Apple (AAPL) Inc designs, manufactures, & markets mobile communication & media devices, personal computers, portable digital music players and sells a variety of related software, services, accessories, networking solutions & third-party digital content.

-Seven Year Revenue Growth Rate: 40.85%

-Seven Year EPS Growth Rate: 33.64%

-Seven Year Dividend Growth Rate: N/A%

-Current Dividend Yield: 1.67%

-Balance Sheet Strength: Extremely Strong

Overview

While it may seem like that everything has been said about Apple, it is not the case from a dividend growth investing perspective. This is why today, I’ll not only take a look at the fast growing and innovative company that Apple is but more about the future cash distribution machine it will become over the next 10 years.

Business Segments

The strongest asset Apple has is definitely its brand. Apple’s brand is known across the world and for a good reason; all of their products are well designed, well thought out and, most importantly, they interact perfectly in the most beautiful product ecosystem ever created. In this ecosystem, we find the following products:

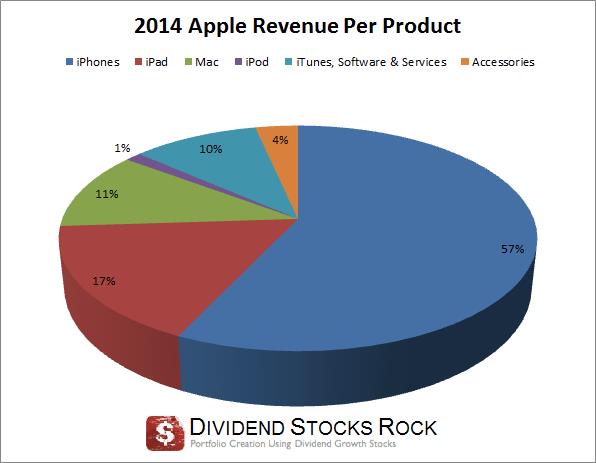

iPhone, iPad, iPod, Mac, iTunes & App Stores, iCloud, Apple Pay, Apple Watch & Apple TV and Operating System Software. As you can see, Apple wouldn’t be the biggest company by market capitalization if it didn’t sell iPhones:

I like to say that Apple used to sell Macs as it now only represents 11% of its total revenue. The tablet sales have been a concern for AAPL over the past couple of years. Therefore, company results are highly dependent on how many iPhones it sells.

Ratios

Price to Earnings: 16.5

Price to Free Cash Flow: 12.22

Price to Book: 5.92

Return on Equity: 36.70%

Revenue

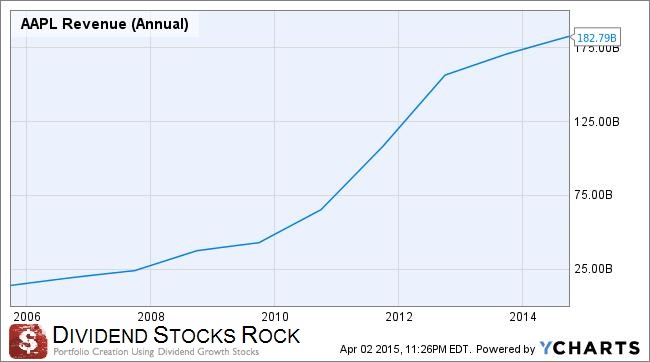

Revenue grew at an incredible annualized rate of 29.34% over the past 10 years. The company will probably continue to raise revenues in the future but not at this pace. Over the past three years, the annualized growth has normalized to 5.31% which is still pretty solid.

The product integration increases the volume of sales per client. Therefore, each time Apple sells a product to a new customer, the chance of seeing him buy a second, third and fourth product is very high.

