Summary

National Presto Industries (NPK) is an oddly diversified producer of military arms, adult diapers, and small cooking appliances with a market capitalization of well under $1 billion.

-Revenue growth rate over the last three years: 4%

-Net Income growth rate over the last three years: 18%

-Dividend growth rate over the last three years: 25%

-Current dividend yield: 7.30%

-Balance Sheet: Extremely strong, with tons of cash and zero debt.

-NPK’s CEO, Maryjo Cohen, owns 30% of the company.

-All of this comes with a P/E of only a bit over 12 as of this writing.

My conclusion is that National Presto is very good long term stock pick based on the large dividend, diversification, extremely strong balance sheet, and reasonable growth prospects, but that it should be purchased with a large margin of safety due to unique risks.

Overview

National Presto Industries Inc. (NYSE: NPK) was founded in 1905 in Wisconsin. The company has long since produced a wide range of small cooking appliances, and in the past several years has made acquisitions to be a producer of small military products and adult absorbent products.

NPK has been in business for decades, and currently consists of three business segments:

-Housewares/Small Appliance Segment (33% of total sales and 28% of total operating profit)

-Defense Products Segment (50% of sales and 63% of total operating profit)

-Absorbent Products Segment (17% of sales and 9% of total operating profit)

That’s good diversification, ranging from pressure cookers to ammunition to adult diapers. Their appliances are numerous, ranging from products for pizza to popcorn, deep frying, tea kettles, grills, griddles, and more. The defense segment produces ammunition, fuses, cartridges, and precision mechanical and electro-mechanical assemblies. The company also has a portfolio of over $100 million in short-term investments.

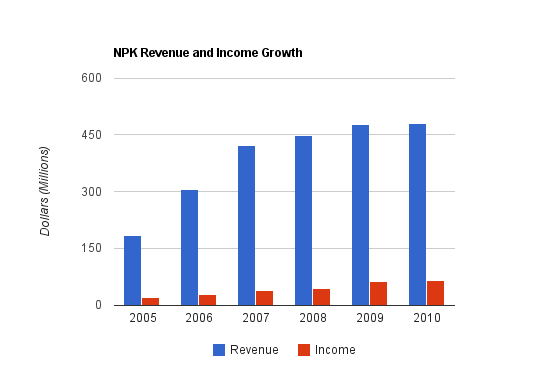

Revenue, Income, Cash Flow, and Metrics

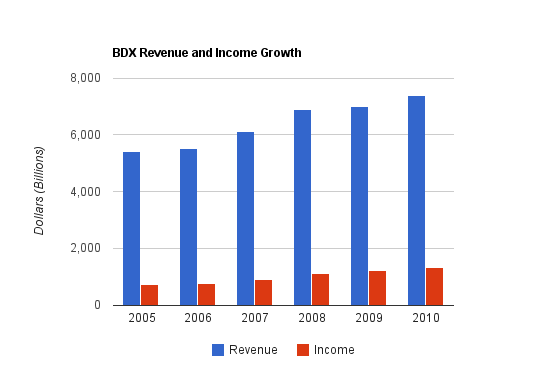

NPK has had impressive growth over the years, but growth in the future will be at a more realistic level.

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $479 million |

| 2009 | $478 million |

| 2008 | $448 million |

| 2007 | $421 million |

| 2006 | $305 million |

| 2005 | $185 million |

Over this period, the five-year revenue growth was 21%, and the three-year revenue growth was a bit over 4%. Largely this is due to a difference in acquisitions, with the past being strongly influenced by extremely successful acquisitions, and so the more recent period is more predictive of future results. The company does, however, expect to make future acquisitions.

2010 revenue saw a big bump from appliances and absorbent products (5% and 8.2%), but a reduction in sales of the defense segment due to timing differences between the comparable years.

Income Growth

| Year | Income |

|---|---|

| 2010 | $63.5 million |

| 2009 | $62.6 million |

| 2008 | $44.1 million |

| 2007 | $38.6 million |

| 2006 | $28.0 million |

| 2005 | $19.0 million |

Net Income has grown by 27% annually over this five year period. It has grown by 18% over the current three-year period, and has had negligible growth in the past year.

