-Seven Year Average Revenue Growth Rate: <3%

-Seven Year Average EPS Growth Rate: 10.7%

-Seven Year Average Dividend Growth Rate: 10.5%

-Current Dividend Yield: 3.26%

-Balance Sheet Strength: Perfect

Chevron appears to represent a decent buying opportunity at this time in the mid-$120’s.

Overview

Founded in 1879, Chevron (NYSE: CVX) is currently one of the largest oil and gas companies in the world. The company is involved in almost every type of energy business available.

Exploration and Production

In 2012, Chevron produced an average of 2.61 million barrels of oil per day, and at the end of the year their proved oil-equivalent reserves were 11.35 billion barrels. The company has exploration and production operations all over the world, and tends to particularly specialize in deep sea drilling.

Gas and Midstream

Chevron has a strong vertically integrated natural gas business. They’re involved in liquefaction, pipelines, marine transport, marketing/trading, and power generation. The company has 160 billion cubic feet of natural gas resources.

Downstream and Chemicals

In 2012, Chevron processed 1.7 million barrels of oil per day on average. This results in fuels, lubricants, and petrochemicals. There are over 16,000 stations selling Chevron products.

Technology

The company operates technology centers in the United States, United Kingdom, and Australia where they develop technology for use in the other business areas.

Renewable Energy and Energy Efficiency

Chevron is one of the largest global producers of geothermal energy, and is also involved in the solar energy industry and the non-food biofuel industry. Chevron Energy Solutions installs large solar arrays for clients.

Valuation Metrics

Price to Earnings: 10

Price to Free Cash Flow: Highly Variable

Price to Book: 1.7

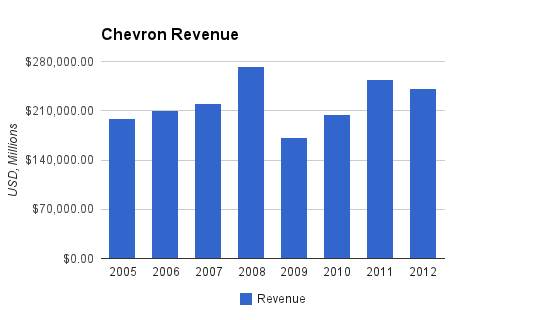

Revenue

(Chart Source: DividendMonk.com)

Chevron has somewhat erratic revenue growth, with an average of under 3% per year. The growth comes from production quantity as well as the current pricing of their commodities and end-products.

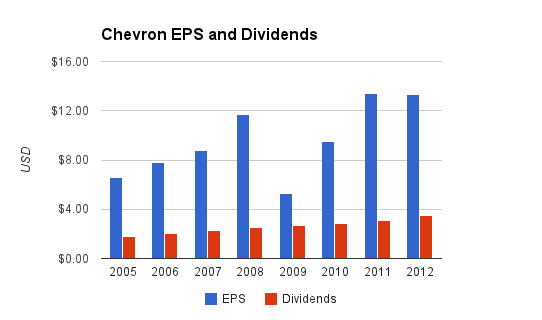

Earnings and Dividends

(Chart Source: DividendMonk.com)

Chevron has enjoyed 10.7% average EPS growth over the last seven years, although these numbers were also made erratic during the financial crisis. This is fairly strong EPS growth, considering that the company also pays a higher than average dividend yield to shareholders.

The dividend growth rate over the same period was about 10.5% per year, and so the dividend payout ratio has remained flat at around 25%. The earnings of oil companies tend to be cyclical, so they keep payout ratios on the lower end so that the dividend can be grown even during the barely profitable periods. The current dividend yield is a healthy 3.26%, and the company recently achieved 25 years of consecutive annual dividend growth.

Approximate Historical Dividend Yield at Beginning of Each Year:

| Year | Yield |

|---|---|

| Current | 3.26% |

| 2013 | 3.3% |

| 2012 | 3.0% |

| 2011 | 3.2% |

| 2010 | 3.6% |

| 2009 | 3.4% |

| 2008 | 2.4% |

| 2007 | 2.9% |

| 2006 | 3.1% |

How Does Chevron Spend Its Cash?

