Last year, Baxter International (BAX) announced it will spin-off its pharmaceutical division into Baxalta (BXLT) in order to unlock value to shareholders. While BAX used to pay a healthy dividend, it seems the distribution got lost during the spin-off as both companies are not offering interesting dividend perspectives at the moment… Let’s take a deeper look at both companies:

Baxter overview:

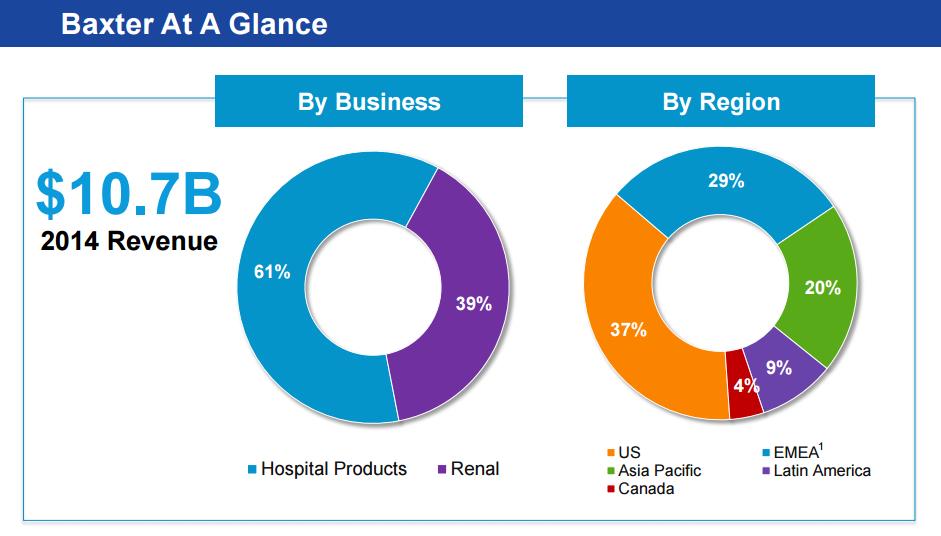

After the spinoff, Baxter will focus on its two segments: hospital products and renal products. The hospital products business manufactures equipment used in the delivery of fluids and drugs to patients across the continuum of care. Baxter’s Renal portfolio addresses the needs of patients with kidney failure & disease, and their healthcare providers, with a comprehensive range of therapeutic options across home, in-center, and hospital settings for better individualized care.

The company generated $10.7 billion in 2014 for net earnings of $760M. The company therefore shows high sales volume combined with low margins. The company expect to grow its revenue by 4% CAGR over the next 5 years. BAX shows a strong brand portfolio where most of its products are #1 and #2 in terms of market share.

When the spin-off occurred. BAX kept 19% of Baxalta shares. The idea is to sell this position over time to refund BAX’s underfunded pension plan and increase liquidity. Baxter’s payout ratio guidelines are now around 35% and management hasn’t mentioned anything about dividend growth yet. BAX current dividend yield stands at 1.22%. Not much of interest for a dividend growth investor. At this point in time, we are left with a vague promise from management to increase the dividend in step with earnings growth while keeping a payout ratio around 35%. I like companies with low payout ratios, but the dividend growth potential must be there. It is not that obvious with BAX right now.

Baxalta overview:

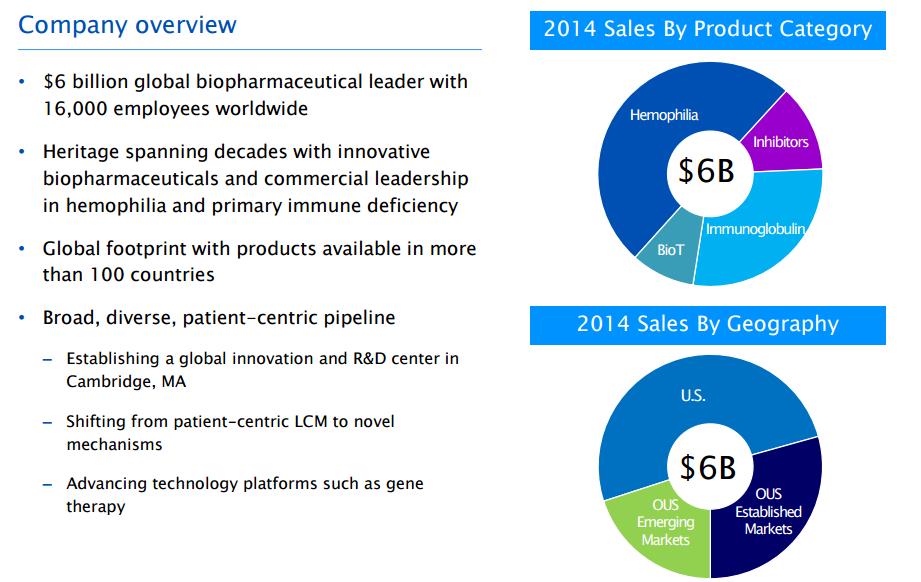

Baxalta is the biopharma division of Baxter. They focus their R&D toward three businesses; hematology, immunology and oncology:

BXLT seems more profitable than Baxter with $6B in revenue but $1.18 billion in net earnings. The company shows some great potential with roughly 20 products to be launched by 2020. They currently use their strong free cash flow to build their third segment; oncology. They expect to post growing revenue of 8% CAGR over the next 5 years.

Overall, it seems the company will focus on R&D and creating its new oncology business. Then again, these are great perspectives for investors, but no mention on the dividend policy was issued clearly.

Looking Forward

Baxter is expected to earn $1.29/share in 2015, and to grow earnings to $1.91/share by 2018. This means that the stock is selling for 31 times estimated earnings and yields 1.15%.

Baxalta on the other hand is expected to earn $1.94/share in 2015, and to grow earnings to $2.35/share by 2018. This means that the stock is selling for 20.50 times expected earnings and yields 0.70%.

Both companies show relatively high valuations at first glance. My favorite stock valuation tool is the dividend discount model and it can’t be used at the moment. There isn’t enough information about the future use of cash flow to determine both companies’ value. I find their growth perspectives interesting, but it seems both companies don’t fall within a dividend growth portfolio.

Personally, I will leave both companies aside and focus on companies being more generous with their shareholders!

Leave a Reply