Church and Dwight (NYSE: CHD) is one of the smaller major producers of consumer products.

-Seven Year Revenue Growth: 9%

-Seven Year EPS Growth: 16.7%

-Current Dividend Yield: 2.03%

-Balance Sheet Strength: Excellent

Overall, I think Church and Dwight is currently richly valued. I view it as a hold. The company is very well positioned and likely has a bright future, but personally I’d invest elsewhere for now.

Overview

Church and Dwight (NYSE: CHD) is a producer of various consumer products. It was founded by John Dwight in 1847 and came to its more current form when John Dwight partnered with Austin Church in 1896 to sell baking soda. Business tycoon, Armand Hammer, sat on the board of directors at a later date, and was born after the baking soda brand “Arm and Hammer” was created.

Brands

The company has over 80 brands, but 8 of those brands account for over 80% of total sales:

Arm and Hammer

The brand of baking soda that, in one form or another, is in 90% of American households.

Trojan

The market leading condom brand.

Oxi Clean

Laundry additives

Spinbrush

Battery powered toothbrushes

First Response

Pregnancy kit

Nair

Hair removal

Orajel

Oral pain relief

Xtra

Deep value laundry detergent

Overall, 47% of sales are household products, 26% are personal care products, 17% are consumer international, and 10% are specialty products.

Revenue, Earnings, Cash Flow, and Metrics

Church and Dwight has had very consistent growth, and its stock has gone nowhere but up, over the last decade.

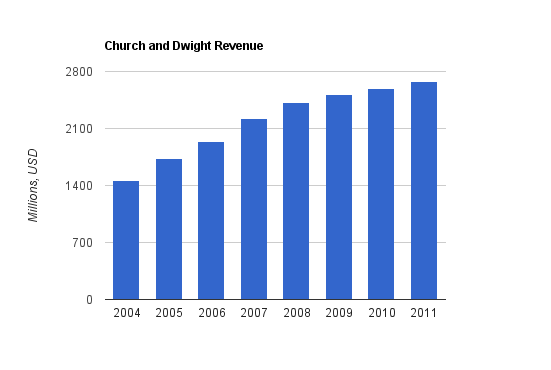

Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $2.68 billion |

| 2010 | $2.59 billion |

| 2009 | $2.52 billion |

| 2008 | $2.42 billion |

| 2007 | $2.22 billion |

| 2006 | $1.95 billion |

| 2005 | $1.74 billion |

| 2004 | $1.46 billion |

Over this time period, Church and Dwight has grown revenue by approximately 9% annually, which is excellent.

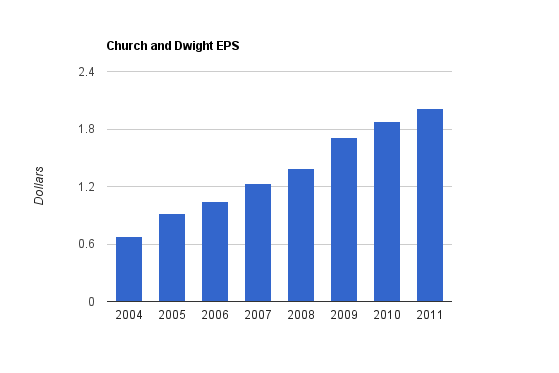

Earnings Growth

| Year | EPS |

|---|---|

| TTM | $2.01 |

| 2010 | $1.88 |

| 2009 | $1.71 |

| 2008 | $1.39 |

| 2007 | $1.23 |

| 2006 | $1.04 |

| 2005 | $0.92 |

| 2004 | $0.68 |

The annualized EPS growth rate over this period is 16.7% annually, which is very high.

Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| TTM | $459 million | $392 million |

| 2010 | $428 million | $365 million |

| 2009 | $401 million | $265 million |

| 2008 | $336 million | $238 million |

| 2007 | $249 million | $200 million |

| 2006 | $186 million | $139 million |

| 2005 | $190 million | $152 million |

| 2004 | $195 million | $160 million |

Operating cash flow grew by 13% annually over this period, and free cash flow grew by 13.7% annually. Very robust growth.

Metrics

Price to Earnings: 23.5

Price to Free Cash Flow: 17.2

Price to Book: 3.3

Return on Equity: 15%

Dividends

The company finally breached a 2% dividend yield, and currently offers a 2.03% dividend yield. The dividend payout ratio from earnings is a bit under 50%, and the payout ratio from free cash flow is around 35%.

Church and Dwight had a very small dividend yield over the last several years, so a table showing the large growth of the tiny dividend will be excluded. However, the latest quarterly increase for the first dividend in calendar year 2012 brought the quarterly dividend up to $0.24 from $0.17, which is an increase of more than 40%. The previous year’s increase was very large as well. The dividend, while still small, has become meaningful.

How Church and Dwight Spends Its Free Cash

Over the trailing twelve months, the company pulled in $392 million in free cash flow. Less than $90 million was spent on dividends, and none was spent on share repurchases. A fair bit over $100 million was spent on acquisitions. The company therefore had ample room to increase the dividend, and will now be paying out a figure of more like $140 million or so on dividends annually. Over the last ten years, the company has spent much of its free cash flow on acquisitions, little or none of the free cash flow on share repurchases, and only a moderately small amount of free cash flow on dividends.

Balance Sheet

Church and Dwight has a total debt/equity ratio of only 0.12, an interest coverage ratio of over 30, a total debt to net income ratio of under 1, and goodwill is substantial but is less than half of shareholder equity. Overall, the company has an excellent balance sheet.