The company faced increasing commodity and transportation costs in 2010, and expects the trend to continue in 2011. Increased state taxes also bit into their profits, and their short-term investment returns are being held down by the low Federal Reserve interest rates.

Operational Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $57.8 million |

| 2009 | $62.1 million |

| 2008 | $35.3 million |

| 2007 | $38.0 million |

| 2006 | $5.5 million |

| 2005 | $22.3 million |

The cash flow pattern is similar to net income, although a bit more erratic. The defense segments routinely provide timing differences.

Metrics

Price to Earnings: 12.2

Price to FCF: 13.5

Price to Book: 2.25

Return on Equity: 18%

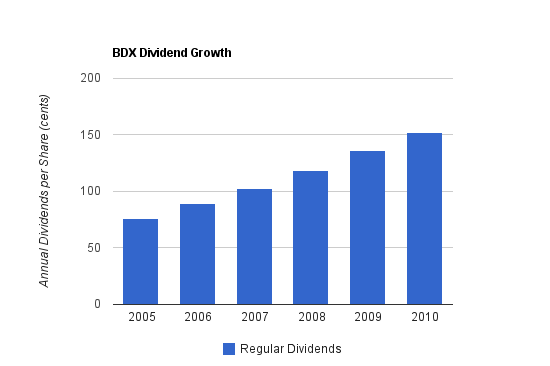

Dividends

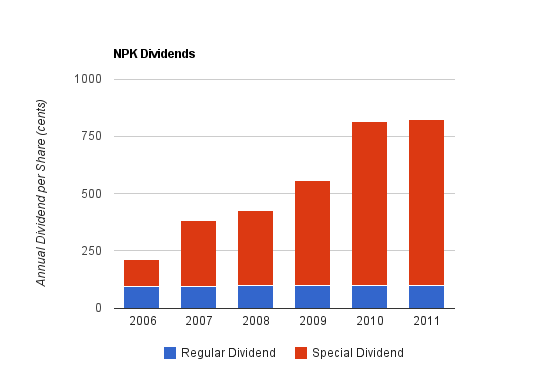

Among the strongest aspects of NPK stock is the dividend, which is paid once annually after the previous year’s results have been stated. NPK pays a regular $1 dividend every year. This is the dividend that shows up on most stock screeners. With such a low yield, people barely take notice. But, NPK also pays a special dividend every year based on profits. All dividends paid are adequately covered by earnings, and they reserve dividend flexibility by calculating their annual dividend based on their annual earnings.

Dividend Growth

| Year | Regular Dividend | Special Dividend | Total Dividend | Dividend Yield |

|---|---|---|---|---|

| 2011 | $1.00 | $7.25 | $8.25 | 6.60% |

| 2010 | $1.00 | $7.15 | $8.15 | 6.50% |

| 2009 | $1.00 | $4.55 | $5.55 | 9.00% |

| 2008 | $1.00 | $3.25 | $4.25 | 7.00% |

| 2007 | $0.95 | $2.85 | $3.80 | 6.00% |

| 2006 | $0.92 | $1.20 | $2.12 | 4.50% |

Over this five-year period, NPK has grown its dividend by approximately 31% annually on average. The three-year dividend growth is a bit under 25%. The most recent increase, however, was only around 1%.

The most recent dividend, which was declared in 2011 based on 2010 performance, was $8.25, and EPS was $9.26. The company paid out approximately 90% of its earnings per share as dividends. Keep in mind that NPK holds to a flexible dividend policy, so the payout ratio is intentionally high. The company doesn’t perform share repurchases, and instead pays out excess cash in the form of special dividends.

The dividend yield as of this writing, based on the total dividend paid out earlier this year ($8.25) divided by the current stock price (which has since dipped to a bit over $112), is over 7.3%.

Balance Sheet

NPK has a current ratio of nearly 5, has zero long-term debt, and their goodwill is negligible compared to their equity. Their financial position is therefore essentially flawless.

