Summary

Chevron (CVX) is a leading energy company involved in crude oil, natural gas, and other energy production.

-Seven Year Revenue Growth: 7%

-Seven Year EPS Growth: 11.4%

-Dividend Yield: 3.03%

-Seven Year Dividend Growth: 10.5%

-Balance Sheet: Excellent

Overall, with a strong balance sheet, solid operations, a low valuation, but taking into account vulnerability to the volatile nature of oil prices and litigation risk, I find Chevron to be an acceptable buy for a dividend portfolio at current prices in the low $100’s.

Overview

Founded in 1879, Chevron (NYSE: CVX) is currently one of the largest oil and gas companies in the world.

In 2010, Chevron reported a net production of 1.923 million barrels of crude oil and natural gas liquids and 5.040 billion cubic feet of natural gas per day. Overall, 2010 production was up to 2.763 million oil-equivalent barrels from 2.704 in 2009, a 2.2% increase. Over the same period, net proved reserves of oil and gas liquids, and natural gas decreased 7.4% and 6.3% respectively.

Businesses

Chevron is divided into a number of different businesses. Some of them are directly profitable while others are supplementary to meeting Chevron’s needs.

For 2010, $17.677 billion in income as attributed to upstream operations, $2.478 billion in income was attributed to downstream operations, and ($1.131 billion) was attributed to All Other. So upstream income was more than seven times downstream income. Even among supermajor oil companies, Chevron is particularly focused on upstream projects and therefore is most directly linked to the price of these resources.

Oil Exploration

Chevron extracts oil from locations around the world, including from deepwater wells in the Gulf of Mexico and off of other coasts such as Brazil, from offshore wells in Europe and other locations, and on land from California, Africa, Kazakhstan, and other places, and oil sands operations in Canada.

Natural Gas Exploration

Chevron’s natural gas portfolio stretches across six continents. Chevron has the ability to transport natural gas from production locations to user locations by means of pipelines, liquefied natural gas (LNG), and gas-to-liquid (GTL) technology.

Refining

Chevron has the capability to turn its basic produced resources into finished materials ready for use. Seven refineries make up three-quarters of Chevron’s total fuel refining capability.

Supply and Trading

Chevron’s requirements to get materials from upstream projects to downstream projects is huge. Chevron has to develop and maintain logistics and partners to get products to where they need to be safely and for a low cost. For instance, Chevron markets aviation fuel at more than 875 airports and is the leading marketer of jet fuels in the US.

Marketing

Chevron operates the three brands of Chevron, Texaco, and Caltex to drivers across the world.

Pipelines

Chevron operates and invests in pipelines around the world. Significant projects are located in North America, Asia, and Africa.

Lubricants

Chevron markets lubricants on six continents.

Shipping

Headquarted in California, Chevron Shipping commissioned their first ship in 1895 and now ships crude oil, liquefied gas, and refined products to customers globally.

Chemicals

Chevron’s chemical products are incredibly diverse, with uses in food packaging, electronics, to medicine.

Mining

Chevron operates three coal mines and a Molybdenum mine in the US.

Power

Chevron’s produces gigawatts of power. Much of the power is derived from natural gas, while some is from wind. Chevron is the largest producer of geothermal energy in the world.

Technology

Chevron invests in emerging energy opportunities including solar projects, hydrogen projects, and bio-fuels products.

Revenue and Earnings

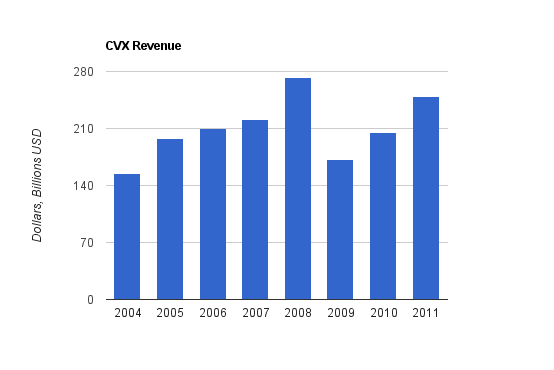

Chevron’s growth was strong until 2009 when the effects from the global recession took a significant chunk out of the revenues and profits of all big oil companies. Growth has since rebounded, but weakness is currently estimated for 2012.