Investment Thesis

One of my first published analysis articles was of Church and Dwight. I was a shareholder of the company at the time, and published an analysis saying it’s reasonably valued, that it’s not going to make anyone rich but that it should be a steady performer over the long term, and is superior to its competitors Procter and Gamble, Colgate-Pamolive, and Clorox. As it turned out, between 2009 and 2012 the stock price doubled, so I guess I may have underestimated the “not going to make anyone rich” part. That’s a rather stellar increase for 3 years of selling baking soda and condoms.

I ended up selling my position after a rather large gain as part of a minor portfolio shift of letting go two low-yielding holdings and buying some higher-yield holdings, but that was back when the company had a yield of considerably below 2%. Overall, I considered it to be richly valued, and with its low yield was a good candidate for sale as part of my shift towards a higher portfolio yield after it had already had a substantial appreciation in price.

Acquisitions

The problem with acquisitions is that they use up part of the free cash flow, rendering it not really “free” at that point, since it’s required for the existing levels of growth. Church and Dwight, however, has been exceedingly good at picking smart acquisition targets to fuel their market-beating returns over the past decade.

Selected Historical Acquisitions:

2001: Xtra, leading value laundry brand, Trojan Condoms, leading condom brand in US, and Arrid and Nair

2003: Mentodent and Pepsodent oral care

2006: Oxiclean, Orange Glo, Kaboom

2008: Orajel, helped boost profit margins

2010: Simply Saline, Feline Pine

Global Expansion and Brand Power

Church and Dwight has some particularly strong brands, with an emphasis on Arm and Hammer and Trojan.

When it comes to something as critical as birth control when it’s used, the strength of brand perception can easily bring in strong profit margins. Birth control simply isn’t the first area that people are going to cut costs on when they’re trying to save money.

As far as global expansion is concerned, Church and Dwight is a bit behind the curve compared to some of its larger competitors. Ten years ago, the company had close to zero international exposure, but now has more than 20% of sales coming from outside the United States. I expect this trend to continue, and for Church and Dwight to continue to capture international market share.

As a company with a market cap below $7 billion, Church and Dwight has a lot of room to grow if managed well. In addition, I wouldn’t be overly surprised if one day the company were acquired by another company for a premium price, but I wouldn’t speculate on that possibility as a reason to invest.

Risks

Church and Dwight has the standard risks of the defensive basic consumer products industry; commodity costs, margin risks, competition over market share, currency risks, and so forth.

The company is smaller than most of its rivals such as Procter and Gamble (PG), Colgate-Palmolive (CL), and Clorox (CLX), so I wouldn’t view the company as having any intrinsic economic advantage or “moat”, and that would worry me a bit as an investor.

An upside, however, is that Church and Dwight’s substantial portfolio of value brands gives it an extra layer of defense against recessions, since if consumers downgrade from premium branded products to value brands, the company still can do well.

Another risk is that of product failure. Just the other day, the FDA sent out a warning about Spinbrush products having issues of breaking apart and causing injuries. Church and Dwight is fairly diversified into numerous product groups but any setbacks for their top 8 brands (of which Spinbrush is one), can be financially noticeable depending on the scale of the issue and the amount of any intangible damages to the brand.

Conclusion and Valuation

Church and Dwight has performed superbly over the last decade. The company simultaneously:

a) Improved the balance sheet from fairly weak to excellent,

b) Grew revenue strongly via both organic growth and smart acquisitions,

c) Increased gross, operating, and net profit margins substantially,

d) Went from virtually zero international exposure to over 20% international exposure,

d) Brought the dividend from negligible to small-but-meaningful.

The outstanding stock price growth over the last decade or so has clearly demonstrated this success.

In some ways, the past successes could indicate a downside rather than an upside for the future. Afterall, there’s a lot more improvement to be had from a broken car than a well-oiled driving machine. As the company increases substantially in size, and as margins inch closer to maximum efficiency, and as the balance sheet is nearly cleared of debt, there are fewer “easy fixes”, and now everything must come from growth and shareholder returns. But on the other side of the coin, this newer, brighter situation gives the company greater freedom to provide substantial dividends, and gives it more leverage to deal with the larger competitors.

Coming up with a reasonably accurate intrinsic valuation for Church and Dwight proves tricky due to the rather substantial growth and the usage of free cash flow for substantial acquisition expenditure.

If I subtract the five-year average annual net acquisition costs from free cash flow (FCF), and then assign a rather aggressive 10% growth rate for FCF from the current figure, and use a 12% discount rate to represent high expectations and a lack of a moat, then I calculate that the current market cap is currently approximately 15% more expensive than this calculated intrinsic value of less than $6 billion. If I dial it back a bit, and assume 8% FCF growth with a 10% discount rate, I get a similar figure of over-valuation.

If, however, the company were to continue its 13% FCF growth rate, then even the higher discount rate would lead to a conclusion that the current stock price is undervalued. Similarly, if the lower FCF growth were used but the discount rate were dropped to 8% to represent the fairly conservative nature of the industry that the company operates in, then the stock is currently undervalued. These options, however, may be overly optimistic, and provide no margin of safety.

Therefore my conclusion is that the company is currently richly valued. Not dramatically so, but enough to keep me from buying at the current price. I doubt an investor 10 years from now would be sorry for purchasing Church and Dwight stock today, but I do think there are better options out there currently.

Full Disclosure: At the time of this writing, I have no position in CHD.

You can see my dividend portfolio here.

Get the Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Nice earnings growth, but as you point out, no competitive moat. Not a bad investment, but I think there are better opportunities out there.

I wonder if there will be a take-over bid in the coming years…

Good analysis DM!

Nice analysis. I agree that CHD is a bit overvalued, which is the main reason I have stayed away from it. However, it does seem like a pretty solid company and your analysis supports that view.