Earnings and Dividends

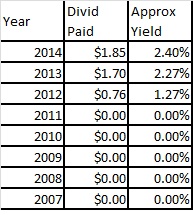

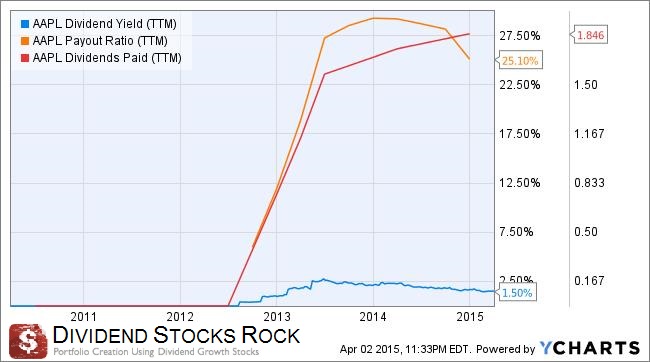

As you can see, AAPL is not close to becoming the next aristocrat as its first dividend payment was made in 2012. Pressured by the market and more especially by Carl Icahn, Apple finally accepted to share a part of its ever growing bank account. The rate has been quite modest over the year.

Approximate historical dividend yield at beginning of each year:

Due to another stock rally, the stock is currently yielding a relatively small yield of 1.50%. But what I really like about this future dividend grower is the fact that dividend is now increasing significantly each year and the company has plenty of room to continue its growth since the payout ratio is around 25%. You can then expect 10% dividend growth for several years without being worried.

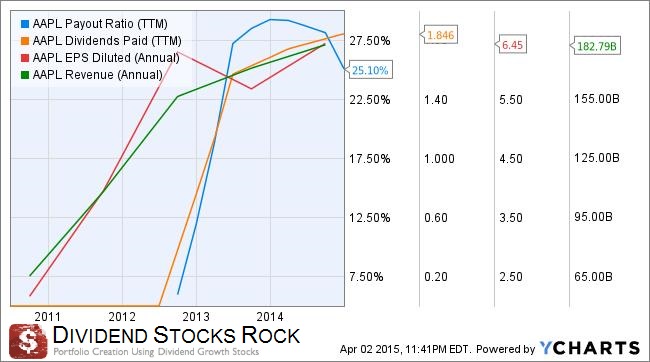

By looking at the previous graph, we are in a better position to appreciate AAPL as a dividend stock. Earnings have grown strongly over the past five years and the current environment will help Apple to rise to new highs. Most importantly, revenues are following a similar trend.

How Does AAPL Company Spend Its Cash?

Well the biggest problem with AAPL is that it doesn’t spend most of its cash. The company is generating an annual free cash flow of $60B. From this cash flow, AAPL distributed 10.5 billion in 2013 and 11 billion in 2014. The company also repurchased approximately for 22 billion of its stock. This means that 30 billion hasn’t been redistributed to investors. I bet you won’t be surprised to find almost 14 billion sitting in cash and another 11 billion in short term securities on its September 2014 balance sheet.

Apple has always remained a very cautious company with its cash. While many dividend investors ignore Apple for this reason (as they expect a higher distribution), I prefer buying a company that will always increase its payout and continue to have a clean balance sheet.

Balance Sheet

Apple’s balance sheet is very strong. The debt on equity ratio is sitting at 1.124 and the company could pay its long term debt in 5 years without blinking. The long term debt on debt income ratio is at 0.4409. You might think AAPL had included a huge goodwill value on its balance sheet since their brand is so powerful but only 4 billion out of a total asset of 231 billion is shown as goodwill. The company has virtually no debt as the long term debt of $29B could be paid off simply by writing a check from short term securities and the cash account.

Investment Thesis

The reason to buy Apple is not because it sells a great smart phone. It is not because tablets and other electronic device will continue to drive consumers to their stores. It is not also because AAPL is continuously innovating with new products or services such as the iWatch and Apple Pay launched recently. Those could all be good reason for a growth investor, but not for a dividend investor.

As a dividend investor, I’ve purchased this stock because of the company’s diversified product ecosystem. Buying an Apple product makes you want to buy another one and build your ecosystem at home. The integration is easy to do and generate efficiency to a maximum. My wife lost her phone not so long ago and I had to do was to pick-up my daughter’s tablet to find it within seconds.