Investment Thesis

Sometimes dividend portfolios can be too concentrated in large-cap stocks. What I truly love to see is a small or medium sized company with reasonable growth prospects paying a dividend. To me it’s the best of both worlds. National Presto Industries, Inc. is just that sort of company.

In addition, the long-tenured chairperson and CEO Maryjo Cohen currently owns an impressive 30% of NPK. With hundreds of millions invested into this company, her interests are aligned with shareholders. That explains why this has been such a shareholder friendly company over the last several years.

The company has:

-An attractive valuation

-An extremely strong balance sheet

-Impressive backward growth with reasonable forward growth prospects

-A large and sustainable dividend

-Large insider ownership (mainly by the CEO)

-Simple and practical products in diversified segments

-Fairly strong free cash flow, because they pay very little in capital expenditure.

When it comes to catalysts for future growth, the defense segment looks to increase vertical integration to increase profitability, and the absorbent products segment has ordered a new machine, expected to be in operation in Q2 of 2011, that will produce gender-specific disposable underwear, ease capacity restraints, and expand the customer base. The segment expects to enter the retail market while continuing to compete in the institutional market. The defense segment’s backlog has grown from $274 million in 2009 to $329 million in 2010.

Although NPK is currently facing pricing pressure, the sales growth of their appliance and absorbent segments is promising. The company has shown enormous resiliency in this difficult economy, and performed exceptionally well in the period before when the economy was strong. I expect that as the economy improves, and interest rates eventually increase, NPK will rebound and continue reasonable growth.

The strong balance sheet and huge dividend mean that very little growth is even necessary to get reasonable returns, but growth is expected to be icing on the cake to increase overall returns. Current management has shown strong ability to grow the company organically and through acquisitions, so there is substantial potential upside in the future.

Risks

NPK has an odd risk profile. On one hand, their diversification into completely different markets provides risk reduction, and their products across all categories are very practical and needed. Combined with a beautiful balance sheet and conservative and frugal management with large insider ownership, NPK has a lot of stability.

On the other hand, NPK does have a fair number of significant risks. Their appliance and absorbent products segments face commodity cost issues, and rely on Wal-Mart and Medline Industries for significant percentages of appliance and absorbent products sales. (And Medline is currently building its own absorbent products segment that will likely eventually result in a reduction of business with NPK.) Neither of these two segments has an economic moat worth speaking of, so their pricing power is limited. In addition, NPK has contracts with the United States Department of Defense which add a lot of risk because NPK could potentially lose these contracts. Their defense segments rely on this very large customer. In 2005, they formed a five-year contract for 40mm ammunition systems with the Department of Defense, and in 2010 this contract was awarded for another five years. The amount of sales under the contract can vary from year to year, as funding and requirements change.

A potentially lucrative risk is the stock price volatility. Last year when I analyzed NPK, its stock price was a bit higher than it is now, and had recently had a large price increase, and I warned that it could potentially have a large price setback. In doing so, I mentioned that such a setback would be a good buying opportunity as long as the fundamentals remained intact. Sure enough, months afterward, the stock price dropped over 25% to under $90/share, and has since climbed back up to around $110+ (and for a while, significantly higher at nearly $140). I used this reduction in stock price as an opportunity to increase my position size and reduce my cost basis. The same thing may or may not happen in the coming year. With this stock, I find it a good idea to really focus on dollar-cost-averaging. Due to the volatility, it’s best to enter one’s position over time, so that one can spread the risk out and potentially decrease the cost basis of the purchased shares.

Conclusion and Valuation

If you want a small to medium sized, diversified, high-yielding company with decent growth prospects, zero debt, shareholder-friendly management and an earnings multiple in the low double digits, and you can stomach some volatility and an unclear political future, NPK might be a good pick. Based on the small size, even with the high payout ratio there is substantial growth potential, and the company pays a very large dividend.

Based on earnings of $9.26/share for 2010 and a reasonable P/E considering the growth and the dividend to be 15 in my opinion, I think shares are reasonably valued as long as they remain under $140, but it would be prudent to seek a significant margin of safety due to the varying risks.

Full Disclosure: I own shares of NPK.

You can see my individual holdings here.

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips: