Becton Dickinson is a global health company that focuses on durable medical supplies and medical devices.

-Seven Year Revenue Growth Rate: 5.2%

-Seven Year EPS Growth Rate: 10.5%

-Dividend Yield: 2.24%

-Balance Sheet: Moderately Strong

Becton Dickinson remains a solid long-term pick in my opinion, but the recent stock price leaves little margin of safety. I’m awaiting dips before considering increasing my position in this company.

Overview

Becton Dickinson (NYSE: BDX) is divided into three business segments:

BD Medical

BD Medical contributes by far the largest percent of revenue, with $4.091 billion of Becton Dickinson’s total revenue. A bit over $2 billion of this comes from medical and surgical systems. Slightly over $1 billion comes from pharmaceutical systems, and the remainder comes from diabetes care. These products come in the form of needles, syringes, and drug-delivery systems, and the major customers are hospitals, clinics, physicians’ offices, government agencies, and healthcare workers.

BD Diagnostics

BD Diagnostics pulls in the second largest amount of revenue, with $2.538 billion of BD’s total revenue. It is about evenly split up, with about $1.3 billion in revenue each from Preanalytical Systems and Diagnostic Systems. This segment concerns specimen collection, identification, testing, and specific systems, and the major customers are hospitals, laboratories, blood banks, physicians’ offices, and so forth.

BD Biosciences

BD Biosciences is the smallest segment, with $1.080 billion in revenue. The products are mainly kits for cell analysis, cell imaging systems, and laboratory products.

Overall, 43% of Becton Dickinson revenue comes from the United States, 31% comes from Europe, 15% comes from a combination of Latin America, Canada, and Japan, and 11% comes from Asia Pacific.

Stock Metrics

Price to Earnings: 16

Price to Free Cash Flow: 21

Price to Book: 3.9

Return on Equity: 26%

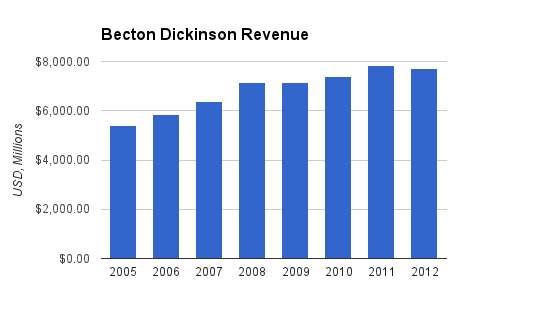

Revenue

Last year, BDX broke its streak of consecutive annual revenue increases that has existed since at least the 1990’s by reporting revenue that was slightly below 2011. Regardless, revenue growth over this period has been fairly strong at an average growth rate of 5.2% per year.

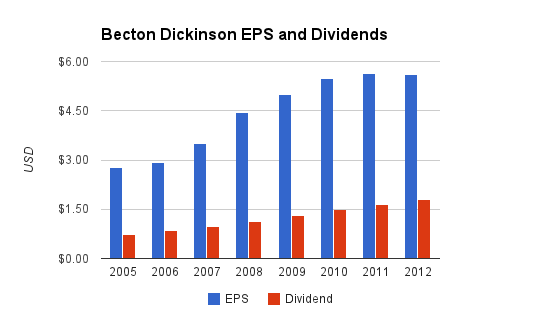

Earnings and Dividends

The average EPS growth rate over the last seven years is 10.5%, which is respectable. Over the last few years, however, EPS has stalled.

The company has 40 consecutive years of dividend increases, but currently only yields 2.24%. The payout ratio from earnings is under 40% and the growth rate over the last seven years is 14%. The most recent increase was 10%.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.24% |

| 2012 | 2.5% |

| 2011 | 2.0% |

| 2010 | 1.9% |

| 2009 | 1.9% |

| 2008 | 1.3% |

| 2007 | 1.4% |

| 2006 | 1.4% |

| 2005 | 1.3% |

The average yield has increased in part because the stock was valued at a higher premium in the middle of the last decade, and because the company has increased its dividend payout ratio from under 20% to under 35%.

How Does Becton Dickinson Spend Its Cash?

