Canadian National Railway is a major North American rail business.

-Seven Year Revenue Growth Rate: 4.7%

-Seven Year EPS Growth Rate: 14%

-Dividend Yield: 1.87%

-Balance Sheet: Quite Strong

The quantitative and qualitative factors for Canadian National Railway all look strong. As far as price is concerned, I view the stock as approximately 20% overvalued, and would look for $65 as the threshold for where I’d consider the stock to be a good buy.

Overview

Founded in 1918, Canadian National Railway is the largest railway in Canada and has significant operations in the United States. The rail network extends from the Atlantic Ocean to the Pacific Ocean through Canada, and also extends southward to the Gulf of Mexico through the United States. The total mileage of track exceeds 20,000.

The company is divided into seven commodity groups:

-Petroleum and Chemicals

-Metals and Minerals

-Forest Products

-Coal

-Grain and Fertilizers

-Intermodal

-Automotive

Stock Metrics

Price to Earnings: 15

Price to Free Cash Flow: 26

Price to Book: 3.4

Return on Equity: 22%

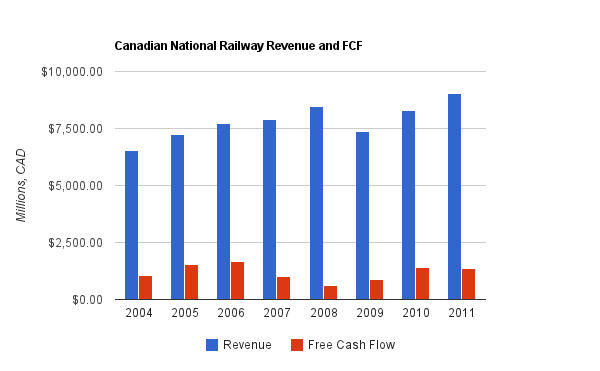

Revenue and Free Cash Flow

Canadian National Railway grew revenue by an average of 4.7% per year over this period, and grew FCF by only 3.4% annually over the same period.

Revenue growth was fairly consistent with the major exception of the financial crisis which disrupted most companies. Free cash flow, however, grew rather erratically and slowly. This was mainly because operating cash flow was itself rather erratic, while capital expenditures grew rather smoothly and consistently. Capital expenditures actually grew by a compound rate of 6.2% over this period, which outpaced both revenue and operating cash flow, and therefore had a negative impact on FCF. Management expects this continued capital expenditure growth to continue into 2012 as well.

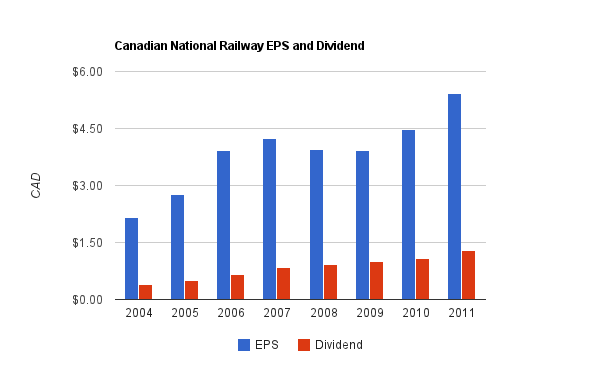

Earnings and Dividends

EPS grew by almost 14% annually over this same seven year period, and the dividend grew by over 18.7% annually. The dividend yield is low, at only 1.87%, so the company can benefit from accelerated dividend growth for a while. Eventually, dividend growth must be capped by EPS growth for the payout ratio to stop rising. The dividend payout ratio from earnings is currently under 40% and therefore has plenty of room. The most recent quarterly increase, between 2011 and 2012, was over 15%.

