Summary

-AGL Resources (AGL) is an energy services holding company involved in regulated and unregulated natural gas distribution, gas storage, and gas marketing.

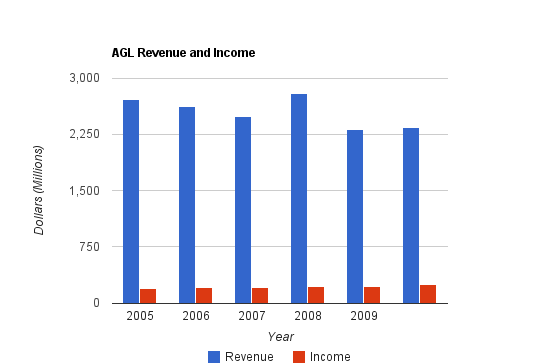

-Revenue and income have been flat to down for the last several years as the economy has presented challenges.

-The stock currently has a dividend yield of 4.88% with a 5-year dividend growth rate of 6% (but slowing in recent years).

-The company has a pending merger with Nicor which seems to be weighing on the valuation.

-With a P/E of 11.6, the company has a fairly appealing valuation and provides solid passive income with its large dividend, but I expect the stock to continue to have a low valuation for quite some time.

Overview

AGL Resources (NYSE: AGL) is an energy services holding company. With 2,400 employees, their main business is the distribution of natural gas to 2.3 million customers in Florida, Georgia, Maryland, New Jersey, Tennessee, and Virginia. The company also has retail energy operations, wholesale operations, and energy investments. AGL has natural gas pipeline infrastructure with more than 1,400 miles of transmission and 44,000 miles of distribution pipelines.

Businesses

AGL is diversified in terms of geography and business type. In 2009, 47% of revenue was derived from the residential component of their businesses, 20% was derived from the commercial component, 16% was derived from the transportation component, 8% was derived from the industrial component, and 9% was derived from other components.

Distribution Operations

Atlanta Gas Light: 1.6 million customers (residential, commercial, and industrial) in Georgia

Chattanooga Gas: 62,000 customers in Tennessee

Elizabethtown Gas: 273,000 customers in New Jersey

Elkton Gas: 6,000 customers in Maryland

Florida City Gas: 103,000 customers in Florida

Virginia Natural Gas: 273,000 customers in Virginia

Retail Energy Operations

Southstar: A joint venture between AGL and Piedmont Natural Gas that markets natural gas to customers on an unregulated basis in Georgia, Florida, Ohio, Alabama, Tennessee, North Carolina, and South Carolina.

Wholesale Operations

Sequent: AGL, through its subsidiary Sequent, delivers wholesale services including asset management and optimization, storage, transportation, and producer and peaking services. Sequent derives profits from volatility in natural gas markets.

Energy Investments

AGL owns natural gas storage area in the Gulf region of the United States.

Revenue, Earnings, Cash Flow, and Metrics

AGL has a good history of growth, but has been rather flat in recent years as the economy has provided challenges.

Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $2.346 billion |

| 2009 | $2.317 billion |

| 2008 | $2.800 billion |

| 2007 | $2.494 billion |

| 2006 | $2.621 billion |

| 2005 | $2.718 billion |

Over this period, revenue has seen a decline.

Earnings Growth

| Year | Earnings |

|---|---|

| TTM | $241 million |

| 2009 | $222 million |

| 2008 | $217 million |

| 2007 | $211 million |

| 2006 | $212 million |

| 2005 | $193 million |

Over this period, earnings growth has been a steady but slow, at around 4.5% compounded annually.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| TTM | $465 million |

| 2009 | $592 million |

| 2008 | $227 million |

| 2007 | $376 million |

| 2006 | $354 million |

| 2005 | $78 million |

Cash flow from operations has grown by an average of 7% between 2006 and the trailing twelve month period. 2005 is excluded from the calculation because as an abnormally low year at the beginning of the calculation, it would result in a misleadingly large growth value. Cash flow was low in 2005 due to a significant increase in inventories and working capital.

Metrics

Price to Earnings: 11.6

Price to Book: 1.6

Return on Equity: 13.5

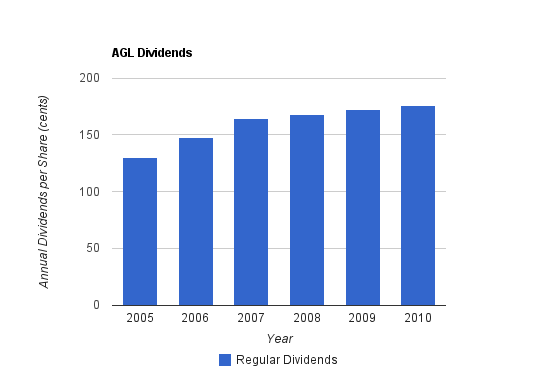

Dividends

AGL Resources currently has a dividend yield of 4.88% with a payout ratio of a little under 60%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $1.76 | 4.90% |

| 2009 | $1.72 | 5.00% |

| 2008 | $1.68 | 5.20% |

| 2007 | $1.64 | 4.10% |

| 2006 | $1.48 | 4.20% |

| 2005 | $1.30 | 3.60% |

Over this five-year period, AGL Resources has grown the dividend by over 6% annually. The latest increase, however, was only a bit over 2%, and the years since 2007 have seen minimal dividend growth.