Over the fiscal years of 2010, 2011, and 2012, BDX reported approximately $3.4 billion in free cash flow. Over the same period, the company spent over $3.7 billion in share repurchases, spent nearly $1.1 billion on dividends, and spent approximately $600 million on net acquisitions. Over the last ten years, the number of shares has decreased from around 260 million to around 200 million.

The way the numbers work out, the company spent more than they brought in over this three year period. The difference comes from the fact that Becton Dickinson added over $2 billion in debt to its balance sheet over this period to take advantage of low interest rate environment. (Borrow at a rate close to zero and use it to invest at a rate that greatly exceeds that low borrowing rate).

Balance Sheet

When I first published an analysis of Becton Dickinson around three years ago, the balance sheet was particularly strong. BDX management, however, has decided to issue debt to accelerate their share repurchases. Considering that interest rates are artificially low, and I consider BDX stock to be trading near its intrinsic value, this may be a good use of cash in terms of ROI.

Total debt/equity has risen to over 90%, but the interest coverage ratio is currently still over 10, which is strong, and goodwill makes up less than 25% of equity. The total debt/income is a bit under 3.

Overall, the balance sheet is still strong in an absolute sense, but not when compared relative to its position 3 years ago. The balance sheet has not deteriorated out of necessity, but rather, management has taken advantage of low interest rates to buy assets that should produce better long-term returns: their own stock.

Investment Thesis

Becton Dickinson’s growth has slowed somewhat, but the company remains strong. Their necessary products are used throughout the world, with more than half of sales coming outside of the United States.

Their exposure in emerging markets is solid with 23% sales growth for 2012 compared to 2011, with their sales in China growing by almost 25%.

The company’s products are not particularly unique, so they face substantial competition. But with Becton Dickinson’s long history of producing surgical tools, its large scale, and its pioneering of safety-focused equipment, it has a fairly defensive position in my opinion.

Unfortunately, disease and sickness aren’t going anywhere, especially in the developing world where Becton Dickinson is focusing its growth. Their core business of disposable needles and syringes has strong growth prospects in areas that are consistently prone to disease and areas that are just now beginning to develop mass-use of basic modern medicine.

Risks

As a global health care provider, Becton Dickinson faces currency risks and litigation risks, as well as regulation risk. In the health care sector, device manufacturers are buffered from the continual concentrated risk of blockbuster patent losses that pharmaceutical companies deal with, but the global regulatory environment for medical devices is still rather strict. Changes in national budgets or health care regulation can substantially affect producers of equipment related to health care.

Conclusion and Valuation

My BDX report from last year called the stock reasonable at $76. The stock was somewhat volatile but fairly flat through 2012, but with the bull market of 2013, BDX quickly jumped from the high $70’s to the high $80’s. The price is currently around $88.50.

Due to the low yield and fairly high dividend growth rate for this stock, I use a two stage Dividend Discount Model to determine a rough intrinsic value. Based on an estimate of 10% dividend growth for the next ten years followed by 7% growth thereafter, with a 10% discount rate (desired rate of return), the value of the stock is only around $84.

Because the dividend yield is low, the model is fairly sensitive, and so this estimate is on the conservative side. Compared to the current price in the high $80’s, I’m not buying more BDX stock after the recent run-up in price, but will hold my position and consider looking for dips.

Full Disclosure: As of this writing, I am long BDX.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I generally like BDX, but at this point I find the yield way too low to consider purchasing. I’ll wait for the stock to dip or reconsider later on as the yield will likely increase over time.

Great analysis Matt. I was able to pick up some shares of BDX before it’s most recent run up. I am in agreement with you the macro trend for healthcare is bullish. As always during the next market decline I’ll look to start picking up some shares.

At one point BDX was in my buy area, but unfortunately I had no extra cash laying around. If it drops below $79.20/share I would be a buyer..

I’m interested in BDX after recently visiting a hospital and seeing their name along with Cardinal Health on quite a bit of the products being used. I’d like a higher current dividend yield and will certainly keep an eye on the company for any dips to possibly start a position. Thanks for doing this analysis!