Summary:

#1 Canadian National Railway is back on track for future growth.

#2 The stock jumped by 10.67% over the past 12 months, but lost 5% in the past 30 day. , It’s time to buy the dip.

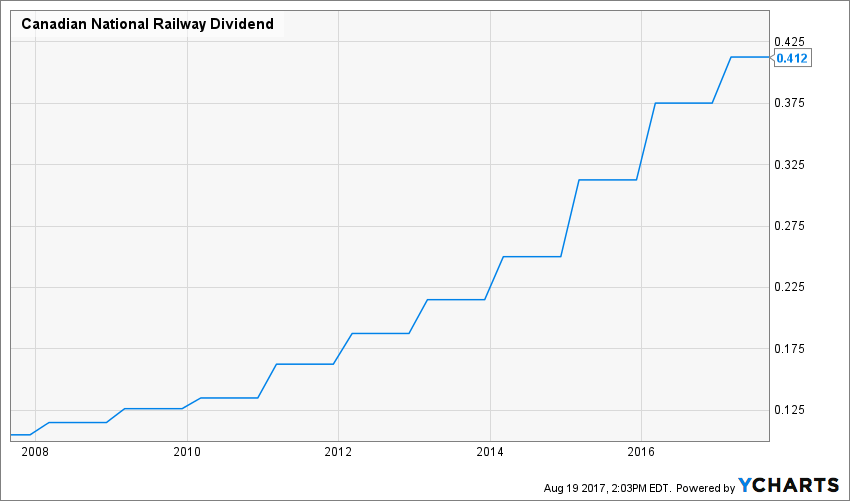

#3 Meanwhile, the dividend has jumped by 120% over the past 5 years.

Canadian National Railway (CNI) has been on a great stock ride over the past 12 months. As the TSX decreased by 2%, CNI stock is up 10.67% as at August 19th. This creates another interesting entry point for this strong dividend grower.

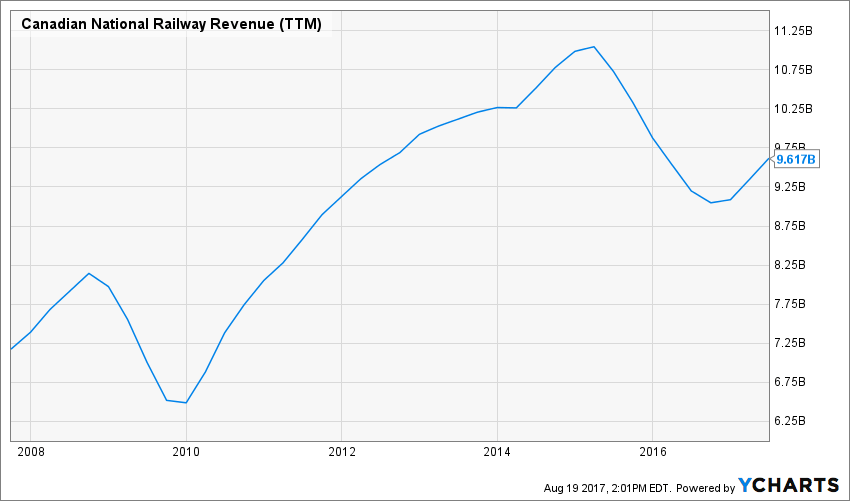

Revenue

Revenue Graph from Ycharts

As you can see, the railroad industry cycles up and down. The latest down cycle happened during the oil bust, but CNI’s great diversification helped it weather the storm

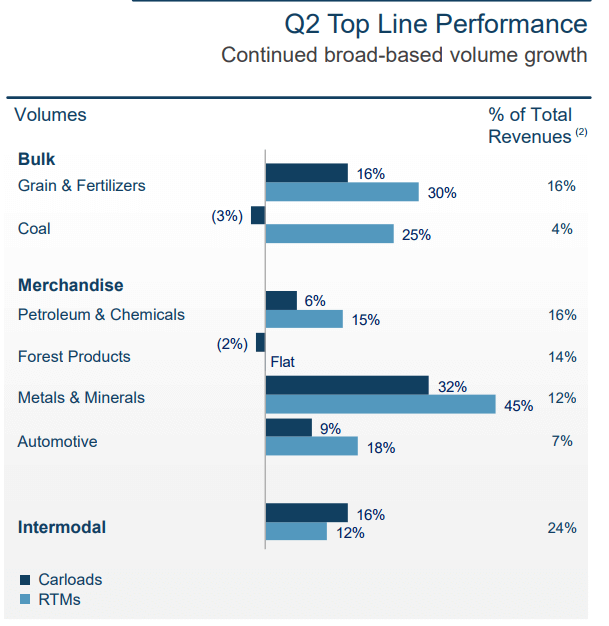

Source: CNI Q2 presentation`

Now that the Canadian economy seems to be more resilient than expected, Canadian National Railway has started to see signs of recovery faster than expected.

How CNI fares vs. My 7 Principles of Investing

We all have our methods for analyzing a company. Over my years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

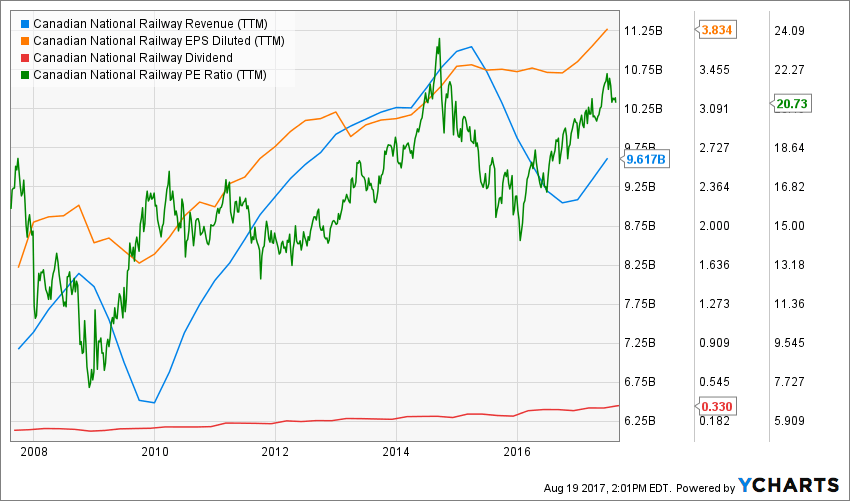

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rules: I try to avoid most companies with a dividend yield over 5%. I will make very few investments like this (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment, or because the company has nothing else but a constant cash flow to offer its investors. However, high yields hardly come with dividend growth and this is what I am seeking most.

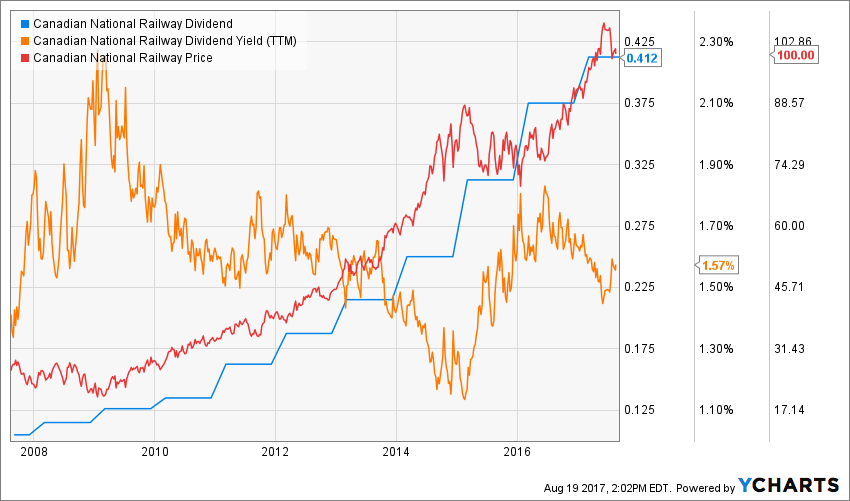

Source: data from Ycharts.

CNI hasn’t been one of the most generous companies in term of yield. It has maintained a very cautious approach by steadily increasing the dividend but also keeping enough money for its capital intensive business model. After all, taking care of thousands of kilometers of railroads has a price! Overall, CNI’s yield isn’t incredible at 1.57%, but it surely doesn’t raise a red flag.

CNI meets my 1st investing principle.

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: Ycharts

While CNI’s dividend yield isn’t impressive, its dividend growth history is. CNI shows a dividend growth streak of 22 consecutive years. If it were an American company, it would even be part of the Dividend Achievers. On top of that, CNI’s annualized growth rate for the past 5 years is 17.08%. The company has more than doubled its payouts during this period going from $0.188/share to $0.415/share (Canadian dollar).

CNI meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what has happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

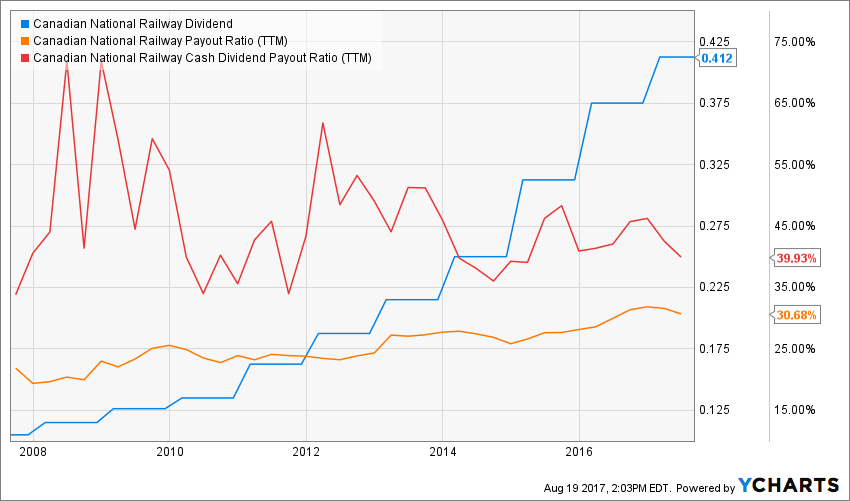

Source: data from Ycharts.