Revenue Growth

| Year | Revenue |

|---|---|

| 2011 | $249.8 billion |

| 2010 | $204.9 billion |

| 2009 | $171.6 billion |

| 2008 | $273.0 billion |

| 2007 | $220.9 billion |

| 2006 | $210.1 billion |

| 2005 | $198.2 billion |

| 2004 | $155.3 billion |

Please note that the revenue figure for 2011, and most other 2011 figures in this report, are estimated. The first three quarters for 2011 are reported, and the fourth quarter is based on analyst estimates, so there could be slight overall variance. Revenue over this seven year period grew by 7% per year annualized.

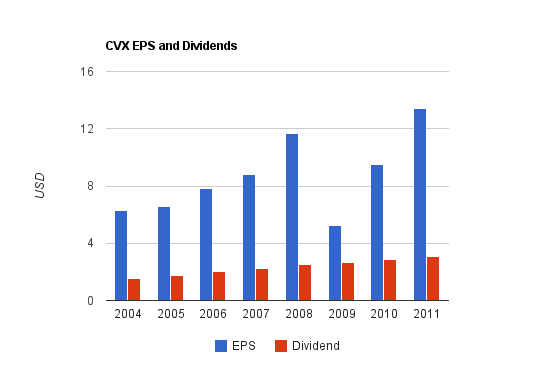

Earnings Growth

| Year | EPS | 2011 | $13.40 |

|---|---|

| 2010 | $9.48 |

| 2009 | $5.24 |

| 2008 | $11.67 |

| 2007 | $8.77 |

| 2006 | $7.80 |

| 2005 | $6.54 |

| 2004 | $6.28 |

Earnings growth over this seven-year time period has averaged 11.4%, but has been highly erratic. EPS is estimated by analysts to be slightly lower next year.

Metrics

Price to Earnings: 7.9

Price to Free Cash Flow: 13.6

Price to Book: 1.8

Return on Equity: 22%

Dividends

Chevron has increased its dividend every year for two and half decades straight, currently yields 3.03%, and has a dividend payout ratio from earnings of only about 25%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $3.09 |

| 2010 | $2.84 |

| 2009 | $2.66 |

| 2008 | $2.53 |

| 2007 | $2.26 |

| 2006 | $2.01 |

| 2005 | $1.75 |

| 2004 | $1.53 |

Chevron has grown its dividend by a 10.5% annualized rate over this period. It’s pretty nice to have dividend income double in a seven year period (and double more quickly if the dividends are reinvested).

It’s worth noting that Chevron increased its dividend not once, but twice this past year. The company increased the quarterly payout from $0.72 to $0.78, but after two quarters of paying $0.78, they increased the quarterly amount to $0.81.

Balance Sheet

Chevron is approximately tied with Exxon Mobil (XOM) as having the strongest integrated oil balance sheet. Total debt/equity is only 0.08, and the interest expense is negligible. Goodwill is nearly nonexistent on the balance sheet. Annual net income exceeds total debt by 2-3 times. Practically flawless.

Investment Thesis

Energy companies like Chevron face a changing world. Their proven energy reserves are huge, but finite, and increasing environmental concerns and backlash, along with increasingly cost-efficient alternative energy solutions are significant trends to be aware of. Chevron’s quantity of proved reserves has been flat to down over the last several years. Hydrocarbons are still among the most efficient energy sources, since the energy source consists basically of solar energy captured over long periods of time into energy-dense forms, but oil companies find themselves going to more costly methods to get oil, such as through capital intensive deep-sea drilling, or extracting it from oil sands over vast amounts of land in Canada. Chevron in particular specializes in deep-sea drilling.

Liquid Natural Gas (LNG) also plays a role in Chevron’s business. Natural gas uses up a lot of volume per unit of energy, and this is acceptable for pipelines, but to transport it to places without pipeline access is not cost effective. Chevron and other companies can now compress it into liquid form, ship it anywhere they want via specialized insulated ships, and then return it to its gas form on arrival. The Australian Gorgon LNG project is a significant development project.

Chevron acquired Atlas Energy, Inc. in 2011. The company now has access to the Marcellus shale; a very large U.S. reserve of natural gas.

Chevron Energy Solutions is a unit of Chevron that focuses on providing renewable power sources and maximizing energy efficiency for its clients. The size of their projects range from $1 million to over $100 million, and they are the largest installer of solar panels for educational facilities in the US as well as one of the largest developers of solar photovoltaic projects in California. Chevron is also the largest producer of geothermal energy in the world.

Although these alternative energy businesses are respectable, and their projects are valuable, they’re drops in the ocean of oil that is Chevron. Fossil fuels are where their money comes from. But, energy companies are aware of changing trends and the usefulness of a variety of energy sources. Big Oil companies are not just oil companies, but also some of the largest and most profitable corporations on the planet that employ an incredible number of scientists and engineers. The combination of enormous amounts of capital and technical prowess provides Chevron and similar companies the chance to grasp opportunities when presented with them. They’ve been undergoing shifts towards profitable natural gas growth, and can make other shifts as needed.

Over the last decade, Chevron has rapidly grown its asset base. The following table shows Chevron’s increasing company book value over the last seven years.

Expansion

| Year | Total Assets | Total Liabilities | Shareholder Equity |

|---|---|---|---|

| Current | $204.1 billion | $83.2 billion | $120.9 billion |

| 2010 | $184.8 billion | $79.7 billion | $105.1 billion |

| 2009 | $164.6 billion | $72.7 billion | $91.9 billion |

| 2008 | $161.1 billion | $74.5 billion | $86.6 billion |

| 2007 | $148.8 billion | $71.7 billion | $77.1 billion |

| 2006 | $132.6 billion | $63.7 billion | $68.9 billion |

| 2005 | $125.8 billion | $63.1 billion | $62.7 billion |

| 2004 | $93.2 billion | $48.0 billion | $45.2 billion |

Shareholder Equity has grown by an average of 15% annually over this seven-year period. The company has reduced debt totals and substantially increased asset totals.

Risks

Every company has risks, and big oil companies certainly have their fair share of them. Chevron faces uncertainty in terms of currencies, geopolitics, litigation, and regulation. Litigation is an ever-present risk due to the large scale that a company like Chevron operates at and the drastic effects they have, some for better and some for worse, on communities around the world. I’ve personally known people from several countries that have described first hand the kind of damage the world’s need for energy has caused their communities.

The primary risk for the business is that of changing oil prices, which are outside of Chevron’s control and have the largest impact on their profitability. Chevron is even more susceptible to changing oil prices than its peers. Refining margins are volatile and can affect downstream profitability substantially in a given year. In addition, not too long ago, BP reminded investors of yet another risk that is always present in this type of company: catastrophic failures.

A long-term risk to be aware of is reserve management. Oil majors have to maintain or increase proved energy reserves over the long term if they expect to continue to grow in production and profitability. It’s worth watching for multi-year trends, since oil and other fossil fuels are rather finite.

Ecuadorean Litigation

The largest and most public litigation against Chevron is from Ecuador. Texaco is charged with spilling a share of millions of gallons of oil, and dumping a share of billions of gallons of toxic waste into the Ecuadorean Amazon rainforest in the 1960’s, 1970’s, 1980’s, and 1990’s. Texaco became part of Chevron ten years ago, so Chevron has inherited this old and sustained litigation. There have been back and forth legal battles; plaintiffs claim tremendous damage has been done and is still present, Chevron claims it paid millions of dollars that supposedly cleaned it up. More specifically, Chevron also points out that Texaco was only one of the operators involved (the other being Petroecuador), and that Texaco remediated its part of production. Ecuador originally imposed a nearly $9 billion fine, but has recently doubled it to over $18 billion. A US court has upheld the fine, but the litigation continues. There have been reports of bribes, conflicts of interest, and the enormity of the mess is nearly unprecedented.

