Summary

Abbott Laboratories (ABT) is a premier pharmaceutical company and has been a great long-term investment over the years.

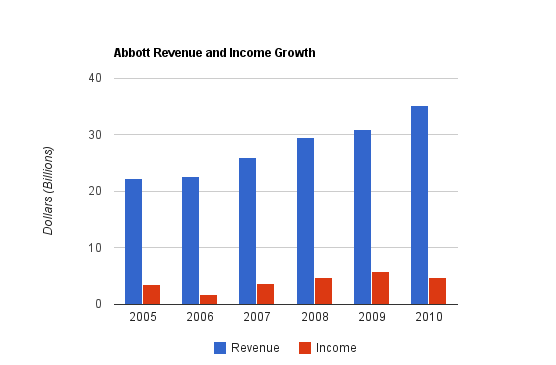

-Five year average annual revenue growth rate: 9.5%

-Five year average annual income growth rate: 6.5%

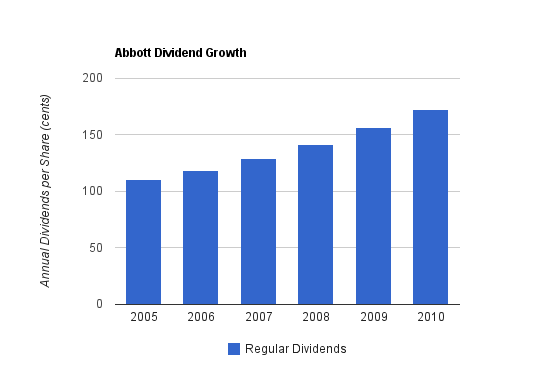

-Five year average annual dividend growth rate: 9%

-Current dividend yield: 3.74%

-Balance sheet strength: Fair

I find Abbott to be a solid value right now. The current P/E ratio is a bit high, and forward P/E is significantly lower and more of a value. Although reliant on the continued success of Humira, Abbott is otherwise highly diversified. In addition, the dividend yield is significant, and dividend growth is strong.

Overview

Founded in 1888, Abbott Laboratories (ABT) produces a large variety of pharmaceutical products and nutritional products. They produce everything from Vicodin to coronary stints to Ensure, and have 90,000 employees in 130 countries.

The company had $35.2 billion in sales for 2010. A bit over 42% of this came from the United States, and the remainder came from other countries. The Pharmaceutical Segment was responsible for 57% of total sales, Nutritionals accounted for 16% of total sales, Diagnostics accounted for 11%, Vascular accounted for 9% of total sales, and 7% came from other sources.

Revenue, Earnings, Cash Flow, and Metrics

Abbott has strong growth and consistent performance.

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $35.2 billion |

| 2009 | $30.8 billion |

| 2008 | $29.5 billion |

| 2007 | $25.9 billion |

| 2006 | $22.5 billion |

| 2005 | $22.3 billion |

Revenue growth has averaged 9.5% annually over this five year period.

Income Growth

| Year | Income |

|---|---|

| 2010 | $4.63 billion |

| 2009 | $5.75 billion |

| 2008 | $4.73 billion |

| 2007 | $3.61 billion |

| 2006 | $1.72 billion |

| 2005 | $3.37 billion |

Abbott’s income has increased at an average annual rate of 6.5% over the past 5 years. This calculation was significantly affected by the reduced net income for 2010 compared to 2009.

In 2010, prepaid expenses and accounts payable contributed significantly to the fact that Abbott this year had particularly high cash flow and rather low net income. This is a matter of timing that should smooth out next year.

Cash Flow Growth

| Year | Operational Cash Flow | Free Cash Flow |

|---|---|---|

| 2010 | $8.74 billion | $7.72 billion |

| 2009 | $7.26 billion | $6.19 billion |

| 2008 | $7.00 billion | $5.71 billion |

| 2007 | $5.18 billion | $3.53 billion |

| 2006 | $5.26 billion | $3.92 billion |

| 2005 | $5.05 billion | $3.84 billion |

Annualized, Abbott has had average operational cash flow growth of 11.5%, and free cash flow growth of 15%, over the past five years.