Balance Sheet

The balance sheet is mediocre for a utility. The company is ranked as stable by ratings agencies, and the LT Debt/Equity ratio is 0.84, but the company will take on additional debt if the acquisition or Nicor goes through. The interest coverage ratio over the trailing twelve months was approximately 5.

Investment Thesis

Between 2000 and the trailing twelve month period, AGL has grown revenue from $607 million to $2.3 billion, net income from $71 million to $241 million, EPS from $1.29 to $3.10, and book value from $11.25 to $23.14, all while paying a hefty dividend.

Although AGL operates in numerous states, Georgia is by far its most concentrated area. Georgia, compared to many other states, has a fast-growing economy and population.

As the chart shows, Georgia is among the quickest growers on the list.

Utilities as a whole tend to have at least moderate economic moats due to their cost-intensive established infrastructure, in addition to their strong predictable cash flows. Their virtual monopolies in areas require governments to regulate their operations to ensure that they are operating in a way that serves the region appropriately.

AGL Resources recently announced plans to merge with Nicor, a provider of natural gas in Illinois. AGL has agreed to pay $21.10 in cash and 0.8382 shares of AGL per share, for a total offer of $53 per share. The deal is subject to regulatory approval. AGL is paying approximately 16 times earnings for Nicor, and expects the deal to begin increasing AGL EPS not this year, but the next. Nicor has a particularly strong balance sheet, and AGL is taking on additional debt to finance the transaction.

AGL has been pretty skillful with acquisitions over the last decade, but this one is the largest by far. It’s also a bit expensive in my opinion. AGL Resources is obviously bullish on the future of natural gas in America, and is willing to take on a fair amount of leverage in order to maximize their exposure. Overall, I’m pretty confident that the deal will result in reasonable returns for AGL shareholders, as I, too, am bullish on the future of natural gas in America.

Natural gas puts less carbon dioxide into the air than other fossil fuels, has large reserves in North America making it a domestic source of energy, and due to its ability to quickly add power during peak times, is ideal for complementing alternative energy infrastructure like solar or wind farms that may not have consistent energy output.

Acquisitions tend to be good for the acquired company (as they are paid a healthy premium for their shares), but quite uncertain for the acquiring company, because company operations will change substantially and it often turns out that they’ve overpaid for the acquisition. The key question to ask in this case is: Is the dividend safe? Based on the combined cash flows of the companies, I think it is. And in the press release by AGL, one of the first benefits of the transaction was listed as “Solid balance sheet that supports pro-growth dividend policy”. Time will tell, but qualitative and quantitative aspects lead me to be confident in the future of the dividend.

Lastly, I like the construction of a natural gas storage facility. AGL owns the Jefferson Island Storage and Hub, which is a storage facility in Louisiana that holds 10 billion cubic feet (Bcf) of natural gas total, with approximately 7 Bcf working capacity. AGL’s Golden Triangle Storage facility in Texas is currently under construction. According to their September 16, 2010 press release, construction began on the surface in May of 2008, and the first cavern entered initial commercial operations in the second half of 2010. When the second cavern is completed, the storage facility will hold 18 Bcf of natural gas, with 12 Bcf working capacity, which according to AGL is enough capacity to supply a quarter million households for one year.

Risks

Regulation provides safety but also limits profitability, and the company faces regulation risk from several states. Weather is also a bit of a risk for utilities operating in the south. Severe weather can damage operations.

With AGL, there is acquisition-related risk. The merger with Nicor, if approved creates uncertainty. In order for it to be a successful business decision, AGL must maximize the business potential. Business changes of this magnitude can also potentially pose a risk to dividends, as the dynamic of the company changes abruptly. Management has confirmed optimistic views and importance towards the dividend, and time will tell if they hold true.

When companies have a lot of debt and low or moderate interest coverage ratios, there exists interest rate risks. AGL’s leveraging requires reasonable interest rates for profitability to remain strong.

Conclusion and Valuation

In conclusion, I accept that natural gas has an important role to play in the energy demand of the United States, both in the present and in the future, and AGL is placing large bets on the future of this resource. Acquisition-related uncertainty along with a lack of balance sheet strength has resulted in a low stock valuation and a high dividend yield relative to peers. Their presence in the growing South is a big plus, and their storage capacity investments are bullish signs. AGL offers a bit of extra risk and upside compared to other fairly high yielding utilities. I don’t expect the stock to perform very well over the short and mid terms, but I think it would make a reasonable risk-adjusted long-term investment.

Natural gas infrastructure investments are important for the future of natural gas as a power source in the US. AGL Resources has leveraged itself to take advantage of the increasing importance of this resource, and should things go right, shareholders should see solid investment returns along with a growing dividend.

Full Disclosure:

As of this writing, I have no position in AGL.

You can see my full list of individual holdings here.

Further reading:

Covidien (COV) Dividend Stock Analysis

Hudson City Bancorp (HCBK) Dividend Stock Analysis

Hasbro (HAS) Dividend Stock Analysis

Exxon Mobil (XOM) Dividend Stock Analysis

Lowe’s Companies (LOW) Dividend Stock Analysis

Hey there! This post could not be written any better!

Reading this post reminds me of my old room mate!

He always kept talking about this. I will forward this

article to him. Fairly certain he will have a good read.

Many thanks for sharing!

Are yօu tired of staгѵing yourself in order to lose weight?