AT&T Inc. (T) is a telecommunications provider of wired and wireless services, and is one of the largest companies in the United States and the world.

-Four Year Annual Revenue Growth Rate: 1.6%

-Four Year Annual EPS Growth Rate: negative

-Four Year Annual Dividend Growth Rate: 4.9%

-Current Dividend Yield: 4.93%

-Balance Sheet Strength: Leveraged, but Stable

I believe that although AT&T is a quality company in an industry with significant long-term growth, at the current price of over $35, AT&T is on the expensive side, and would look for a dip to the low $30’s before considering it a solid investment.

Overview

AT&T Inc. (NYSE: T) traces its history back to the 1800’s as part of the original company named after Alexander Graham Bell, who is credited with the invention of the first practical telephone. In its current form, AT&T’s history as a public company goes back to the 1980’s, after the original company was broken apart and the pieces began merging back together.

In 2011, approximately 50% of revenue came from wireless and 26% came from wired data/managed services. The company considers these two areas to be their growth engines. The rest of revenue came 19% from wireline voice and 5% from advertising/other, which are considered the company’s legacy businesses.

Ratios

Price to Earnings: 51 (due to one-time earnings hit from failed T-Mobile acquisition)

Forward P/E: Approximately 14

Price to Free Cash Flow: 15

Price to Book: 2

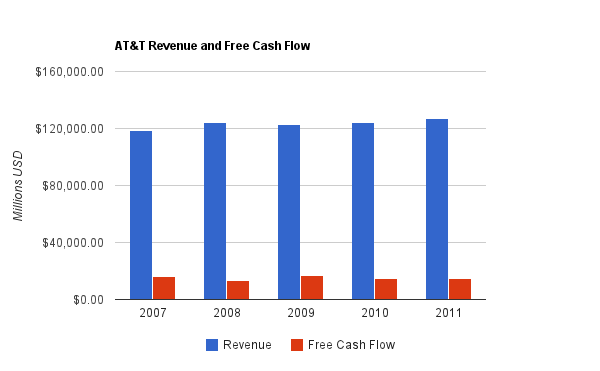

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

AT&T has experienced good system growth over the last several years, which is discussed below, but it has not particularly shown through in the numbers. Revenue grew at 1.6% per year over this period, while free cash flow had a weaker report in 2011 than in 2007. AT&T requires significant continued capital expenditures to keep its communications system fast and widespread, and much of their growth is offset by declines in their legacy businesses.

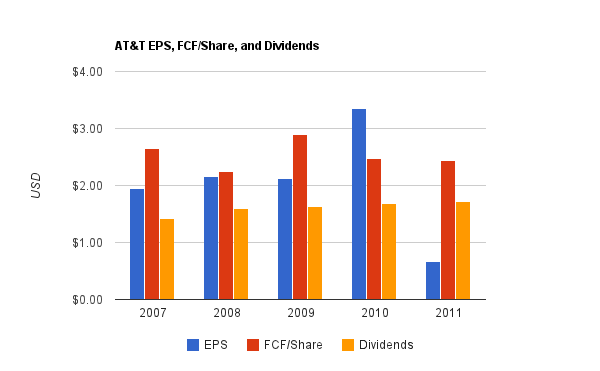

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings growth was lacking over this period. The low 2011 EPS figure is due to one-time events that affected EPS; primarily the costs of the failed merger attempt with T-Mobile. In reality, free cash flow and the normal earnings remain solid, albeit without much per-share growth.

Dividend growth has slowed lately, because the company has been increasing the quarterly dividend by a penny each year, which means a slightly lower raise in terms of percentage each year. The dividend grew at less than 5% annually over this period, and the more recent increases were under 3%. Raising the quarterly dividend from $0.43 in 2011 to $0.44 in 2012 represents 2.32% dividend growth for the year.

In 2012, the company is paying approximately three-quarters of its EPS out as dividends. The dividend is therefore rather safe for this type of business, but EPS will have to continue to grow if dividend growth is going to continue. The company has not utilized share repurchases recently, but has authorization to do so.

Balance Sheet

AT&T doesn’t have a very comfortable balance sheet, but for a stable infrastructure-intensive business, they’re solid enough.

The total debt/equity ratio is around 66%, but if the substantial amount of goodwill is removed from equity, total debt/equity in the tangible sense is quite high, at over 200%. The company also has substantial pension obligations.

Interest coverage is under 3, which is not a comfortable margin, but not the lowest in its peer group.

The interest coverage ratio has not been static, but rather, has decreased in recent years from more comfortable pre-recession levels. The company borrows significant sums to fund capital investment, which in this low interest rate environment, is rational.

Investment Thesis

A newsletter issue I published a couple months back focused on cloud computing and the effects it can have on lower-tech industries that aren’t on the cutting edge of cloud software. In short, the world is hungry for data. Mobile internet requires vast amounts of data for apps, movies, browsing, and rich media, and wired or wireless Software-as-a-Service requires robust data usage and reliability. While high valuations are focused towards cloud software, someone’s got to provide the data.

The primary force that has driven cloud computing to this point is that the data networks around the world have become fast enough to deliver good software over long distances. Something as simple as making the charts in this article in a web-browser quickly and effectively only works because networks have become so fast and there’s barely a noticeable difference between a client-based office tool and a server-based office tool.