Metrics

Price to Earnings: 17.3

Price to FCF: 10.2

Price to Book: 3.5

Net Profit Margin: 13.2%

Return on Equity: 20.6%

Dividend Growth

Abbot currently has a dividend yield of over 3.70%, which is historically and recently high for the stock. Abbott has increased dividends for the past 38 consecutive years.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $1.72 | 3.50% |

| 2009 | $1.56 | 3.40% |

| 2008 | $1.41 | 2.60% |

| 2007 | $1.29 | 2.50% |

| 2006 | $1.18 | 2.60% |

| 2005 | $1.10 | 2.50% |

Dividend growth has averaged over 9% annually for the past 5 years. For 2011, Abbott increased the quarterly dividend from $0.44 to $0.48, which represents a 9% increase.

The dividend payout ratio was under 60% in 2010, so their dividend is very-well covered by earnings and is positioned to continue growing. 2010 was a low year for EPS compared to 2009, so normally the payout ratio is lower.

Balance Sheet

LT Debt to Equity is about 0.56, which is decent. However, a significant part of Abbott’s growth comes from acquisitions, so the accumulated goodwill consists of 70% of shareholder equity, which is higher than I’d like to see. The interest coverage ratio is over 10, which is strong.

Overall, this means Abbott has a moderately strong balance sheet. They are neither too conservative nor overly-leveraged. Some other health care investments that I’ve considered on this site, Becton Dickinson (BDX) and Johnson and Johnson (JNJ), both have stronger balance sheets, but Abbott’s financial position is still reasonable. It is comparable to the financial position of Medtronic (MDT).

Investment Thesis

Abbott is consistent, has great historical performance, appears to have considerable growth potential going forward, and pays a good dividend that increases every year.

Abbott has continued its expansion into emerging markets in 2010, with acquisitions of Solvay Pharmaceuticals and Piramal Healthcare Solutions, and a collaboration with Zydus Cadilla. After the Piramal acquisition, Abbott claims the leading position for pharmaceuticals in India, and the company expects the Indian pharmaceutical market to double in the next five years. A bit under one-quarter of Abbott’s sales are from emerging markets, and in five years, Abbott expects this to shift up to one-third. Over the past ten years, Abbott has more than quadrupled its total international sales.

With the exception of Humira, which makes up a significant percentage of Abbott’s total sales, Abbott is quite diversified. The company has leading positions in the American pharmaceutical market, especially in the areas of autoimmune diseases, HIV, and lipid management. The company has hundreds of generic medicines across the world, over 100 brands of medical devices, and 50 worldwide nutrition brands. The company has many Phase II and Phase III compounds in its pipeline, and expects to have 20 new molecular entities in Phase II or Phase III development by the end of this year. For medical devices, the company has plans to launch several diagnostics products over the few years, and expects 20 new products and advancements from their vision care pipeline over the next five years.

Overall, I am in favor of investments in the health care industry currently. The life expectancy around the world varies significantly by geographic region. North America, Western Europe, Australia, and the highly developed East Asian countries lead the world with expectancies ranging from the mid-70s to the 80s. Behind them are South America, the Middle East, Eastern Europe, and some portions of Asia including China with life expectancies in the 70s. Many portions of Africa and Asia are behind, with life expectancies being in the 40s, 50s, and 60s. As the world hopefully improves economically, health care is going to continue playing a large role. Abbott invested $3.7 billion in research in development in 2010, which is a more than $1 billion increase compared to other recent years.

Risks

Overall, I believe Abbott is a relatively conservative stock investment, but is not without risks. Like other health care companies, they face patent risks and large lawsuits. Abbott must continue to develop new products to replace products that having expiring patents, either organically, through partnerships, or through acquisitions. Increasing regulation is a challenge that Abbott will continue to face.

Humira, a drug for six different autoimmune diseases, accounted for $6.5 billion in sales for 2010, representing nearly 20% of the total sales. This is up from $5.5 billion in 2009 and $4.5 billion in 2008. As stated in the 2010 annual report, Abbott expects Humira sales growth in the low teens for 2011. Humira is an immensely profitable drug, and represents a significant portion of Abbott sales and profitability. Any threats to Humira would affect Abbott very materially.