The ecosystem drives the customer to buy more products and repeat purchases over time. Therefore, once their phone, iPod or tablet is up for a new one, many customers will go back to Apple because they know they will be able to sync their new purchase once back home without any headaches.

This ecosystem is the main reason why the company will continue to raise their dividend in the future as it will eventually become a more “stable” business that won’t surge at any moment. The easy money with Apple is definitely gone, but it doesn’t mean it can’t do well in your portfolio.

Risks

As with any techno stocks, AAPL is vulnerable to evolution. In five years from now, we might even not talk about smart phones anymore as consumers will want to buy something else. We saw many techno giants fall for this reason and AAPL is always one fail away to see its profitability drop. This is one of the reasons why it keeps so much cash in hand.

The second risk for this company is its dependence on the smartphone business. The stock rallied recently because sales in China surprised the market and there is a bigger hype since Samsung (it’s main competitor in the smartphone industry) is struggling with its dozen product launches.

Conclusion and Valuation

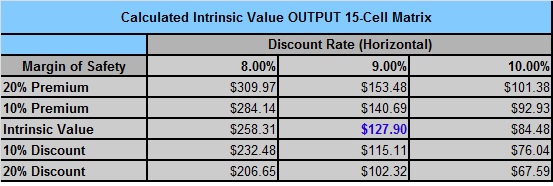

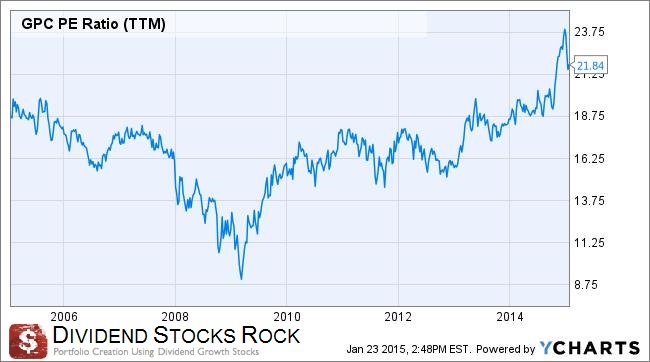

To value the company, I’ll first start with the historical PE ratio of AAPL for the past ten years:

As you can see, the “new” value for this company is now around 17 to 20 times its earnings. The market has calmed down its expectation and the price is more reasonable. Considering today’s market, the stock seems cheap. It is currently trading near its lowest level since 2005 and the overall market is slightly overpriced. Regardless if the stock price as gone up by about 100% over the past three years, AAPL is not overpriced yet.

In order to have a better idea of its valuation, I’ll use the Dividend Discount Model. I use the table found in my Dividend Toolkit to determine the value based on the dividend paid by Apple. I use a discount rate of 9% since it will become a very stable business in the future and there is lots of cash flow generated by its business model. I expect the dividend to grow by 10% over the first 10 years and then it should reduce its pace to 7%. This gives me a fair value of $127.90.

Here again, the stock seems to be fairly price and maybe slightly under priced.

Since using both methods leads me to the same result; I conclude AAPL is a good buy at $125. The company shows strong growth potential and the dividend payout future for this stock is solid.

Full Disclosure: I hold AAPL in my DSR Portfolio

I am always skeptical in purchasing Apple stocks but I may have to put back in my watchlist as the company has been really showing fantastic results every year. Thanks for very detailed and comprehensive analysis.

Cheers,

BeSmartRich

Hello BSR,

This is why I wanted to write this article; to show investors that AAPL should be considered as a dividend stock too and not only as a techno – growth stock with high risk (read for traders only). Over the upcoming years, I see AAPL becoming more like a Microsoft in term of return and dividend payment. If the company decides to pay a 3% yield, it will be an amazing cash flow machine to hold in your portfolio!

Thx for stopping by!

Mike.