The amount of cash spent on acquisitions over this seven year period was rather low, so most of the free cash was truly free, and able to be given to shareholders. Only about a third of it was paid out in dividends, while the rest went to share repurchases. These share repurchases were a decent value, considering that they accelerated EPS growth to 14% per year compared to only 10% per year for company-wide net income, but as is typical among share repurchases, they weren’t timed very well. The company purchased the fewest shares in 2009 when prices were lowest. The company would do well by shareholders to increase the dividend and decrease the share repurchases.

Balance Sheet

Total debt/equity is only around 60%, and the interest coverage ratio is over 9. These are very strong numbers. Further, total debt/income is under 3.

Overall, the company has a very strong balance sheet.

Investment Thesis

Railroads serve a critical part in world transportation. They remain the most energy efficient way of transporting large amounts of material far distances. From an investing point of view, railways also have among the very strongest of economic moats, in that they are established businesses where new competitors are scarce. Obstacles to starting up a new railway business are obvious, because once track is put down to serve an area, duplicate track would be a poor investment.

The company has several strong indicators:

-None of the seven commodity groups account for more than 20% of revenue, which is solid diversification.

-Further in terms of diversification, 18% of revenue comes from U.S. domestic traffic, 22% comes from Canadian domestic traffic, 28% comes from trans-border traffic, and 32% comes from international traffic.

-Compared to 2009, the ratio of injuries and accidents to person-hours and transportation-miles in 2011, respectively, have decreased.

-The total number of employees is up by 8% at year end of 2011 compared to year end of 2009.

-Recovery since 2009 has been broad, with 6 out of 7 of their commodity groups experiencing increased carloads per year in both 2010 vs 2009 and 2011 vs 2010. The only exception to this was coal, which saw an increase in carloads in 2010 but a decrease in 2011.

Overall, I view Canadian National Railway as a fundamentally solid, albeit cyclical, business. The revenue growth is consistent, free cash flow is fairly strong, and the balance sheet is healthy. The business portfolio has satisfactory diversification and breadth in terms of geography and commodity group. Railways have natural moats surrounding their businesses. A simultaneous pro/con is that capital expenditure is very regular and increasing. It shows management is on top of their priorities for long-term sustainable growth, efficiency, and safety, but when this outpaces revenue growth, there is of course a cost.

Risks

The company is fairly safe from competitors in my view, so the risks are mainly associated with macroeconomic conditions. The company held up well during the recession but was still materially impacted by it, and this will likely be the case during the next recession as well, whenever it occurs. The company has good safety metrics and as previously mentioned, spends considerable sums on capital expenditures, so catastrophic incidents should be rare. My view is that the company is cyclical, but fundamentally solid on all observable quantitative and qualitative matters.

Conclusion and Valuation

In conclusion, I view the company as strong. The next question, then, is what about the valuation?

Based on an assumed free cash flow growth rate of 4% and a discount rate of 9%, I calculate that the stock is overvalued by about 20-25%. In order to justify the current valuation at around $80/share, the long-term FCF growth rate would have to be 5%, with a discount rate of 9%. Based on this, I’d hold off on buying unless the stock drops to about $65, at which time I’d consider it a reasonable value.

Previous Analysis:

Becton Dickinson (BDX)

Full Disclosure: As of this writing, I have no position in Canadian National Railway.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Are we talking about dividend reinvestment or stock growth or both? Based on your research it sounds like this company is worth buying shares in -specifically for dividend reinvestment. Now sure, the stock may fluctuate over time, but if we are really into dividend reinvestment (DRIPS) then I can allow the stock to fluctuate over time, because I am planning on holding it for a long period of time, while I take advantage of the great dividends the company will give me.

With the dividend growth rate increasing I am going to be in a better position as it grows in value over time. Am I seeing this wrong or were your saying something else?

I’m talking in terms of total shareholder returns, and usually more specifically as well, reliable growing income streams.

Shares are shares, no matter if you use DRIPs or not. Some forms of holding shares are more or less convenient than others depending on your investing style. My articles are focused purely on long-term investment, so yes, stocks are assumed to fluctuate over time. But when buying new shares, it makes sense to look for good opportunities.