Dividend Stocks 101: The Essential Guide

If you’re new to the site, check out this key resource.

My articles have been fewer but rather long this month (especially one or two of them), and as a recap, they can be found here:

20 Quick Ways To Check A Company

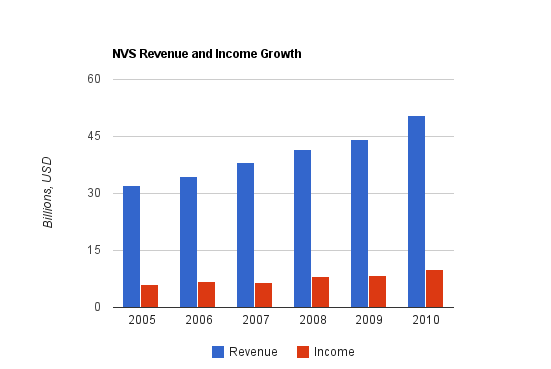

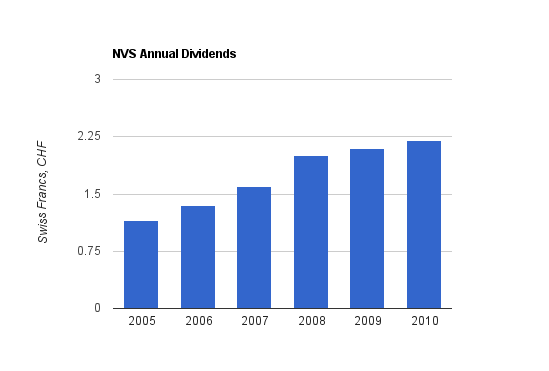

Novartis Dividend Analysis

Step 5: Research

Step 6: Start Small

6 Significant Yields in the Health Care Industry

In Defense of Dividends

MLPs Faltering

Two solid Morningstar videos.

Dividend Dynamos

Dynamic Dividends provides a list of over 200 companies that have raised dividends for at least 10 years. Furthermore, he breaks it up into five classes of dividend longevity.

For example, here’s the Class A 50+ Year List

Community Trust Bank Analysis

D4L analyzes a smaller bank.

Why Your Financial Resolutions Might Have Failed

My Own Advisor discusses some reasons why financial resolutions don’t always come true.

Unilever Analysis

Defensiven provided an analysis of the discounted consumer giant, and also has an article talking about the realized risks of HCBK.

Single Stock: Reloaded

Andrew Hallam asks, if you had to pick one stock and hold it for 80 years, which would it be?

How To Live Off Dividends In Retirement

Dividend Growth Investor presents this good article to readers.

6 Signs of a Good Dividend Yield Part 1

6 Signs of a Good Dividend Yield Part 2

Sigma Swan puts forth a two part article on dividend yields.

Derek Foster Interview Part1

Derek Foster Interview Part 2

Dividend Ninja begins his interview of a man who retired at age 34 with simple investing and frugality.

Go the LifeCycle or Target Fund Route?

DIY Investor analyzes LifeCycle funds.

Why Do We Think We Are So Good As Investors?

The Dividend Guy asks this always important question about overconfidence.

Why I’m Buying Wal-Mart

Dividend Mantra provides a Wal-Mart analysis.

Investment Advice From an Unusual Source

Dividend Partisan provides four lessons.

Cincinnati Financial Analysis

The Passive Income Earner analyzed CINF.