The need for data results in enormous capital expenditures, but also increases in revenue. Wireless services in particular have grown exponentially. As AT&T’s 2011 annual report shows, between 2006 and 2011, the number of wireless subscribers increased from 61 million to 103 million, smart phone users increased from 7 million to 40 million, wireless data usage has surged from near-zero to upwards of 30 petabytes a month, and wireless revenue has grown fivefold. The company has reported that it expects its wireless data usage to grow another 8x in the next five years. AT&T’s “U-Verse” revenue grew almost 10-fold over three years, up to nearly $7 billion.

-Larger quantities of television and movies are watched online, and often on mobile. On a traditional television set, data can come from the internet protocol rather than from cable.

-Tablets and e-readers represent a growing area for wireless data usage.

-The increased number of wireless devices allows for the potential of data-bundling, a customer paying one fee for data usage across multiple devices, or using devices as hotspots for other devices.

-Software as a Service, in wired or wireless variants, generally requires more data than client-based software.

-Emerging areas like data usage from automobiles or in health care can open new revenue streams and continued data growth.

-The need for cloud computing resources for small and large businesses is an area of growth.

Risks

AT&T must continually invest capital to keep its communication system up to par with competitors. Many aspects of the business are a commodity; people want affordable and fast data packages, since it’s just the middle-man between customers and the data they want to consume. Differentiation comes from having solid and growing infrastructure, from offering the right mix of data packages and phone contracts, and from meeting business data/voice needs. There is indeed at least a limited economic moat, as spectrum is limited, and capital expenditures are enormous.

-Investing significant sums of money into infrastructure boosts competitiveness and quality, but this money cannot be paid as dividends as owner’s profit.

-Paying significant dividends is helpful for the owners, but detracts from the money to grow and enhance the network.

Company management must balance growth with profitability.

AT&T also faces regulatory risk, which have been true for the long life of the whole business. Owning infrastructure can result in a monopoly, and so regulations exist with the intention of preserving competition. AT&T lost billions over a failed T-Mobile acquisition due to regulations.

A key regulation concern, as voiced by the CEO of AT&T and others, is that companies are running of allocated radio spectrum for growth. This was a key reason for the attempted T-Mobile merger- to acquire complimentary spectrum. Spectrum is being for other purposes, legally, and since the U.S. allocated spectrum long ago compared to some newer economies, the U.S. has spectrum allocated in a less optimized way.

The company faces strong competition in wireless services, wired internet services, cloud services, and essentially every area where they operate. Leverage has been used to compete, which makes the company more vulnerable when interest rates eventually rise.

Conclusion and Valuation

Telecommunications companies typically pay larger than average dividends with their reliable infrastructure businesses. AT&T has tailwinds from increasing mobile data usage and increasing total data usage from internet, video, and cloud services.

With the spike of the stock price over the last two months, I do believe the stock may have gotten modestly ahead of itself. A 4.93% dividend yield and less than 3% dividend growth is reasonable, but not necessarily attractive. At the current yield and growth rate, approximately 8% total returns can be expected based on the dividend discount model. This can potentially be somewhat enhanced by a strategy of writing covered calls. Instead, I’d propose looking at Vodafone as a preferable telecommunications investment, and checking back with AT&T should the stock dip a bit.

Full Disclosure: As of this writing, I have no position in any stocks mentioned.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I agree that AT&T doesn’t seem ripe for investment right now. I think there are a lot of people dumping money into it because of the high yield and continued sentiment that there is a close tie to Apple. Neither is compelling, and the latter not true enough to be worth discussion.

Vodafone is definitely a viable alternative, though I prefer U.S.-based companies.

What are your thoughts on Verizon (VZ) or more tangentially, Comcast (CMCSA)? I think each has stronger growth prospects, but my research is at its infancy on both.

I agree with your conclusion regarding its overvaluation. I bought it in the low 6% to high 5% yield range and won’t look to add to the position until the price drops enough to bump the yield back to those levels. With such low dividend growth additional income is needed to make it an attractive dividend purchase.

Good timing. I was just looking at AT&T’s line up of phones. Interesting note: six months ago I upgraded and there were plenty of phones that you could get with a new contract for free, or close to free, without a data plan. Those appear to be long gone…there were fewer than five on the site.

I’ve always thought AT&T competes with itself in the phone space. AT&T’s best product is its text messaging packages. It’s pure profit, and is very, very accretive to FCF when you cost-account on a per-byte basis. That said, I do think data will cut in on text messaging revenues. There are a million ways to send a brief message to someone using data, rather than the SMS system – Twitter, Facebook, even Words with Friends has a built-in messaging section that notifies the other person when a new message arrives.

And then there exists a lot of risk with wifi…it’s everywhere. The more wifi hotspots, the less reliant users are on AT&T’s data packages. I have a line-in to my AT&T cell phone through Skype for business. It costs all of $60/yr for unlimited calls US/Canada + dedicated phone number. If I’m not connected to skype/not on wifi, the call is directed to my cell phone automatically with no extra cost.

If Skype didn’t exist, I’d have another AT&T line at 12x the annual cost of Skype. I think that’s where AT&T will really feel some pressure. Skype won’t be a big gain for MSFT, either – just a race to the bottom.

Thx for the analysis Matt. I regard T as a good addition to a dividend portfolio for current income but the trade off is limited dividend growth. Of course I think if a Divy stock is paying north of 5%, then a 2-4% growth rate might be acceptable. Trouble is, as you point out, T is a bit rich in the mid 30’s and it’s Div yield is starting to dip below 5%. Much better buy at about 30. I don’t think it will get to 40 but if it does I would consider selling at least some as I think it would be substantially overvalued at that price. Thoughts?

P.S. Still bummed that D Mantra put his blog on hiatus but I understand his reasons. Must be a lot of work; heck, posting an occasional comment is a lot of work for me. LOL.