Brazilian Litigation

In late 2011, Chevron, along with everyone’s favorite offshore drilling contractor Transocean, were involved in an oil spill of thousands of barrels off of the Brazilian coast. Brazilian plaintiffs are currently seeking over $10 billion in damages. This is a potential risk, but I think that compared to the scale of the Ecuadorian damage, risk from major financial loss is larger from Ecuador than Brazil by a substantial margin. Billions of dollars for thousands of barrels isn’t typical.

In a more recent even, just days old, there has been a large fire on a Nigerian offshore drilling rig. The extent of effects are not currently known.

Comments on Litigation

There are a couple points to make regarding these.

The first is that these are the types of problems associated with oil. These types of energy sources often damage land, air, and water, so efforts to shift any political or environmental discussion purely towards the effects of carbon emissions detracts from these issues. Problems with hydrocarbons aren’t just on paper; they affect real lives all the time. Behind all the “We Agree” campaigns and solar installations is this reality. Events such as these cause not only tangible financial risk, but less tangible potential regulation changes down the road from all countries in which Chevron and other businesses operate.

The second is that Chevron is a legal giant. In terms of damages sought, we could compare these to some large examples: the 1989 Exxon Valdez spill in Alaska, and the 2010 BP spill in the Gulf of Mexico. Exxon Mobil dragged litigation on for decades and although it has paid out billions, the awards were reduced and spread out through cleaning costs and fines. BP ended up getting hit very hard financially for their spill, but this had a few key points. One was that it was one of the largest oil spills ever. Only a few have ever been larger, and most of those were attributed to Iraqi forces purposely burning unfathomable amounts of oil in Kuwait during the Gulf War. The second was that BP’s spill affected primarily people from a highly publicized developed country, and shown center-stage on television for months. With Chevron’s litigation concerning Ecuadorian environmental damage from decades ago, I’m more inclined to expect it’ll play out more similarly to the Exxon Valdez oil spill litigation. But we’ll see; the world has a different view towards environmental concerns than it did in the 1980’s.

Let’s suppose it’s a worst case scenario for Chevron, which might be where justice is. Let’s say they get hit with $20 billion worth of fines and legal fees for Ecuador and another $10 billion from Brazil (however unlikely); how large of a quantitative impact would this have on the company? Chevron has over $200 billion in assets, including over $20 billion in cash and other liquid funds. As previously described, the balance sheet is excellent. As for profitability, Chevron brought in $40 billion worth of cash flow over the past 12 months alone, and over $15 billion was free cash flow. Suppose after getting hit with $30 billion in litigation liabilities, they pay out $10 billion with cash and put the other $20 billion on as debt. Their total debt/equity ratio would increase to around 0.35. This would still be a strong balance sheet; comparable to the balance sheet of ConocoPhillips (COP).

So while the Ecuadorian and Brazilian litigation may be playing a part in Chevron’s lower valuation than COP or XOM, it’s something that the company could absorb (although it would be a major financial loss), and more likely may just continue to legally battle and delay. It’s no surprise that credit rating agencies aren’t particularly concerned with Chevron and have a high credit rating assigned to the company. There are certainly risks associated with Chevron, including litigation risks, regulation risks, and oil price risk, but as part of a diversified portfolio, Chevron’s risks are acceptable in my view.

Conclusion and Valuation

In my last Chevron analysis from 15 months ago when the stock price was in the low $80’s, I wrote that Chevron may be poised to offer investors a significant opportunity, and considered it a buy. After volatile upward movement, the stock is currently well over $100, although the valuation is lower than it was at that time. I’d caution, however, that there is likely less upside at this point, since oil prices have rebounded to substantial levels. Cyclical businesses sometimes have high P/E ratios during market bottoms and tend to have lower valuations during market tops, which can be counter-intuitive, as investors try to take into account the future.