Chevron brought in over $34 billion in free cash flow cumulatively during the fiscal years of 2010, 2011, and 2012. Over the same time period, the company spent about $3 billion on acquisitions, nearly $19 billion on dividends, and about $4 billion on share repurchases.

Balance Sheet

Chevron’s balance sheet is about as strong as they come. Total debt/equity is only 14%, and the amount of goodwill on the balance sheet is negligible compared to equity. The debt/income ratio is less than 1x, and the interest coverage ratio is extremely high. Not counting other long term liabilities, there is more cash sitting on the balance sheet than there is total short term and long term debt.

Balance Sheet Expansion

| Year | Total Assets | Total Liabilities | Shareholder Equity |

|---|---|---|---|

| Current | $244.0 billion | $101.2 billion | $142.8 billion |

| 2012 | $233.0 billion | $96.5 billion | $136.5 billion |

| 2011 | $209.5 billion | $88.1 billion | $121.4 billion |

| 2010 | $184.8 billion | $79.7 billion | $105.1 billion |

| 2009 | $164.6 billion | $72.7 billion | $91.9 billion |

| 2008 | $161.1 billion | $74.5 billion | $86.6 billion |

| 2007 | $148.8 billion | $71.7 billion | $77.1 billion |

| 2006 | $132.6 billion | $63.7 billion | $68.9 billion |

Shareholder Equity has grown by an average of 11% annually over this seven-year period.

Investment Thesis

Chevron is constantly developing new upstream resources, but the key growth over the next several years will be from Australia. The company’s LNG production is going to more than double in the next four years, primarily due to the Gorgon (operational in 2015) and Wheatstone (operational in 2016) projects in Australia. Gorgon had budget overruns but these challenges have been worked through, and the project is now two-thirds complete. The other two main sources of growth will be from deepwater drilling and from shale production.

Risks

Large oil companies have among the largest and broadest set of risks for any investment.

There is an ever-present risk of an environmental catastrophe, which can lead to up to ten-figure lawsuits. Chevron is still dealing with the nearly $20 billion litigation risk related to operations in Ecuador, which were part of the Texaco acquisition in the 90’s. Recent court decisions have generally favored Chevron on these matters.

More regularly, the company has to deal with more commonplace instances of litigation, changing oil and other commodity prices, and managing its oil and gas reserves in a competitive environment driven by scarcity. The company has reported 112% reserve replacement rates on average over the last five years, meaning that reserves are being maintained and grown at the current time.

Conclusion and Valuation

Chevron consistently adapts to changing energy needs, with a currently strong presence in deepwater drilling, moves towards shale production, and huge investments in LNG, along with smaller operations like Chevron’s Energy Solutions (solar) business. The company has a 25 year history of paying growing dividends, and currently offers a reasonable dividend yield of over 3% with a low and safe payout ratio.

Based on a two-stage Dividend Discount Model, assuming a 10% discount rate, if the company grows its dividend by 9% per year for the next decade and 7% per year thereafter, then the calculated fair price for the stock today is over $147. The current price of under $123 gives a more than 15% margin of safety for these estimated figures, leading to what appears to be a reasonable buying opportunity in a diversified and financially stable dividend-paying company.

Full Disclosure: As of this writing, I am long CVX.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Would you agree the energy sector is undervalued right now, in general?

I think energy is a sector where reasonable values can be found. I’d be hesitant to call any sector undervalued in this market, based on the valuations I’ve been seeing, but it’s one of the better areas currently in my view.

I am a big fan of CVX, which has a decent yield, low P/E and most importantly a history of consistent dividend increases. It is one of my top five positions.

Thanks for the detailed analysis of the stock!

Thanks for a great blog!

I see a lot of dividend oriented bloggers analyzing and buying BAX now. What is your opinion of the stock?

I own it indirectly via VTI, but can’t afford enough shares right now.

Another killer analysis.

Mark

Thanks for the great blog.

Indeed Chevron is the best choice for dividend hunters. I found an interesting comparison of ExxonMobil and Chevron at http://goo.gl/ZSZQo3 which shows that Chevron has highest EPS and dividend per share as compared to ExxonMobil, BP and Shell.

From the perspective of having personally being involved on the Gorgon project, I can say that it’s going great guns despite early setbacks. Chevron is a good company to work with, and consequently, to own share in.