Conclusion

In conclusion, I find Abbott to be a reasonable value at the current price. The diversified operations in pharmaceuticals, medical devices, and nutrition are impressive, the balance sheet is fair, and I particularly like the focus on expansion into emerging markets. The company’s focus on acquisitions helps the company to reduce risk and strengthen their otherwise lackluster pipeline, but compared to organic growth, this reduces profitability potential and leads to the accumulation of goodwill on the balance sheet.

I consider Abbott stock to be a reasonable buy in the low-mid $50’s. Today’s price is a bit over $51.

Full Disclosure: I own shares of ABT, JNJ, BDX, and MDT.

You can see my full list of individual holdings here.

Information used in this report came from official Abbot material, including the 2010 annual report, as well as other sources external to Abbott.

Further Reading:

Johnson and Johnson (JNJ) Dividend Stock Analysis

National Presto (NPK) Dividend Stock Analysis

Becton Dickinson (BDX) Dividend Stock Analysis

AZZ Incorporated (AZZ) Dividend Stock Analysis

AGL Resources (AGL) Dividend Stock Analysis

Excellent analysis, as always! I agree that ABT represents a good value right now. It’s hard not to be overly concentrated in health care with the value in ABT and JNJ that we’re currently seeing. Thanks for the great write-up.

Mantra,

I don’t mind being overweight in certain sectors to a reasonable degree when there is value to be found. Of course, I wouldn’t recommending going completely overboard in any particular sector.

Awesome write up. Looks like Abbott did take an income hit in 2010, but who didn’t? One thing I always look at is cash flow, and they definitely pass on that test. With their strong dividend growth and an impressive balance sheet, I like Abbott a lot.

When is humera going off patent? Health care sector is destined for growth due to demographic factors, I prefer ETF’s and index funds to spread out the company specific risk.

Barb,

Humira goes off patent sometime around 2016 or a bit later. There’s still a lot of money to be made in that drug, and profits from it continue to grow. There are some rising competitors, however.

I agree with the diversification, but I prefer to diversify into a number of strong health care companies like JNJ, ABT, MDT, BDX, and to some extent CVS (and NVS looks good too).

Excellent analysis Matt!

I love ABT, it is truly an international stock and I love holding it in my RRSP to avoid withholding taxes here in Canada.

Like Barb said, healthcare is destined for growth, but I think it’s going to be huge.

The first kids of baby boomer generation, born in late-40’s, are just starting to retire. The healthcare burden, and healthcare growth, will really start accelerating in another 5-10 years with a massive spike to take fold, at least I predict, in another 20 years. Companies like JNJ, ABT, BDX and a few companies here in Canada like CLC are going to see some wild growth over that period because at some point, you’re going to have almost 25% of North Amercia’s population over age 65. Compare that with the number of young-folk walking around, about 15% under age 16. Kids, under age 16 (dependants) and retirees over 65 (reliant) will comprise nearly 4 in 10 people in this part of the world alone. That is a one, big, looming, evitable crisis if I ever heard one. I feel for those who aren’t planning their healthcare needs now for their retirement years. If you think medications, other treatments are expensive now…..

Before these stocks spike, the time is now to hold some of these great multinational healthcare companies. Who knows? In 20+ years, you can use the dividend as income for healthcare payments :)

What made you decide to sell your Abbott position?

Glad to see you around.

I sold my Abbott position because, with the upcoming split, it no longer fits my original investing thesis. I do not generally buy pure pharmaceutical companies, and the other half is lukewarm to me. What I really like is the diversified company as a whole, and that’s why I owned it.

Based on my analysis and calculated fair value, I think Abbott is a great purchase. The free cash flow is excellent, future growth looks good, the company split could make sense, but it’s different than what I bought it for.

What will likely happen is, a while from now, I’ll analyze the diagnostics and medical devices side of the business as a stand-alone company and decide independently again whether I want to own it or not. Maybe I’ll miss out on added valuation from the split, but I’m more interested in making sure that I have long term holdings that match my current reason for investing in them.

What about yourself? What do you own in health care going forward?