I do think, however, that Chevron is currently a decent buy. I don’t consider it an extremely strong buy based on what its P/E of 8 might imply at first glance, but I do still think it would make a good long term investment at the current price. Litigation risks and relatively high current oil prices probably mean that Chevron’s valuation will stay low for a while. The low valuation, in my view, reasonably takes into account a potential reduction in oil prices or potential financial loss from litigation, as well as the industry-typical issue of having large capital expenditures (and therefore limited free cash flow). If Chevron had an earnings multiple equal to COP, it would be trading at $120/share right now. For investors looking for years of business growth, dividend growth, dividend reinvestment at a low earnings multiple, and solid total returns, I think Chevron can be a way to go. It’s important to factor in conservative oil prices, and make room for litigation problems, in order to have a margin of safety.

Full Disclosure: At the time of this writing, I own shares of CVX and XOM.

You can see my dividend portfolio here.

Dividend Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Chevron (CVX) has been a core holding of the Arbor Asset Allocation Model Portfolio (AAAMP) since 2005. Thank you for the outstanding and balanced analysis for your readers!

Hi Ken,

Thanks for the comment. If I may ask, do you hold other oil majors as well, or only Chevron in that area, and if the latter, were there specific reasons you went with Chevron rather than its peers?

Great stuff, as usual.

I’m long CVX and would like to add on dips below $100. I think there’s value to be had here looking out long-term, but the volatility of oil makes me want to seek a certain margin of safety. Oil is controlled by so many outside factors, it makes my head spin so it’s hard to really come even close to figuring out where it’s heading. I’m long COP, TOT and XOM as well so I like Big Oil in general. Dwindling supply and increasing demand goes a long way here.

Best wishes!

Matt, great article. You cover it all.

Last friday i bought shares of CVX @ 104., the price went down simply because: “In the fourth quarter, Chevron Corp.’s profits slipped by 3.2 percent to $5.12 billion, or $2.58 per share. The results fell short of Wall Street forecasts of $2.86 per share”

I like to buy when things are going down, for the wrong reasons. I may play this short and sell next week, with a decent profit. If the stock keeps going down, i may keep on buying. Why? i dont know if Matt mention this: – CVX has increased payouts for 24 straight years – I mean, this is something Buffet will look into it. The ability to keep making money.

When is a good time to buy CVX again? when the stock faces a stepback or a negative ruling from litigators in Ecuador and Brazil… We will see. Bad news are the best friend of Value investors.

Matt, what do you think about the estimated 1 year target price of yahoo finance of USD 124 x share of CVX.

I also bought this stock, 1. because as Charlie Munger will say: – a great business at a fair price, IS SUPERIOR to a fair business at a great price –

2. Chevron recently announced its next payout which goes ex-dividend on February 15th and is payable on March 12th.

3. Watson continued, “In the fourth quarter, we took another important step forward in our efforts to commercialize the company’s significant natural gas resources with the start of construction at the Wheatstone liquefied natural gas project in Australia. We also recently announced two additional natural gas discoveries in the Carnarvon Basin that will help underpin future LNG expansion opportunities. At the same time, we ramped up production to over 330 million cubic feet per day at the Platong II natural gas project in the Gulf of Thailand.”

Watson commented that the company added approximately 1.67 billion barrels of net oil-equivalent reserves in 2011. These additions, which are subject to final reviews, equate to 171 percent of net oil-equivalent production for the year

I used to own this stock at USD 83. I sold it with a quick profit. Shame on me!

Always remember fellas: Money is make in the waiting not in the doing.

Great comment Julian.

As far as short term price targets are concerned, I have no idea if a stock will meet them or not. $124/share is in line with what I mentioned about how if CVX had the same stock valuation as COP, it would be trading at $120.

I’m pleased with their natural gas projects, as you describe in the comment.

Hi Matt,

Great article, thanks a lot, it’s really helping me with my university coursework. In your paragraph titled “Balance Sheet”, you’ve written that Chevron’s debt to equity ratio is 0.8, is this correct or did you mean to write 0.08 inferring 8%?

Many thanks.

Ryan

Yep, 0.08%, or 8%. Sorry about that, and I’ve updated the number.

-Matt