which included some restructuring. Free cash flow growth over this period was erratic and negligible; free cash flow was larger in 2007 than 2011, for example.

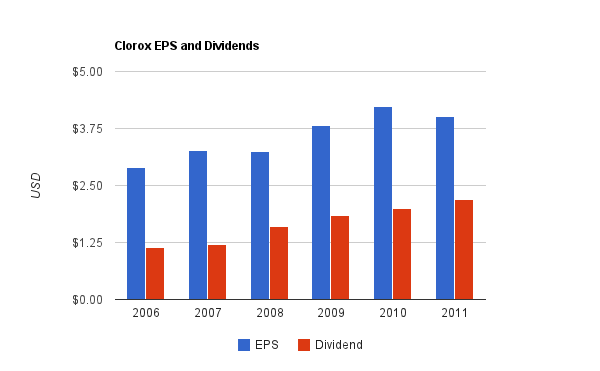

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings per share grew by 6.7% per year, on average, over this period. The dividend, which currently yields 3.68%, grew by 14% annually over the same period. The current dividend payout ratio from earnings is around 60%, and the dividend payout ratio from free cash flow is a bit over 70%, so the dividend appears safe for now. Clorox has a multi-decade stretch of consecutive annual dividend growth that goes back to the late 1970’s.

How Clorox Spends its Cash

During 2009, 2010, and 2011, Clorox generated about $1.6 billion in free cash flows. Around $840 million was paid out in dividends over this period, and another $670 million was used to reduce the number of shares outstanding (value of shares repurchased minus value of shares issued). The company generated another $730 million or so from divestitures, and paid back around $840 more in debt than it issued.

Overall, in my opinion, this company has put cash to good use.

Balance Sheet

Clorox has a total debt/equity ratio that is off the charts, because it has negative equity. The company has slightly more liabilities than assets, by about $100 million. Total debt/income is a bit over 5, which is on the high side for this type of company. The interest coverage ratio is over 7, which is not outstanding, but quite comfortable.

Together, these figures depict a balance sheet that has substantial leverage, but is stable. Interest payments on debt are well-covered by income, and the company can maintain or reduce the debt load over time. But this is a sink of capital that limits how much can be spent on dividends and share repurchases.

Investment Thesis

Despite being a modestly sized company compared to Procter and Gamble, 90% of Clorox’s brands hold the #1 or #2 spot in their markets. So it’s a moderately sized collection of top brands.

Growth has been lackluster over the last several years, and the balance sheet is far less impressive than many of its peers, but the company does have a quantitatively safe dividend, a long history of dividend growth, and fairly basic and defensive products.

Clorox identifies four “megatrends” that it uses to evaluate growth opportunities. These megatrends are:

-health and wellness

-sustainability

-multicultural

-affordability/value

In other words, Clorox intends on targeting consumers interested in health and wellness, targeting consumers that care about the sustainability of their products, attempting to grow their market penetration among non-caucausians, and also making products for people on a budget.

Risks

Put simply, Clorox lacks any definitive “edge”. It’s not the biggest at what it does, and although its brands are strong, there’s nothing that makes it inherently better at what it does, either. Some of the products they sell are looked upon as basic commodity products.

The company has a balance sheet that isn’t particularly strong, and any of its brands can face strong competition from a peer. High commodity costs can reduce profitability, and exchange rates can help or hurt profitability as well.

Conclusion and Valuation

Clorox has strong brands and healthy cash flows, but a fairly weak balance sheet and no major economic moat to speak of. Growth has been moderate over the last several years, though the company does have a nearly 100 year history of strong operations.

Going forward, Clorox’s dividend growth rate must eventually reduce to match the EPS growth rate if the payout ratio is to remain reasonable. If the company can grow its dividend by 6.7% annually over the long term (which is the recent five-year EPS growth rate), then I calculate via the dividend discount model that up to about $75/share is reasonable, compared to the current price of around $70/share. That being said, since the model is highly sensitive to inputs, I’d look for a margin of safety with an entry point in the mid $60’s or lower.

Full Disclosure: As of this writing, I have no position in CLX. I do own shares of PG.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

[…] Articles for the Month: Clorox Company Analysis Coca Cola: Acceptable Risk Adjusted Returns Philip Morris International: A Solid Buy Five of the […]