After this impressive dividend growth period, you would expect the company to show a relatively high payout ratio. Well, think otherwise. Both CNI’s payout and cash payout ratios are under 40%. The company has already been known for its stellar operating ratio in its industry and this reflects on earnings and cash flow.

CNI meets my 3rd investing principle.

Principle #4: The Business Model Ensures Future Growth

Looking at past metrics tells you a story about a company. Unfortunately, this doesn’t mean history will repeat itself in the future. A good way to make sure it does is to understand how the company makes money. CNI owns and operates one of the largest and most efficient railroads systems in North America. Railroad transportation is one of the best ways to move commodities and other goods across such a large continent. Since it is virtually impossible for a new company to build railways these days, CNI will continue to generate cash flow year after year.

CNI shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

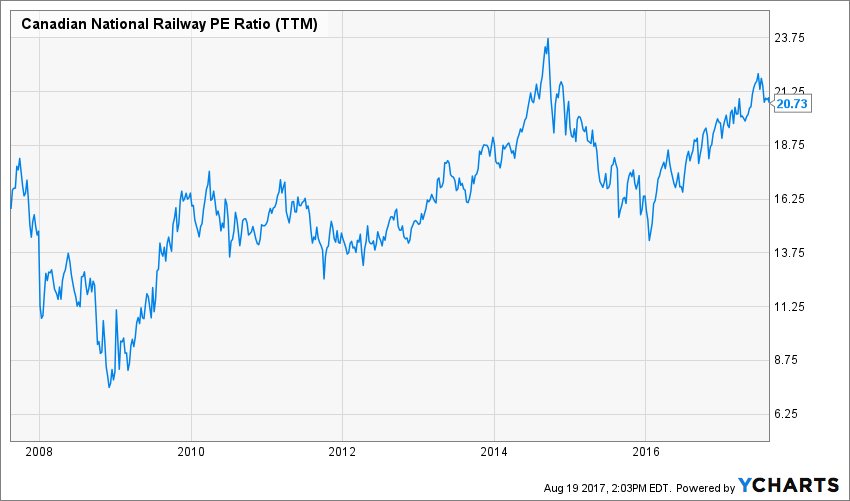

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have set some savings aside. There is a valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

Looking at the past 10 years, you can see the PE ratio is getting closer to a 10 year high. This usually doesn’t look good.

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I rather see companies like big money making machine and assess their value as such.

Here are the details of my calculations:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.65 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 10.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 7.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $276.46 | $136.89 | $90.42 | |

| 10% Premium | $253.42 | $125.48 | $82.89 | |

| Intrinsic Value | $230.39 | $114.07 | $75.35 | |

| 10% Discount | $207.35 | $102.66 | $67.82 | |

| 20% Discount | $184.31 | $91.26 | $60.28 | |

Source: how to use the Dividend Discount Model

Note: this section has been done using CAD metrics.

Looking at the dividend discount model, I can see CNI is still offering potential.

CNI meets my 5th investing principle with a potential upside of 14%

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest struggles an investor faces is knowing when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is time to pull the trigger. My investment decisions are motivated by the fact that the company either does or does not conform my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

Canadian National Railway is the most productive railroad company with the best operating ratio in the industry (55.1%). At a 1.64% yield, we can’t talk about a “strong” dividend payer. However, after digging further, I realized how strong the company’s fundamentals are. CNR has a very strong economic moat since railways are virtually impossible to replicate. Therefore, you can count on increasing cash flow coming in each year. Plus, there isn’t any better way to transport most commodities than by train.

Potential Risks

There isn’t much risk when you invest in a steady cash earning company where virtually no new competitors could enter. This is a privileged market where CNI is dominant.

CNI shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Canadian National Railway will offer great entry points from time to time as it evolves within in a cyclical industry. However, CNI will not show incredible stock price growth overtime. This is a steady earning company that will show more dividend growth than anything else.

CNI is a core holding.

Final Thoughts on CNI – Buy, Hold or Sell?

In short, CNI is definitely a BUY. The company shows a 14% upside and a strong dividend growth potential. Plus, in the event of a market crash, you can count on CNI and its 22 years of dividend growth history to continue raising your “waiting payment”.

Disclaimer: I do hold CNI in my DividendStocksRock portfolios.

The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply